- Santiment knowledge factors to extra bullish indicators following the current aid within the crypto market.

- The crypto market is beginning to meet up with the fairness market after being outperformed over the previous few weeks.

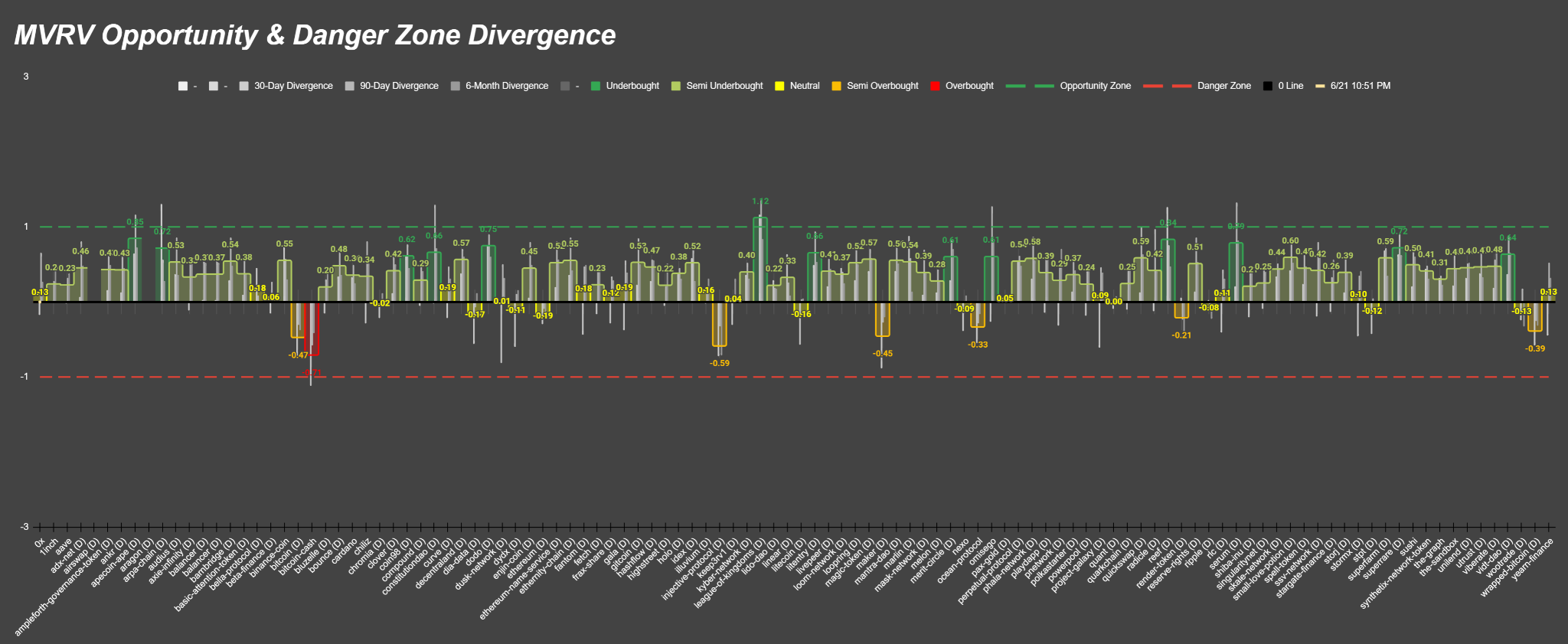

- The typical commerce returns of medium-term merchants present that merchants are nearer to the zones of alternative than the zones of hazard.

The cryptocurrency market breathed a sigh of aid after recovering from the bearish sentiment of 2023. Blockchain intelligence agency, Santiment, revealed in its newest report that its knowledge pointed to much more bullish alerts, suggesting that this restoration may proceed.

The crypto market began 2023 robust however confronted a 19% decline from April to June. On prime of that, Binance and Coinbase have been sued by the SEC, which has raised considerations. Nonetheless, the market has not too long ago seen a rise in its market capitalization resulting from new entrants.

Blackrock’s rumored transfer into crypto and its announcement of a full-fledged ETF additionally drew quite a lot of consideration. Subsequently, different fund managers adopted swimsuit, totaling no less than 10 bulletins. This has carried out wonders for the crypto market, as the worldwide crypto market capitalization has elevated by 3.98% up to now 24 hours alone, in response to CoinMarketCap.

Knowledge from Santiment means that the bullish momentum within the crypto market will persist over the following few weeks because it pointed to much more bullish alerts to think about. First, knowledge from Santiment indicated that the crypto market was catching up with the fairness market, which had been one of the best performer over the previous few weeks.

In the meantime, mid-term merchants’ common commerce returns present that merchants are nearer to areas of alternative than areas of hazard. Regardless of this, Santiment famous that many merchants are nonetheless nicely below water for a lot of belongings.

Santiment additionally reported that the sudden surge in crypto costs shocked many merchants who have been taking income. This means that there’s nonetheless potential for additional positive factors available in the market.

Regardless of the joy surrounding the ETF craze, Santiment careworn the truth that it’s nonetheless vital to stay vigilant relating to the continuing lawsuits towards Binance and Coinbase. The intelligence agency reminded merchants that these authorized points haven’t gone away resulting from ETF developments.

Santiment concluded his report with some ideas for merchants. Based on the report, the crypto crowd changing into excessively euphoric may point out a short lived spike available in the market.

Disclaimer: Views and opinions, in addition to all info shared on this value evaluation, are revealed in good religion. Readers ought to do their very own analysis and due diligence. Any motion taken by the reader is strictly at his personal danger. Coin Version and its associates won’t be held responsible for any direct or oblique harm or loss.