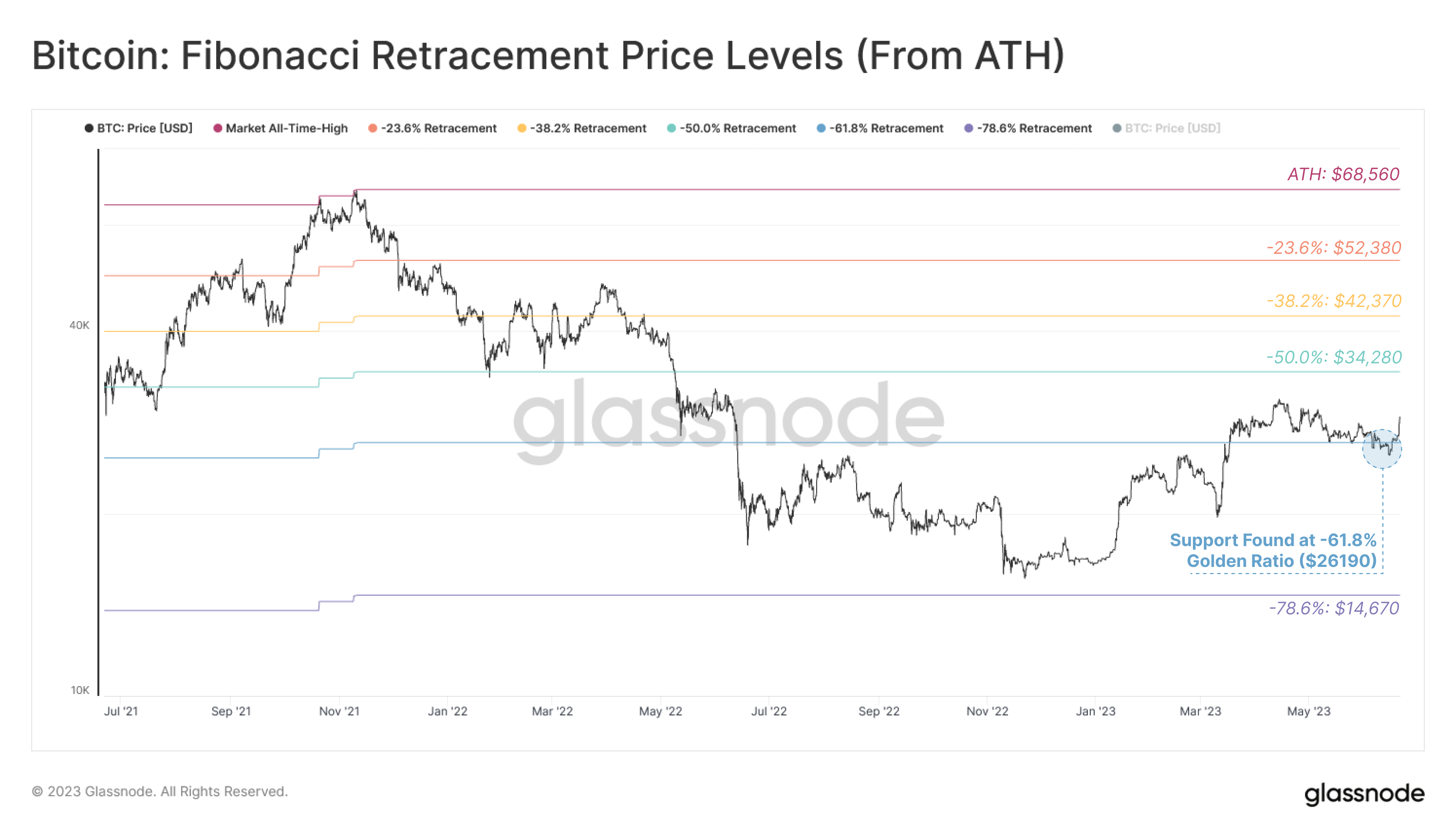

- Bitcoin’s breakout to $29,000 comes after the bulls established $26,190 as a key assist zone.

- If the bulls are making year-to-date highs, the following direct resistance in accordance with the Fibonacci sample could possibly be on the -50.0% retracement of $34,280.

- Bitcoin traded at round $29,030 on Monday morning after one-off ETF information triggered by BlackRock’s submitting helped the bullish momentum.

Bitcoin (BTC) broke above a key downtrend line because it surged above the $28,000 stage on Tuesday. By reaching the $29,000 space, BTC has pushed nicely previous the current hurdle and now has a key assist line at $26,190.

Analysts pointed to Bitcoin’s breakout of a multi-month bearish development as a bullish transfer that places the highest crypto asset on the verge of retesting the $30,000 stage. Can it go increased than its year-to-date highs above $31,000?

The technical image based mostly on the Fibonacci sample suggests it might be pumping previous its year-to-date highs.

Bitcoin value at $34,000 subsequent?

Though Bitcoin is clearly not but in a bull market, the potential for a breakout appears possible as a confluence of optimistic components aligns. As regulatory headwinds, together with SEC lawsuits towards Binance and Coinbase, proceed to loom over the market.

Nonetheless, the resilience demonstrated over the previous few weeks and renewed optimism as main monetary establishments embrace crypto have bulls prepared and a break to $30,000 may be very a lot on the playing cards. Can it go to $34,000 subsequent?

In keeping with Glassnode, a monetary and on-chain metrics knowledge supplier, this robust assist is on the -61.8% Golden Ratio Fibonacci retracement. If the value rises and establishes a transparent uptrend, it’s possible that the bulls will retest the decision of the bears round $34,280.

This is able to be the following direct resistance zone, Glassnode identified on Wednesday, inserting this potential provide reload zone on the -50% Fibonacci retracement stage.

Chart exhibiting all-time Bitcoin Fibonacci retracement ranges. Supply: glass knotHaving survived the detrimental sentiment that surrounded the SEC crackdown, the present wave of shopping for stress might deliver two extra main resistance areas into play.

Chart exhibiting all-time Bitcoin Fibonacci retracement ranges. Supply: glass knotHaving survived the detrimental sentiment that surrounded the SEC crackdown, the present wave of shopping for stress might deliver two extra main resistance areas into play.

Veteran Dealer Peter Brandt believes the breakout transfers the “burden of proof” to the bears because it suggests a rally above $37,000 is feasible. In the meantime, Glassnode identifies the -38.2% and -23.6% Fibonacci retracement ranges of $42,370 and $52,380 respectively as key hurdles.

Presently, BTC/USD is buying and selling at $29,030, which is round 8% increased prior to now 24 hours and nearly 12% increased prior to now week.