Information exhibits that the variety of Bitcoin transactions has elevated lately, however trade deposit and withdrawal transfers have solely deviated.

The variety of Bitcoin transactions has lately seen a pointy improve

In keeping with knowledge from the on-chain analytics firm glass knot, BTC blockchain exercise has elevated considerably lately. The indicator of curiosity right here is “transaction depend”, which measures the entire variety of Bitcoin transactions happening the community in the mean time.

When the worth of this metric is excessive, it signifies that the channel is seeing excessive utilization from holders. Such a pattern means that merchants are energetic available in the market proper now.

Then again, the low values of the indicator counsel that the BTC blockchain is at the moment experiencing low exercise. Such a pattern could also be an indication that basic curiosity within the asset is at the moment low amongst traders.

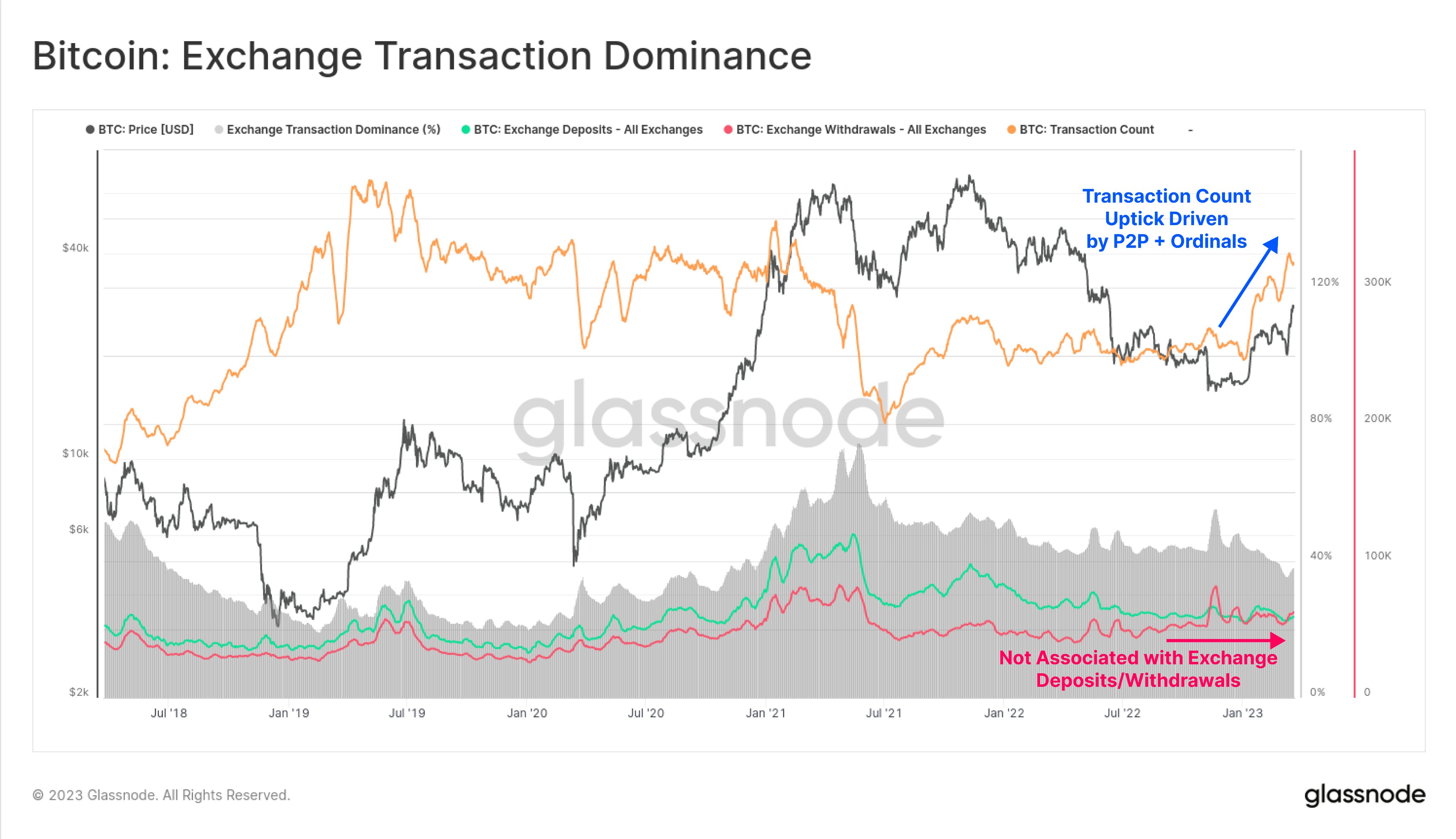

Now, here’s a graph that exhibits the pattern of the variety of Bitcoin transactions over the previous few years:

The worth of the metric appears to have seen a pointy rise in current weeks | Supply: Glassnode on Twitter

As seen within the chart above, the Bitcoin transaction depend had turn into stale after the plunge the place the cryptocurrency descended from the highest of the bullish rally. This pattern held true all through the bear market till the beginning of the restoration this 12 months.

With this new value surge, the indicator has soared and reached ranges that had been solely final seen throughout the bull run within the first half of 2021. Because of this the variety of transfers pending on the chain proper now could be the very best for about two years.

The chart additionally exhibits knowledge for 2 different indicators, Bitcoin trade deposits and trade withdrawals. Because the names of those metrics already point out, they inform us in regards to the complete quantity of transfers out and in of exchanges, respectively.

These metrics shouldn’t be confused with entry and exit indicators, because the latter measure the entire variety of cash coming into and exiting exchanges, quite than the variety of trades.

From the chart, it’s seen that regardless of the spike within the variety of Bitcoin transactions, each of those metrics have continued to pattern sideways. Because of this the rise in transfers comes virtually completely from the peer-to-peer (P2P) facet and never from exchanges.

That is totally different from what was seen within the April 2019 rally and 2021 bull run, the place exchange-related transactions additionally noticed a minimum of some improve alongside rising costs.

Because the Ordinals Protocol, a technique of writing knowledge on to the Bitcoin blockchain (basically BTC model NFTs), has additionally emerged over the previous few months, a part of the rise in transactions is probably going attributable to such transfers made utilizing this protocol. .

BTC value

As of this writing, Bitcoin is buying and selling round $28,200, up 14% previously week.

BTC hasn't moved a lot lately | Supply: BTCUSD on TradingView

Featured picture of Kanchanara from Unsplash.com, charts from TradingView.com, Glassnode.com