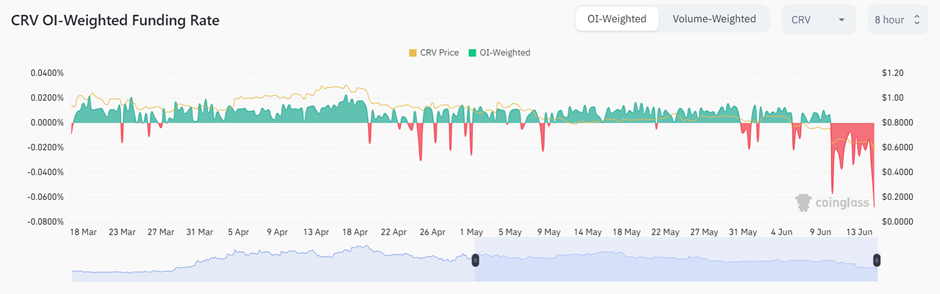

- Funding price for Curve DAO’s CRV token has fallen to a brand new yearly low.

- Previously 24 hours, the CRV token has fallen by 10%.

- The imbalance within the Curve ecosystem precipitated the value of USDT to drop 0.25%.

In keeping with a current evaluation, the funding price of the Curve DAO CRV token fell to a brand new yearly low, with a price of -0.0733% within the final 8 hours. Previously 24 hours, the token has fallen greater than 10%.

Following the imbalance within the Curve ecosystem, there was a big change of USDT towards DAI and USDC, leading to a 0.25% discount within the value of USDT. At press time, USDT is buying and selling at a value of $0.998, down 0.26%, whereas CRV is at $0.5683, down 12.17%.

A outstanding Chinese language journalist, Collin Wu, has shared a collection of Twitter threads by way of his official Wu Blockchain web page, offering perception into potential causes for the annual CRV low.

Apparently, days earlier than, Curve Finance founder Michael Egorov deposited $24 million value of CRV tokens, or 34% of the whole provide. The large deposit in decentralized protocol Aave was an try to mitigate a liquidation threat of a $65 million stablecoin mortgage. In keeping with the crypto sleuth, Lookonchain, Egorov deposited 291 million CRV and borrowed $65 million USDT and USDC.

Immediately, Wu claimed that CRV’s funding price drop might be attributed to Curve founder Michwill’s gamble:

The primary cause for this will have been a wager on the liquidation of the place held by Curve founder michwill (0x7a…5428) by quick sellers. This deal with holds 430 million CRV tokens (about 50% of the circulating provide) as collateral for mortgage protocols.

The reporter integrated the pockets deal with of michwill, declaring that the deal with incorporates greater than 400 million CRV tokens, which equates to a complete quantity of $2,342,134.