The info exhibits Bitcoin traders confirmed indicators of worry as the value of the cryptocurrency plunged under $27,000.

Bitcoin’s social dominance spike suggests worry available in the market

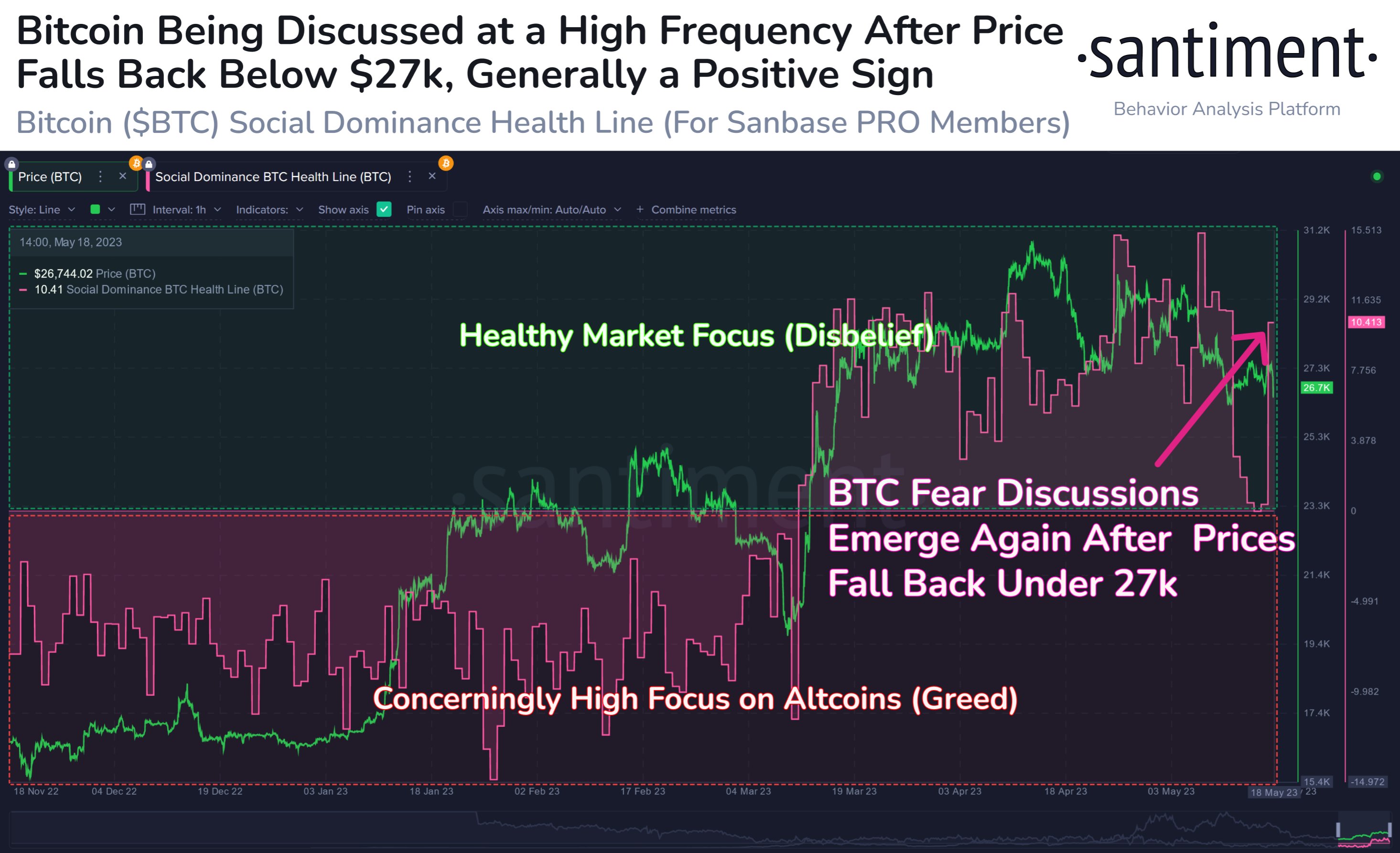

In response to knowledge from the on-chain analytics firm Saniment, BTC’s social dominance has seen an enchancment just lately. “Bitcoin social dominance” is an indicator that measures the share of complete discussions involving the highest 100 property by market capitalization that point out BTC.

What this metric tells us is how the present curiosity in BTC amongst traders compares to that of altcoins. Traditionally, excessive curiosity in altcoins (that means BTC’s social dominance is low) has been an indication of greed available in the market.

Normally, markets acquire a better chance of shifting reverse to common market sentiment, the extra the sentiment leans in a specific course. Thus, in instances of greed, value corrections could turn out to be extra seemingly.

When BTC social dominance is excessive, nevertheless, it’s a signal that curiosity in BTC is excessive proper now. Such market situations might be linked to the presence of worry, and so bounces naturally turn out to be extra seemingly.

Now, here’s a chart that exhibits Bitcoin’s social dominance pattern over the previous few months:

The worth of the metric appears to have been excessive in current days | Supply: Santiment on Twitter

Within the chart above, Santiment has flipped the social dominance scale and made the 20% mark a “0” stage. In response to the analytics agency, this 20% mark serves as one thing of a “well being line” for the cryptocurrency, that means it’s the threshold under which altcoins get harmful ranges of focus. .

From the chart, it’s seen that social dominance had been adverse (i.e. under that 20% well being stage) within the first two months of the rally, which then peaked with the value observing a drop under the $20,000 stage.

Nonetheless, after the value rebounded from these lows, Bitcoin’s social dominance moved into constructive territory. Since then, the metric has remained inside this zone.

Just lately, the indicator was on the verge of falling again into the greed zone, as might be seen on the chart. Nonetheless, BTC-related discuss surged once more as the value of the cryptocurrency struggled additional and dipped under the $27,000 stage.

The timing of this spike seemingly signifies that the present excessive talks are happening because of rumbling worry amongst traders. It’s presently unclear how the market can proceed from there, however the emergence of worry a minimum of implies that there’s a increased chance {that a} native low will quickly be found, after which a rebound might happen.

BTC value

As of this writing, Bitcoin is buying and selling round $26,900, up 2% up to now week.

Appears like the worth of BTC has gone under the $27,000 stage | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Santiment.internet