Knowledge from Glassnode exhibits that an extra 32.3% of Bitcoin’s provide has entered a revenue state with the 2023 rally to this point.

Round 77% of the whole Bitcoin provide is now in revenue

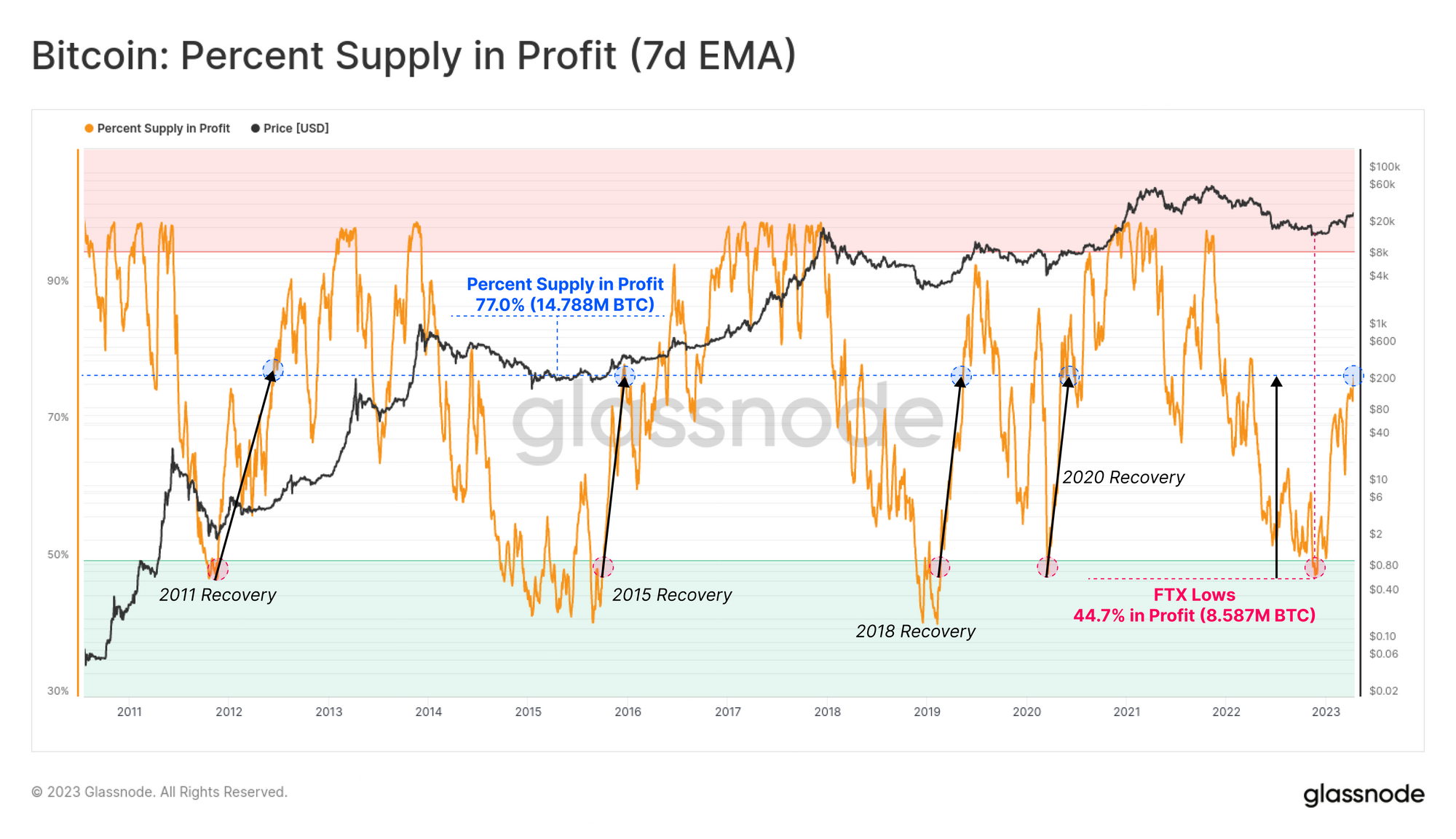

In response to Glassnode’s newest weekly report, a complete of 6.2 million BTC have returned to the inexperienced this 12 months. The related indicator right here is the “revenue provide share”, which tells us what share of Bitcoin’s provide is at present producing a certain quantity of unrealized revenue.

The metric works by strolling by the on-chain historical past of every coin within the circulating provide and checking at what worth it was final moved. If that earlier worth for any coin was decrease than the present worth of BTC, then that particular coin is producing a revenue proper now, and the indicator provides it to its worth.

Associated Studying: Bitcoin Drops Beneath $30,000 After Futures Market Overheats

Usually, the upper the worth of the Revenue Bid Share, the extra possible buyers are to promote and reap a few of the positive aspects they’ve accrued. For that reason, vertices grow to be extra prone to type as the worth of the metric will increase.

Then again, the low values of the indicator indicate that a big a part of the availability is at present in loss, and due to this fact, the holders do not need a lot incentive to promote their cash.

Now, here’s a chart that exhibits the development of the 7-day exponential shifting common (EMA) of Bitcoin’s provide in revenue over all the historical past of the cryptocurrency:

The 7-day EMA worth of the metric appears to have surged in latest days | Supply: Glassnode's The Week Onchain - Week 16, 2023

As proven within the chart above, the Bitcoin 7-Day EMA P.c Provide had dipped to fairly low ranges throughout the bear market final 12 months as a number of crashes put numerous buyers below the hood. ‘water.

The indicator hit its lowest level after the crash as a result of collapse of the FTX cryptocurrency trade, as solely 44.7% of the availability (about 8.6 million BTC) remained in revenue limits.

With the beginning of the rally this 12 months, nonetheless, the metric naturally confirmed a robust restoration, and a complete of round 77% of Bitcoin’s provide (14.8 million BTC) is now in revenue.

In comparison with the beginning of the 12 months, an extra 6.2 million BTC grew to become worthwhile, representing roughly 32.3% of the whole BTC provide. This sharp rise means that a lot of the availability has modified arms beneath the present worth stage.

Traditionally, bear market lows have fashioned when buyers have capitulated after struggling heavy losses. It’s because throughout such capitulation occasions, the availability that these underwater buyers beforehand held strikes into the arms of holders with stronger conviction.

The most recent development in earnings provide may counsel that such a detox could have taken place now, as numerous holders now have their value base at decrease, bearish market costs.

BTC worth

As of this writing, Bitcoin is buying and selling round $29,900, up 1% previously week.

Appears to be like like the worth of the asset has gone down over the past two days | Supply: BTCUSD on TradingView

Featured picture by André François McKenzie on Unsplash.com, charts by TradingView.com, Glassnode.com