Key factors to recollect

- On-chain exercise for Bitcoin and Ethereum fell for the fourth week in a row

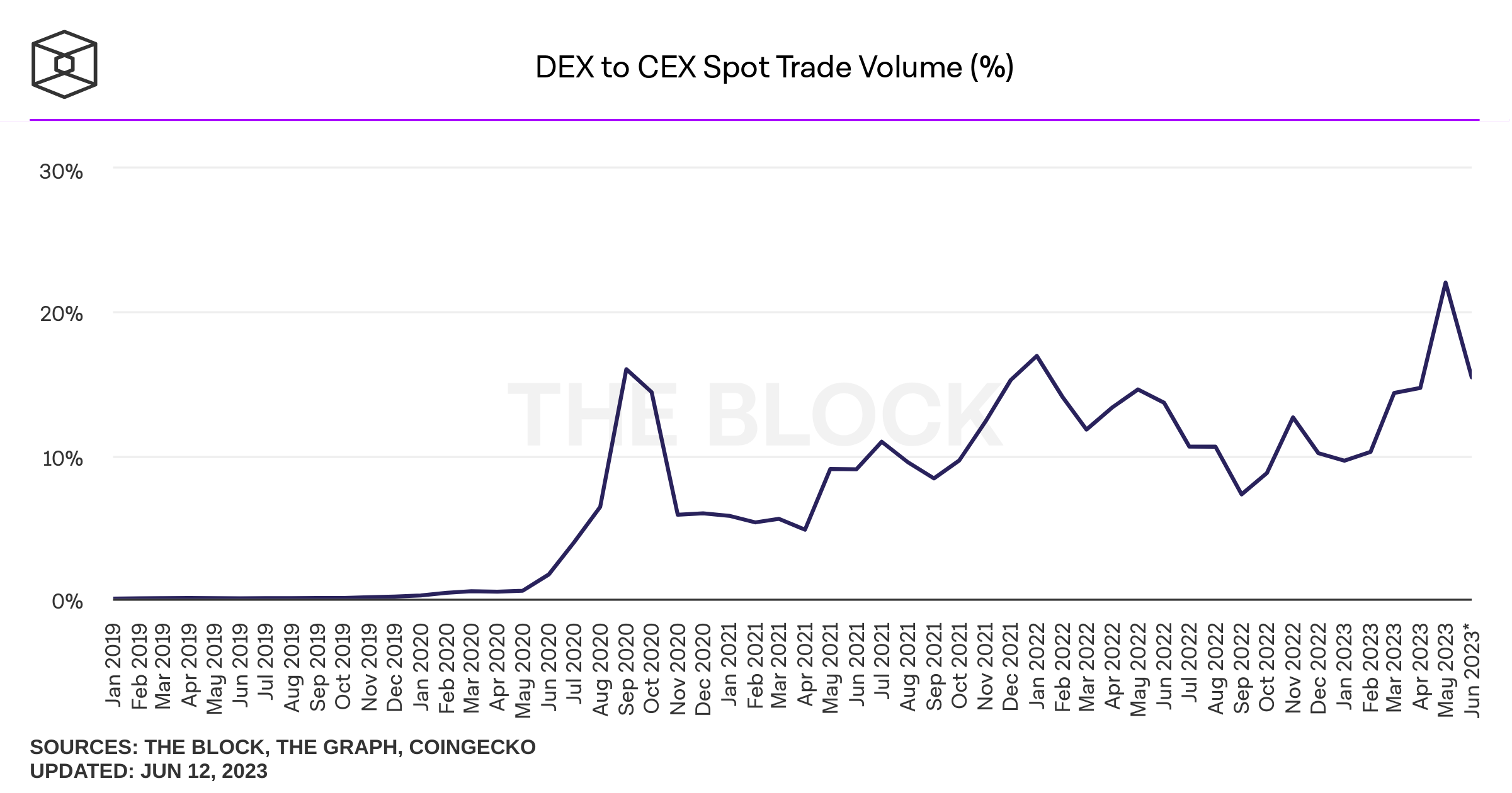

- DEX’s share of buying and selling quantity jumped from 14% to 22% final month amid regulatory crackdown on centralized exchanges

- DEX quantity has since fallen again, nonetheless, and your entire crypto house is seeing low liquidity

Many imagine that the regulatory crackdown in the US will push crypto in two methods: offshore and/or within the decentralized realm. For the primary, it does not want a lot rationalization. The tightening of the noose on crypto companies in the US will pressure those self same firms to maneuver abroad in the event that they wish to proceed operations on the similar capability (or by no means).

However whether or not that can push exercise on the channel presents as a extra attention-grabbing debate. Decentralized exchanges took off in the course of the pandemic hysteria, however their volumes have dropped drastically all through 2022. Whereas quantity has additionally fallen for centralized exchanges (CEX), the ratio of DEX change quantity to CEX quantity fell from 16.9% at first of 2022 to 9.6. % twelve months later, displaying that DEXs have fallen greater than their extra typical counterparts.

Might the regulatory difficulties of Coinbase, Binance and different centralized exchanges reverse this development? The chart under exhibits that there was certainly a rise in exercise represented by DEXs in Might, with DEX exchanges capturing 22.1% of quantity, in comparison with 14.7% the earlier month. Nonetheless, the share fell again to fifteen.4% within the first twelve days of June.

Binance was sued on June 5 and Coinbase on June 6, which is curious when wanting on the development above as DEX’s share has since fallen. Once more, these lawsuits could have been largely taken under consideration. Coinbase acquired a Wells discover just a few months in the past, whereas Binance was (and nonetheless is) dealing with quite a few inquiries from varied lawmakers. The worth of Bitcoin will let you know all the things it is advisable to know – it solely dropped 5% after Binance was formally sued, whereas information from Coinbase hasn’t budged in any respect.

Binance was sued on June 5 and Coinbase on June 6, which is curious when wanting on the development above as DEX’s share has since fallen. Once more, these lawsuits could have been largely taken under consideration. Coinbase acquired a Wells discover just a few months in the past, whereas Binance was (and nonetheless is) dealing with quite a few inquiries from varied lawmakers. The worth of Bitcoin will let you know all the things it is advisable to know – it solely dropped 5% after Binance was formally sued, whereas information from Coinbase hasn’t budged in any respect.

In fact, regardless of the causes, it’s troublesome to attract conclusions from the above information. The quantity stays extremely skinny, as I’ve mentioned in depth beforehand. In truth, on-chain exercise and charges truly fell for the fourth week in a row for Bitcoin, the immense peak of exercise attributable to Ordinals protocol and BRC-20 tokens fading within the again bezel. Regardless of this drop, nonetheless, it needs to be famous that charges are nonetheless considerably greater than at first of the yr.

It is not simply Bitcoin. Charges and exercise are reducing within the crypto house. The chart under is identical however for Ethereum, which has additionally seen 4 consecutive weeks of falling charges. In contrast to Bitcoin, nonetheless, exercise is approaching its January degree.

General, quantity within the cryptocurrency house stays extremely skinny. This is because of a wide range of components. The primary is the worth collapse. When costs fall, individuals invariably commerce much less crypto. And with Bitcoin nonetheless 60% off its late 2021 peak, hysteria and stalled order books appear a great distance off.

However regulation can also be a key issue. This has suppressed enthusiasm for house immeasurably, with explicit implications for establishments. We noticed a telltale signal of this over the weekend, with Crypto.com suspending its US institutional change. Though its retail platform stays operational, the corporate cited restricted demand from establishments as the explanation for its determination.

A cocktail of plummeting costs and an more and more punitive regulatory regime is the worst attainable state of affairs for the business, and it is not laborious to see why establishments have pulled out of the house.

The rise in DEX quantity proven by the on-chain information above could look promising at first look, however that development seems to have reversed. Furthermore, for institutional capital to circulation considerably into the house, centralized exchanges carry out an important operate. Many have been optimistic concerning the arrival of those establishments just a few years in the past, when firms like Tesla saved Bitcoin on their steadiness sheets, however that appears a great distance off now.