Over the previous month, Bitcoin’s worth has fluctuated with each main macro occasion and regulatory announcement, such because the SEC’s current lawsuits towards Coinbase and Binance, which allege a number of securities violations and comprise language that might reshape the market. ‘{industry}.

These occasions solely launched extra volatility, and whereas Bitcoin’s worth swings weren’t as aggressive as they may have been, they led to a chaotic and unsure market environment.

Nonetheless, that hasn’t deterred longtime holders from hoarding.

diamond arms perpetually

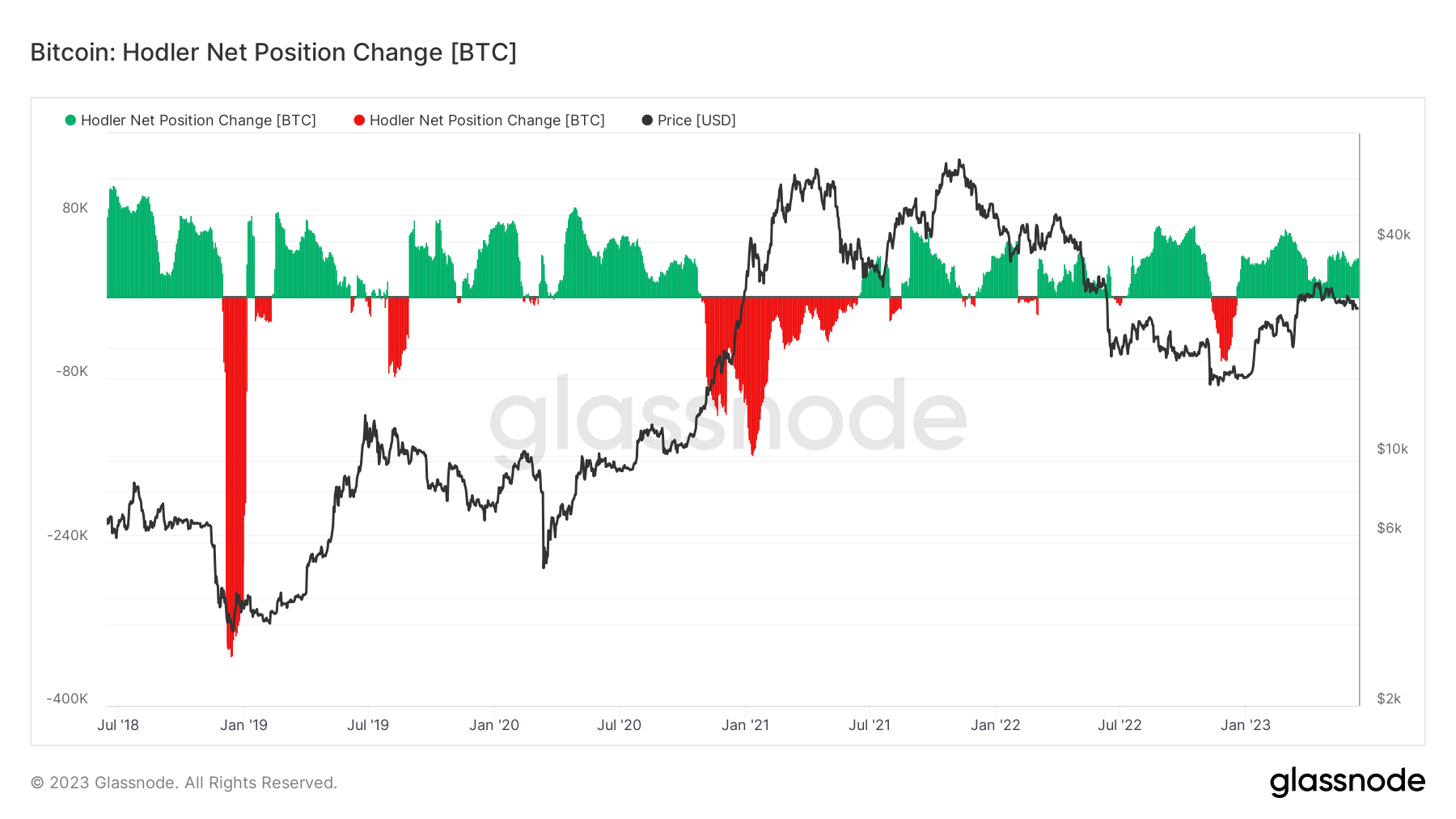

Lengthy-term holders are addresses which have held their cash for a minimum of 155 days with out transferring them, exhibiting a extra affected person and long-term funding method for Bitcoin. As such, they’re an important indicator of market sentiment, as short-term market fluctuations are much less more likely to have an effect on them.

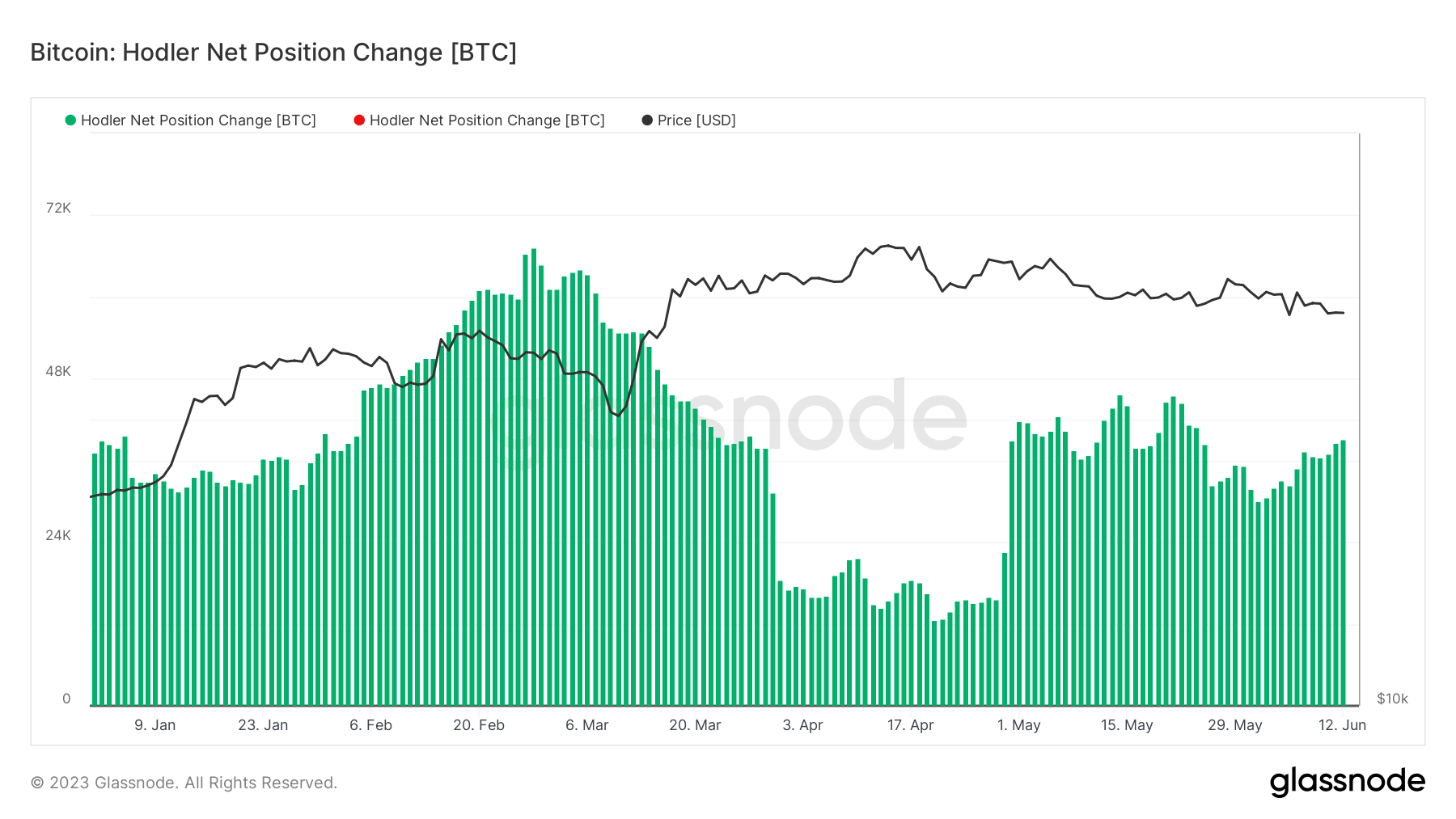

Regardless of continued market uncertainty, holders continued to build up Bitcoin. Knowledge from Glassnode confirmed that holders have elevated their BTC place because the begin of the 12 months, with every day exhibiting a optimistic change of their place.

A noticeable spike in accumulation was noticed in early Could, triggering a brand new wave of accumulation. As of June 12, hodlers had been growing their positions on the fee of 39,233 BTC per 30 days.

Traditionally, web modifications in hodler positions have been inversely correlated to Bitcoin worth actions – when Bitcoin costs peak, long-term hodlers lower their positions. This means that skilled market individuals have a tendency to purchase extra Bitcoin when its worth is low and promote when the value is rising.

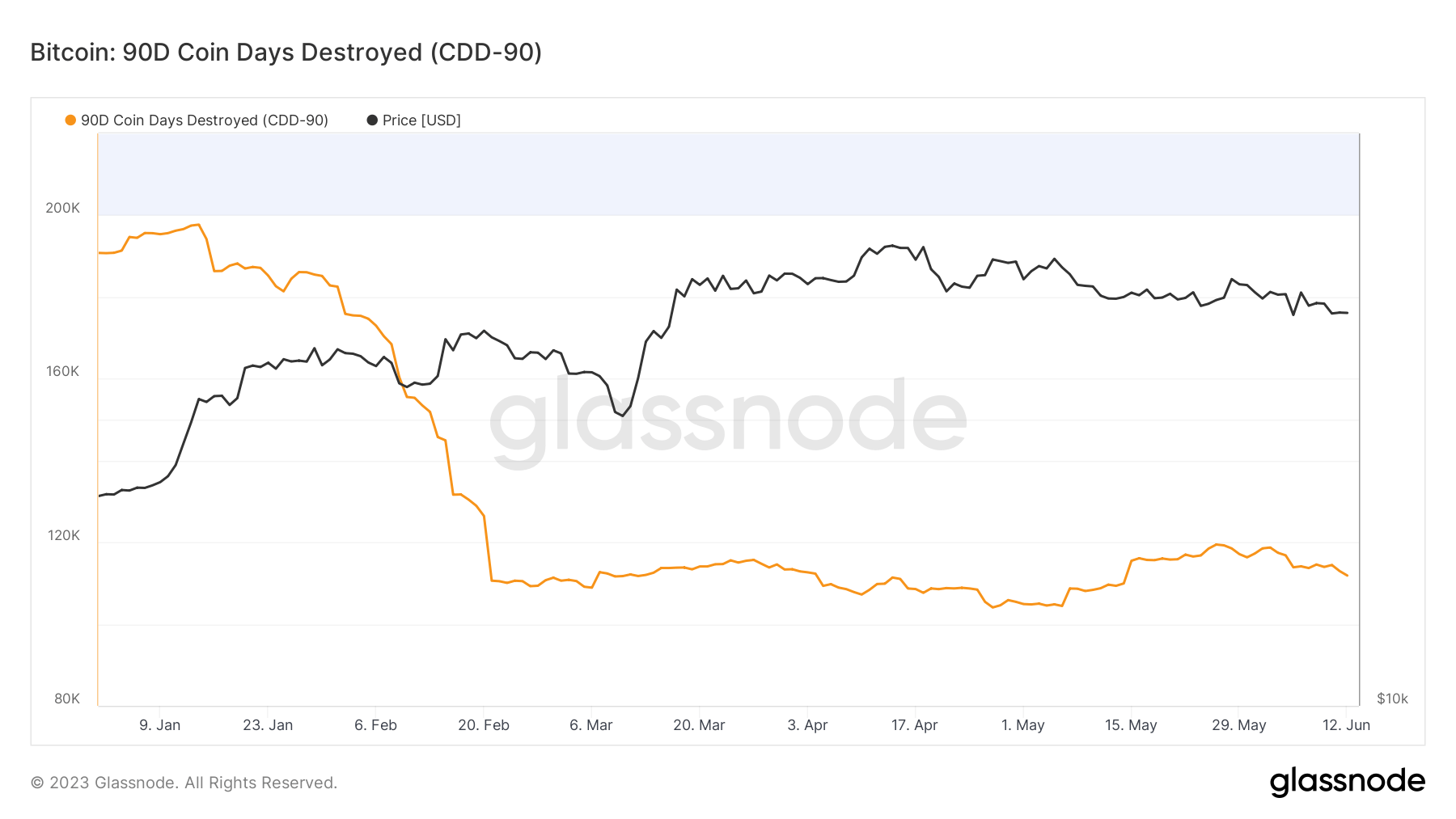

One other on-chain metric, Coin Days Destroyed 90 (CDD-90), additional helps this accumulation pattern.

Coin Days Destroyed is a strategy to measure the motion of outdated cash. Holding a single bitcoin for a day creates a coin day, whereas transferring the bitcoin destroys the coin day. CDD tracks the full age of all Bitcoins moved on a given day, offering perception into what number of older cash held by long-term holders are transferring.

And whereas the CDD offers a stable snapshot of the situation of older elements, the CDD-90 is a way more related metric. The metric sums all CDDs from the previous 90 days, offering a greater take a look at Bitcoin’s financial exercise over an extended time-frame. An uptrend in CDD signifies that holders who personal long-lived cash are promoting, whereas a downtrend exhibits a lower in curiosity.

Since February 21, the CDD-90 has been treading water. This means that hodlers have slowed down their spending and are growing their bitcoin positions. This accumulation reduces the quantity of Bitcoin accessible available in the market, tightening the provision.

The buildup of long-term hodlers and the sideways pattern of CDD-90 counsel continued curiosity in Bitcoin that defies unsure market circumstances. Whereas Bitcoin’s speedy future stays unsure given the complexity of the macro and intra-industry elements at play, these metrics point out quiet however agency confidence within the asset.

The submit Hodlers continues to hoard Bitcoin within the wake of US regulatory onslaught appeared first on forexcryptozone.