Bitcoin (BTC) miners offered a big quantity of their mined Bitcoin in June to fund their operations, based on Glassnode knowledge analyzed by forexcryptozone.

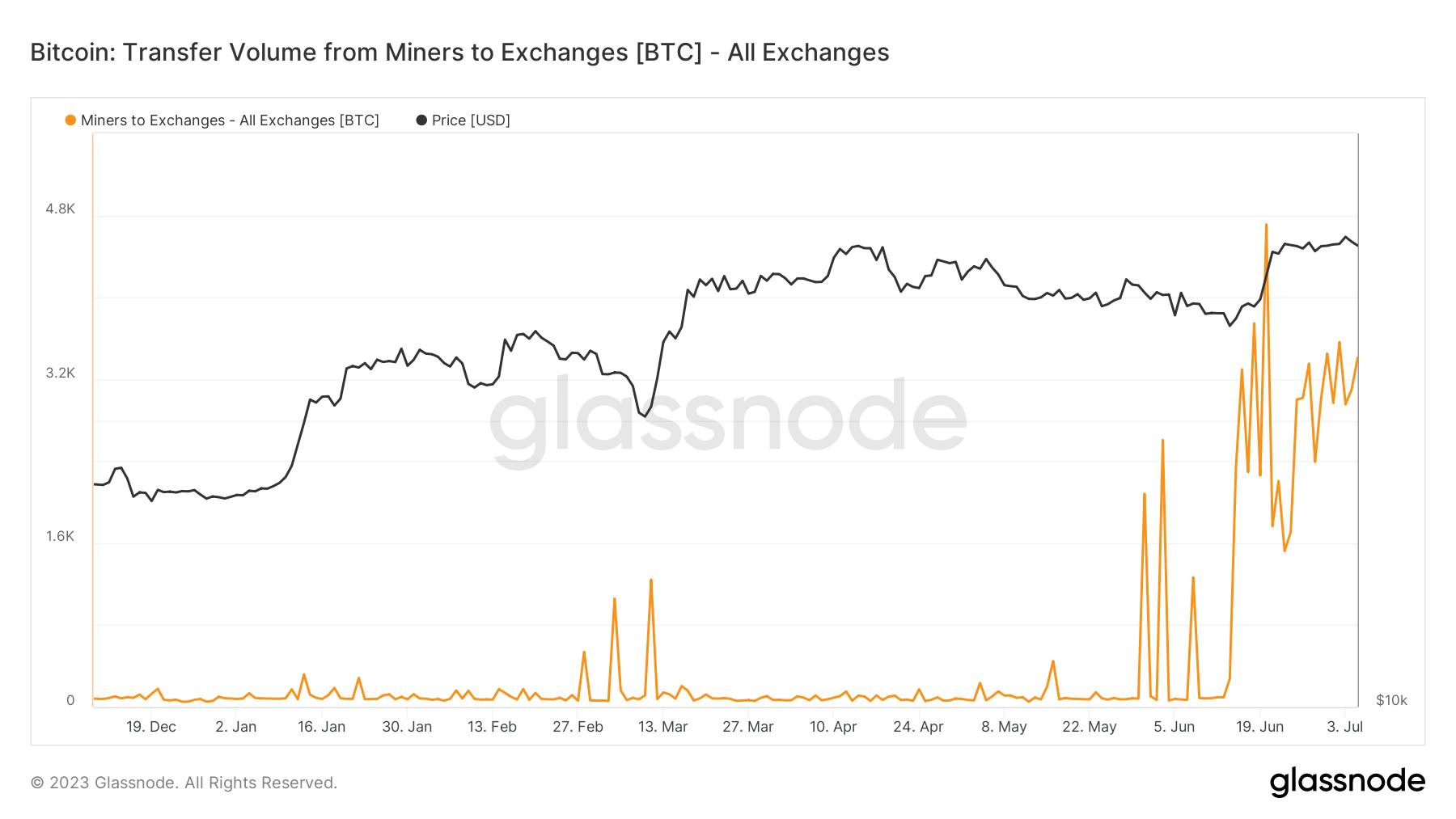

In line with the chart under, miner buying and selling movement peaked at 4,710 BTC on June 20, the very best charge up to now 5 years. The opposite days of the month additionally noticed vital spikes, with trades averaging over 2,000 BTC.

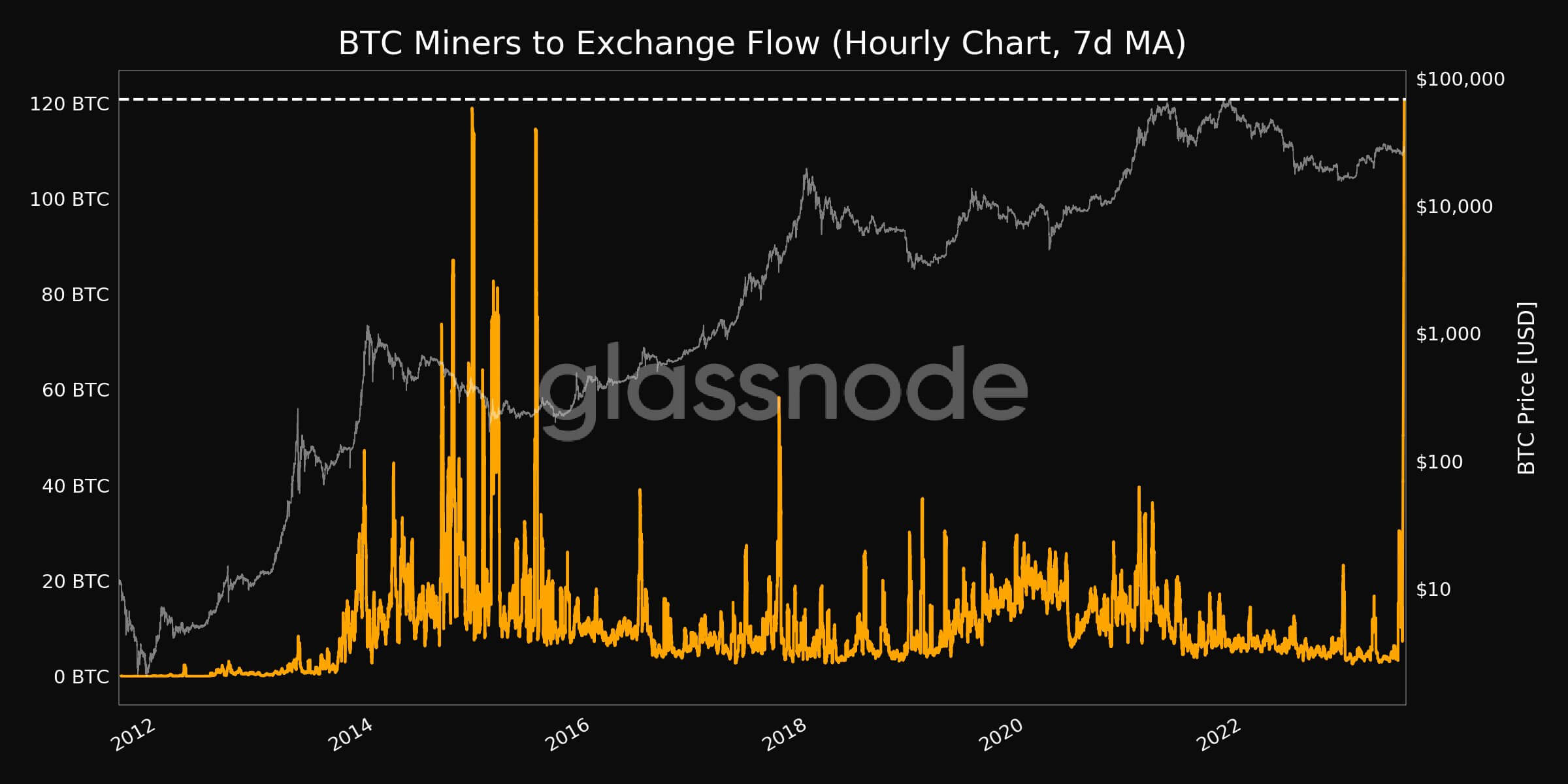

glass knot declared that the seven-day hourly transferring common elapses from miners For echange reached as excessive as 120.77 BTC, one of many highest ranges since 2015.

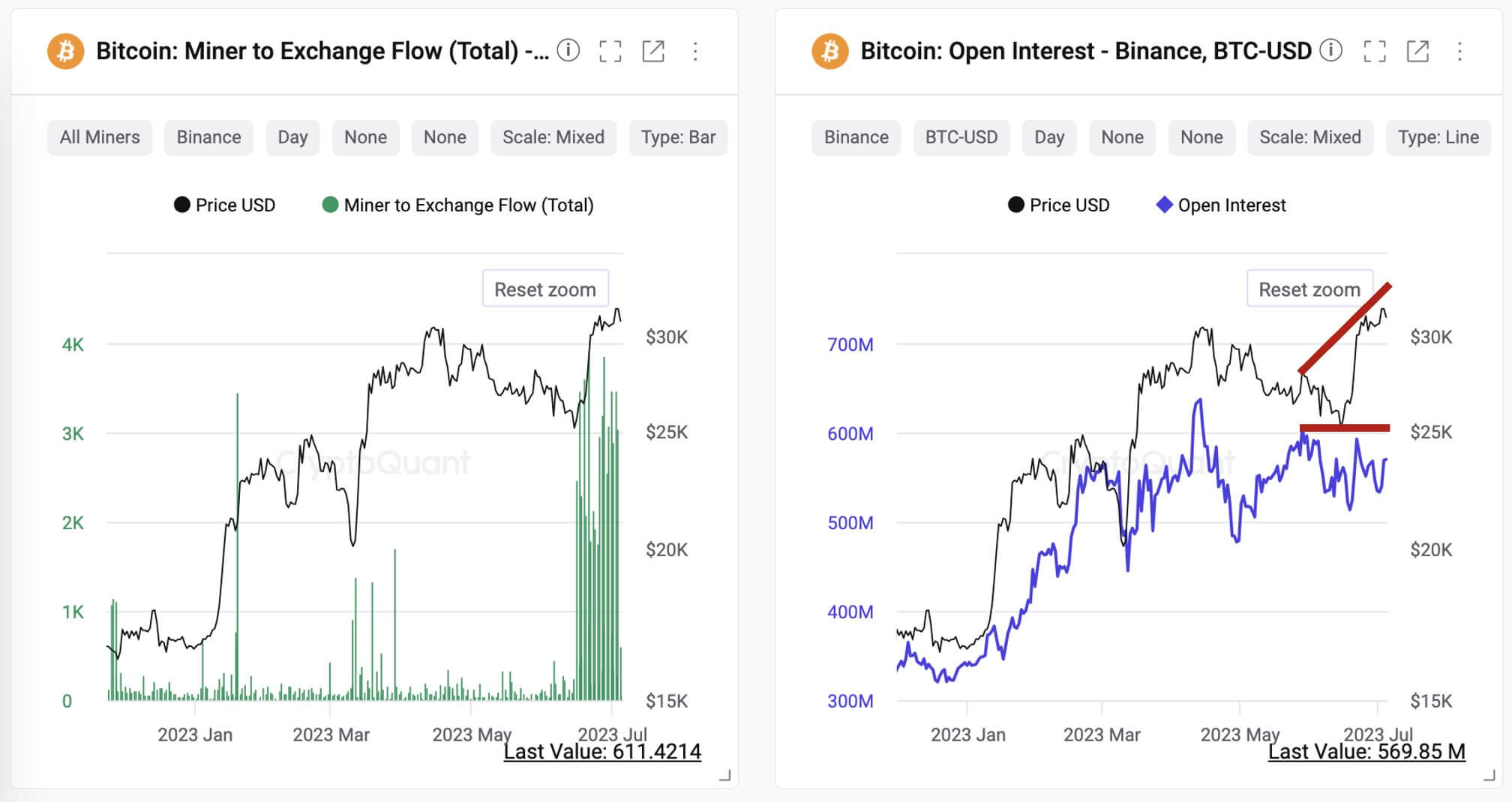

On July 4, Ki Younger Ju, CEO of CryptoQuant stated miners have despatched over 54,000 BTC to Binance up to now three weeks. Ju identified that there was “no vital change in BTC-USD open curiosity, which suggests much less chance of fulfilling collateral to open new lengthy positions.”

Ju added:

“The money sale appears extra probably.”

Of their lately launched operational updates, Bitcoin miners Marathon Digital, Cleanspark, and Hut 8 confirmed these transactions.

In a July 6 press launch, Marathon Digital stated it offered 700 BTC, or 71.5%, of its 979 BTC mined in June for an undisclosed quantity. Its rival, Hut 8, offered 217 BTC, or 100% of the Bitcoin it produced in Could and 70 Bitcoin produced in June, for $7.9 million.

In the meantime, Cleanspark offered 84% of the 491 BTC mined in June for $11.2 million, based on a July 3 launch.

These buying and selling actions counsel that miners wished to capitalize on the latest BTC value surge to safe their earnings. In June, BTC was principally buying and selling above $25,000, peaking at $31,268 after a number of conventional monetary establishments, together with BlackRock and others, filed Bitcoin ETFs.

Put up-Bitcoin miners money in on June’s value spike, promoting hundreds of BTC first seen on forexcryptozone.