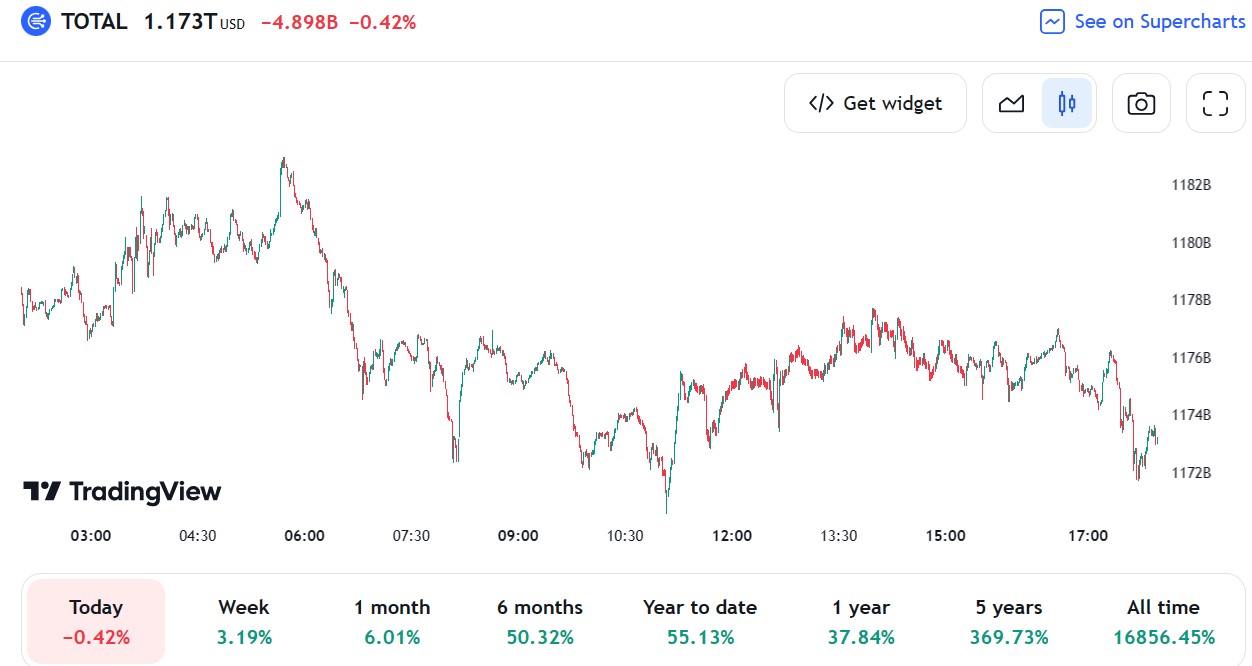

- Whole cryptocurrency market capitalization has elevated by greater than 50% within the final six months

- Traders Bullish as Bitcoin Worth Holds Close to Yearly Excessive

- Ethereum, Litecoin and Ripple adopted Bitcoin increased

The primary half of the enterprise yr is behind us, and one of the vital notable developments is the rise within the complete crypto market capitalization. After 2022, when many crypto buyers had had sufficient of the trade scandals and left, the 2023 rally seems like the beginning of a brand new bull market.

The efficiency is much more spectacular, provided that the US greenback is buying and selling with a blended tone in opposition to its fiat rivals.

Renewed investor curiosity in cryptocurrencies led to complete market capitalization development of greater than 50% within the first half of the yr. Previously week alone, the market is up over 3% and buyers are bullish as Bitcoin, the main cryptocurrency, is holding close to the yearly excessive.

Ethereum, Litecoin and Ripple adopted Bitcoin increased

Bitcoin is the principle cause buyers are optimistic concerning the cryptocurrency trade regardless of ongoing scandals, frauds, and lawsuits. In the end, all that issues to market watchers is that the value of Bitcoin stays close to the yearly excessive, regardless of a restoration in 2023 of greater than +85%.

Due to this fact, the trail of least resistance within the second half of the yr seems to be to the upside.

Bitcoin Chart by TradingView

Nonetheless, not all currencies carried out like Bitcoin. For instance, Dogecoin is flat on the yr, up round +0.3% within the first six months of 2023. It is a enormous divergence from what Bitcoin and different crypto -currencies have carried out (eg, Ethereum, Litecoin, Ripple), and this displays the focus of crypto-investors in just a few cryptocurrencies.

In the course of the second half of the yr, crypto buyers might need to comply with the evolution of the standard foreign money market. Particularly, what’s the Fed going to do with the funds price?

If the US greenback loses floor in opposition to its rival fiat currencies over the following six months, Bitcoin and different main cryptocurrencies are effectively positioned to rally additional. With the Fed suspending price hikes in June, think about the chance that the present funds price is the terminal price for this tightening cycle.