Robinhood will finish its help for quite a few crypto tokens in the present day, June 27, following an announcement made earlier this month. Among the many tokens to be eliminated are Polygon (MATIC) and Cardano (ADA).

Costs for each tokens fell after the crypto buying and selling platform’s preliminary announcement, including to the general negativity sparked by the U.S. Securities and Change Fee’s (SEC) lawsuits towards exchanges. Binance and Coinbase cryptocurrencies.

What’s the worth outlook for the 2 tokens at the same time as Bitcoin (BTC) affords to carry above the psychological stage of $30,000?

Polygon Worth Outlook

MATIC worth fell 35% in two days when Robinhood introduced its delisting on June 9, dropping from practically $0.79 to $0.50. Because the bulls face stress round $0.66, it’s probably {that a} rebound in the direction of the $0.75 space may materialize and provoke patrons.

One of many elements in favor of the Polygon bulls is the rise in change outflows for MATIC. The information exhibits that extra holders have moved tokens to self-custody wallets, the potential impression of which is an additional discount in promoting stress.

In response to crypto analyst Michael van de Poppe, the drop to $0.50 triggered “a series response of long-term selloffs.”

He Remarks that every one of this has since been resumed and that an escape is probably going. Nonetheless, MATIC/USD wants to show $0.75 into help to supply a foundation for additional bullish momentum.

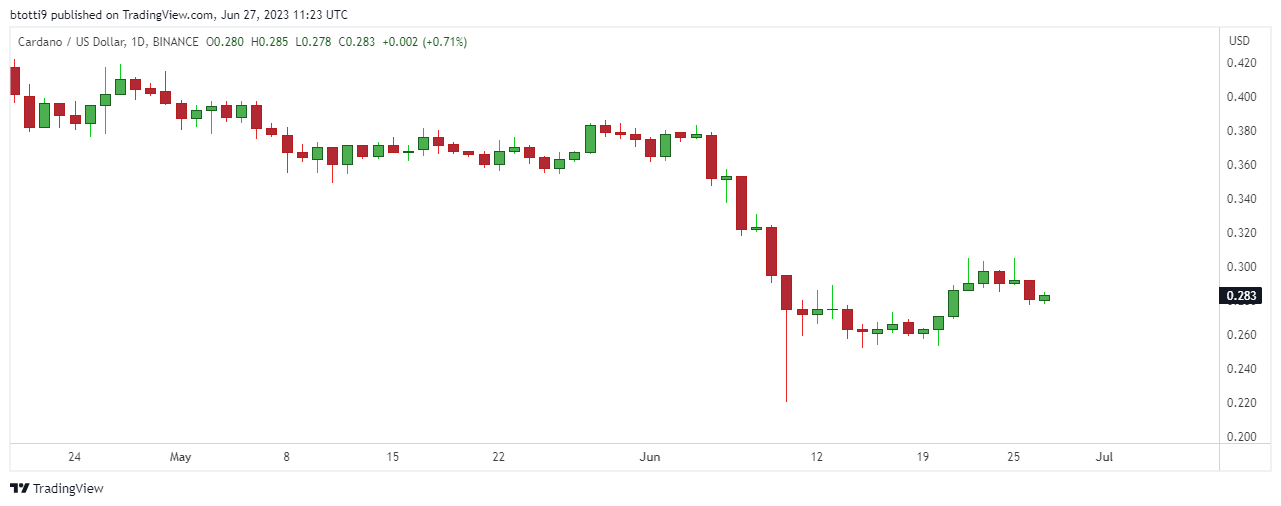

Cardano, like Polygon, fell sharply because the SEC labeled ADA a safety earlier this month. ADA misplaced over 42% of its worth through the week of June 5-10, falling from $0.37 to $0.22.

This was earlier than the current rally in cryptocurrencies helped the bulls to $0.30.

Cardano worth chart. Supply: Buying and selling View

However whereas ADA/USD is up practically 10% up to now week, losses over the previous 30 days quantity to 24% at present costs of $0.28. The areas round $0.25 and $0.22 are key if the bears strengthen within the close to time period.

In the meantime, the flipside would have topped $0.30, once more highlighting $0.40 as the subsequent main hurdle.