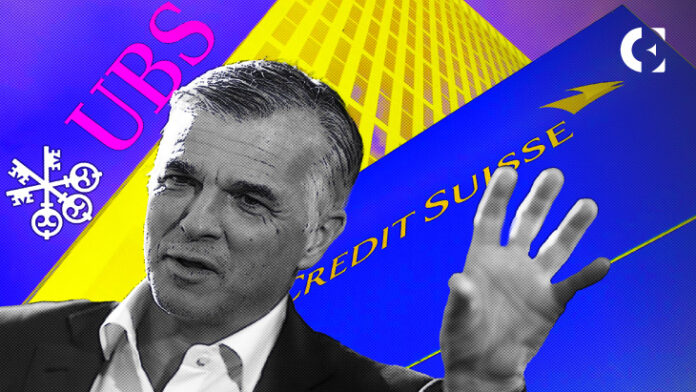

- UBS Group AG brings again Sergio Ermotti as CEO to guide the acquisition of Credit score Suisse.

- Sergio Ermotti’s return faces challenges together with downsizing, downsizing of funding banks and restoring investor confidence.

- The appointment of the brand new CEO despatched UBS shares up 2.3%, taking up weeks after the Credit score Suisse acquisition.

Sources have reported that Sergio Ermotti has been introduced again as CEO of UBS Group AG (UBSG.S) to guide its sizeable acquisition of Credit score Suisse (CSGN.S). The surprising transfer goals to capitalize on his experience in restructuring the financial institution after the worldwide monetary disaster.

As CEO of UBS Group AG, Sergio Ermotti will face a number of urgent challenges, together with the implementation of workforce reductions affecting hundreds of staff and the downsizing of Credit score Suisse’s funding financial institution. As well as, he must restore the arrogance of excessive internet value people, guaranteeing that UBS stays the popular vacation spot for his or her investments.

From April 5, the present chairman of Swiss Re (SRENH.S), Ermotti, will take over the administration. Beforehand, Ermotti was CEO of UBS from 2011 to 2020. Following the announcement of his appointment, pre-market exercise on the Zurich Inventory Change confirmed UBS shares had been up 2.3% .

Moreover, Ermotti will take the reins simply weeks after UBS acquired Swiss financial institution Credit score Suisse, a sudden merger engineered by Swiss authorities to ease instability within the wake of Credit score Suisse’s troubles.

Following the acquisition of Credit score Suisse, UBS grew to become Switzerland’s solely world financial institution, backed by round 260 billion francs ($170 billion) in loans and state ensures. This choice will increase the dependence of the Swiss financial system on a single lender.

Andreas Venditti, an analyst at Vontobel, stated Ermotti’s expertise in downsizing UBS’s funding financial institution after the monetary disaster greater than a decade in the past ready him properly for this new function. .

In the meantime, present UBS CEO Ralph Hamers was absent from the announcement of the takeover, and he agreed to step all the way down to serve the pursuits of the brand new mixture, the Swiss monetary trade and the nation. The choices of the Board of Administrators had been made in gentle of the brand new challenges and priorities that UBS faces after the acquisition.