What’s the information and worth efficiency of crypto belongings Monero (XMR), Ripple (XRP) and Pepe Coin (PEPE)?

A take a look at their most up-to-date performances beneath.

Evaluation of Monero (XMR), Ripple (XRP) and Pepe Coin (PEPE)

It’s price mentioning that Monero (XMR) is a cryptocurrency created in April 2014 that emphasizes privateness, decentralization, scalability, and fungibility. Additionally, its authentic title was BitMonero after which it simply grew to become its present title.

Ripple (XRP), then again, is a real-time cash switch system, a foreign money alternate and remittance community, created in 2012 by Ripple Labs, then OpenCoin.

Lastly, the memecoin PEPE, launched on April 17, reached a market capitalization of $139 million in a really quick time. Nonetheless, the founders emphasised that it was a coin with no intrinsic worth or expectation of monetary return.

Monero continues its upward trajectory within the bear market: comparability with Ripple and Pepe Coin

Based mostly on the most recent knowledge, it may be seen that given the rising shopping for momentum, the most recent evaluation of the worth of Monero (XMR) suggests an uptrend for as we speak. As we all know, the worth of the coin has continued to drop over the previous week, an element that has had a unfavorable impression available on the market.

In truth, distributors had been controlling XMR because it struggled to get assist. Nonetheless, throughout yesterday’s buying and selling day, the bulls returned and absolutely recovered. So, once more as we speak, the development is in favor of the consumers as the worth rose through the day, reaching $157.44.

It needs to be famous that though the rise is minimal, the crypto Monero continues to be on an upward trajectory in a broadly bearish market. Subsequently, because the worth of Monero has lined a transfer increased prior to now 24 hours, the every day worth evaluation helps a uptrend for the market.

Nonetheless, it’s nonetheless barely beneath its transferring common (MA) worth, which is at a place of $157.98 after crossing the SMA 50 curve, which is one other bearish indication.

The worth of the coin has elevated 0.85% over the previous day as buying and selling quantity elevated by greater than 16.9% for as we speak, indicating modest beneficial properties in worth. Basically, consultants predict that the subsequent worth occasions will likely be bullish, given the dimensions of the area between the Bollinger Bands.

We see that the decrease band reveals a price of $152with stronger assist, and the higher band reveals a price of $165reflecting resistance, as worth continues to rise.

Furthermore, the SMA 20 curve is buying and selling beneath the SMA 50 curve, regardless of bullish individuals holding a number one place. Lastly, the Relative Power Index (RSI), which signifies a market bond between consumers and sellers, is presently buying and selling with a horizontal slope of 49.

Ripple runs to success regardless of market turmoil

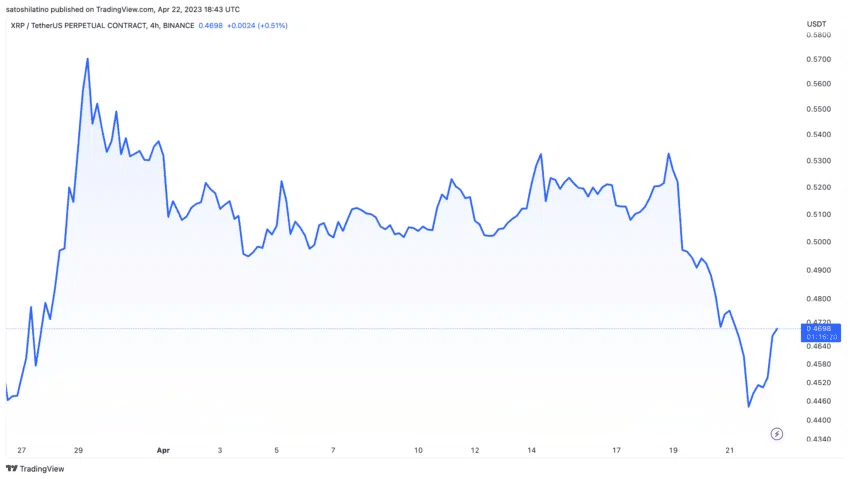

As we’ve got seen, the latest collapse within the worth of Ripple (XRP) caught the eye of buyers and analysts, notably elevating questions on the way forward for Ripple and its native crypto.

Nonetheless, there are key elements highlighted behind Ripple’s worth volatility and development prospects within the European market that would make clear XRP’s continued success regardless of short-term market turmoil.

In any case, it’s simple that XRP, like different cryptocurrencies, has skilled vital worth fluctuation within the final days. Ripple’s latest worth crash will be attributed to elements akin to low buying and selling volumes within the cryptocurrency market and regulatory stress.

Who has even seen buying and selling volumes on the world’s largest cryptocurrency alternate, Binance, measured in opposition to a bear market. Because of this, the worth of XRP has additionally been considerably affected by the bearish sentiment prevailing within the broader market.

In accordance with some, this was additionally fueled by regulatory ambiguity following the failure of the President of the Safety and Trade Fee (SEC) to answer requests from Congress.

Both manner, consultants say it’s Europe that represents an enormous market alternative for Ripple, with a rising variety of monetary establishments adopting its expertise.

A expertise that features a progressive regulatory atmosphere within the area, robust demand for cross-border cost options and strategic partnerships with main monetary gamers. All of the elements that place Ripple effectively for capitalize on the potential of the European marketoffsetting any short-term challenges posed by XRP worth volatility.

Pepe Coin: the memecoin that has turn out to be a useful digital asset

As anticipated, Pepe Nook is a brand new memecoin getting into the market as a competitor to present memecoins. The market capitalization of PEPE has elevated to roughly $146 million with over 24,500 distinctive holders since buying and selling started a couple of days in the past.

Particularly, in response to CoinMarketCap, the worth of PEPE rose by 1000% over the previous two days. At first look, PEPE may look like simply one other hype-generating memecoin, although a complete evaluation of the chain reveals its astonishing growth.

Certainly, as analyst An Ape’s Prologue identified, rising costs have resulted in enormous beneficial properties for memecoin whales, which have amassed practically 30 trillion PEPE, price about $10 million on 13 accounts.

All of this instantly interprets to the truth that Pepe Coin has had a big impact on the rising meme financial system. Once more, how standard memes can evolve into actual worth digital belongings and appeal to thriving communities.

Pepe Coin sheds mild, as soon as once more, on the rising affect of memes on as we speak’s on-line and monetary landscapes. Certainly, PEPE is a residing instance of the social significance that memes have in as we speak’s tradition attributable to their incorporation into the mainstream.