Predominant takeaways

- Spot Quantity Stays Low and Liquidity Skinny in Bitcoin Markets

- Solely 2.7% of provide moved final week; 7% moved within the final month

- This compares to 7% of the full Bitcoin provide that’s probably misplaced.

- Uncertainty is excessive resulting from tighter rules and macroeconomic local weather

- With establishments depositing ETFs and launching exchanges, the liquidity scenario might change drastically sooner or later

Market contributors will know that if something is true concerning the Bitcoin market over the previous 12 months, it has been extremely illiquid.

Market depth was slim anyway by the point November 2022 rolled round. Then got here the FTX implosion and an Alameda-sized gap so as books. Bankman-Fried’s buying and selling firm was additionally one of many largest market makers, and market depth has by no means recovered since its demise.

The impact has worsened in latest months resulting from regulatory repression in america. We have seen a number of market makers cancel their operations within the US, together with Leap Crypto and Jane Avenue in Might (paradoxically, Bankman-Fried labored for the latter earlier than founding Alameda).

We have now arrange a knowledge dive about this in March, however wanting on the steadiness of stablecoins on exchanges beneath, we will see that 60% left exchanges in simply over six months, amounting to $26 billion.

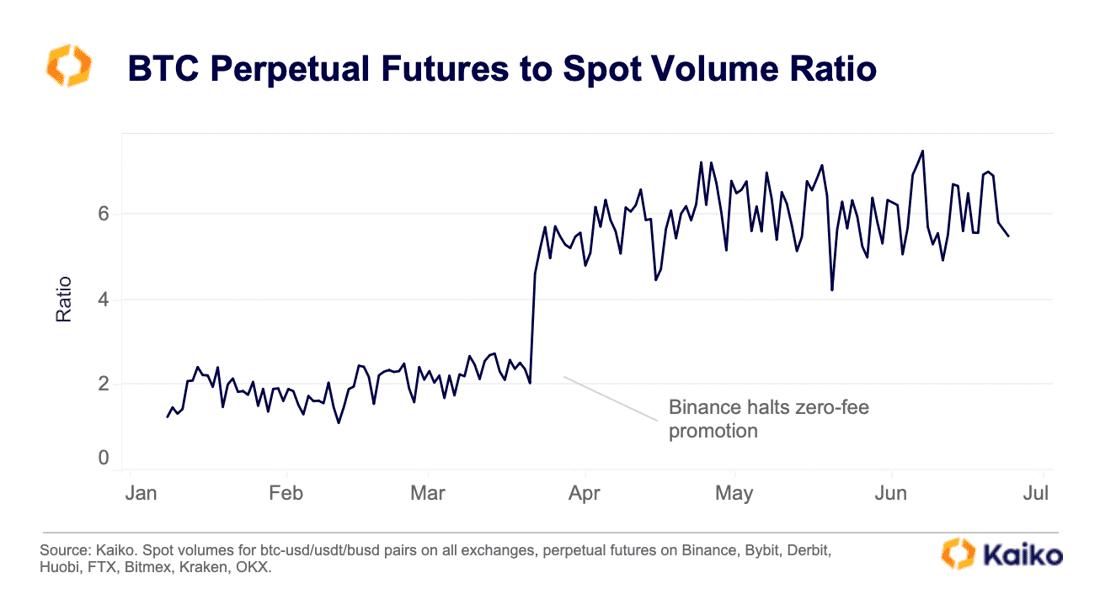

We are able to additionally see beneath that a lot of the quantity in the beginning of the 12 months got here from Binance by way of no-fee promotions. As soon as this promotion ended, the futures quantity ratio within the spot market jumped, highlighting that even this low stage of spot quantity was supported considerably artificially by zero charges (chart by way of Kaiko).

Certainly, one of many (many) accusations Binance faces is that the trade has engaged in “focused washout buying and selling” to spice up volumes. Subsequently, the shallow quantity may very well be even shallower in actuality.

Now everyone knows that. I need to take a second to evaluate the provision facet of the equation, although. From day one, Bitcoin has had two qualities that make it ever so fascinating: a capped ultimate provide of 21 million cash and a predetermined schedule at which these cash are launched (the provision cap to be reached within the 12 months 2140) .

To this point, 92.4% of Bitcoin’s provide has already been launched. Pulling knowledge from the channel, I’ve plotted beneath the proportion of cash which have moved within the final month versus the full provide. This offers a sign of what number of cash are shifting resulting from buying and selling exercise.

The graph reveals that 1.4 million cash have been moved within the final month, which equates to 7% of the circulating provide. In fact, a month might be too broad a time horizon. Breaking it right down to a (nonetheless conservative) week within the subsequent chart, round half one million cash are shifting, or round 2.7% of the full provide.

These charts additional spotlight how little bitcoin really strikes as of late. Actually, if I can use one other graph as an instance the rarity at play right here, let’s take a look at this subsequent one which overlays an estimate of misplaced cash. These misplaced cash are estimated by Glassnode and have been inactive cash since earlier than the launch of the primary Bitcoin trade in July 2010 (as pre-July 2010 cash are spent, this estimate converges to the precise variety of misplaced cash; this isn’t not an ideal measurement, however a superb estimate).

The chart reveals that 7.5% of the full provide can presently be estimated as misplaced (Satoshi Nakamoto’s reserve is included right here). Because of this it’s roughly the identical quantity because the variety of cash that moved within the final month, and triple the variety of cash that moved within the final week.

Subsequently, solely a small a part of the provision is shifting for Bitcoin. On the one hand, it sounds bullish – an oft-repeated mantra within the house is that falling provide will inevitably trigger costs to rise. However that is solely the case if the low provide is accompanied by a rise in demand.

After we have a look at order books and market depth over the previous 9 months, low liquidity is a priority. Nonetheless, there have been a number of vital developments over the previous two weeks that give hope that this may increasingly change. Blackrock, the world’s largest asset supervisor, has filed for a Bitcoin ETF, solely to be shortly adopted by fellow big Constancy. There may be additionally the launch of the EDX trade, backed by trad-fi giants Constancy, Schwab and Citadel.

Even the tightening of the regulatory noose round Binance might assist present a clearer image of the way forward for the house and provides traders confidence that one thing is lastly being finished to scrub up the opaque nature of a lot of it. Of the business.

In conclusion, it is rather probably that we are going to return with admiration to those extraordinarily skinny liquidity circumstances in a number of years. Uncertainty is excessive proper now, each when it comes to regulation and the macro image. There’ll come a day when that may not be the case, and issues may very well be very completely different in consequence. However for now, it is slim there.