Regardless of the volatility Bitcoin skilled in 2023, the extended sideways motion between February and July proved to be fertile floor for accumulation. On-chain evaluation confirmed that short-term holders (STH) and long-term holders (LTH) had steadily accrued over the previous quarter, indicating a robust perception within the long-term worth of the asset. .

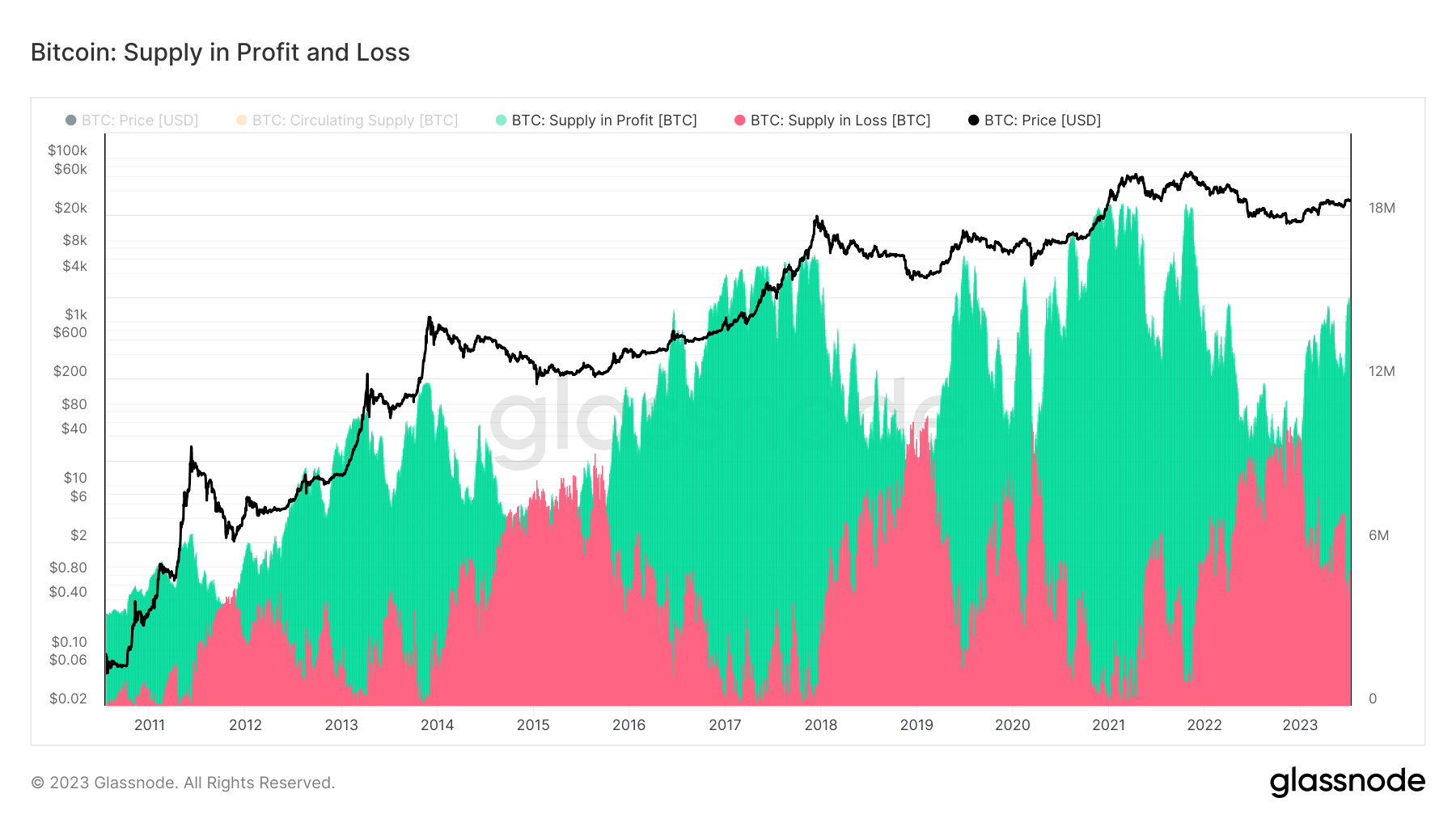

Measuring Bitcoin provide in revenue and loss is an important a part of market evaluation. These metrics present beneficial perception into market sentiment and investor habits – a better revenue bid signifies that buyers are holding onto their property, anticipating additional value appreciation. Conversely, a better bid at a loss might sign potential promoting.

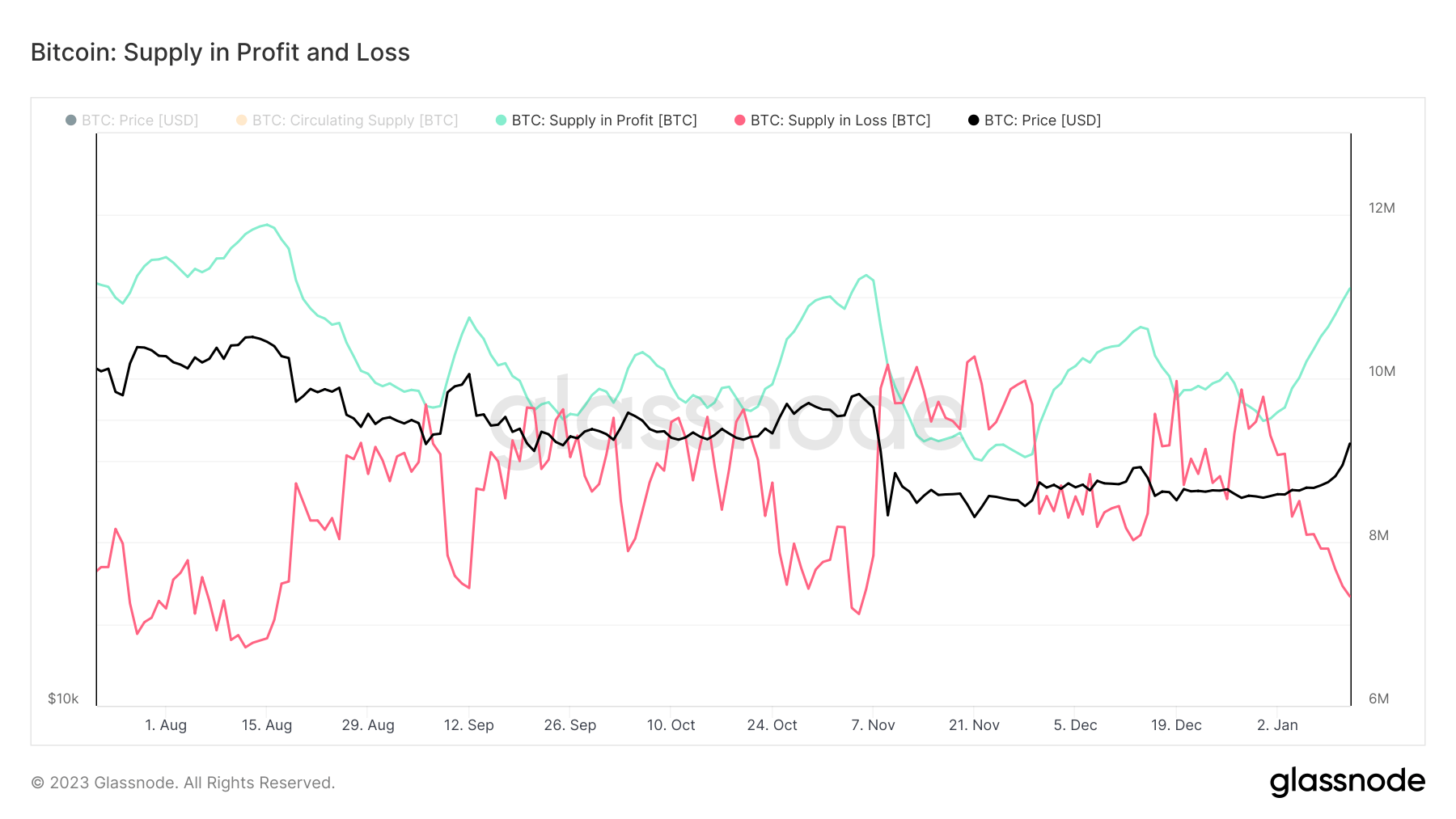

Between September and December 2022, throughout a interval of excessive value volatility, earnings contributions converged on a number of events, reflecting market uncertainty.

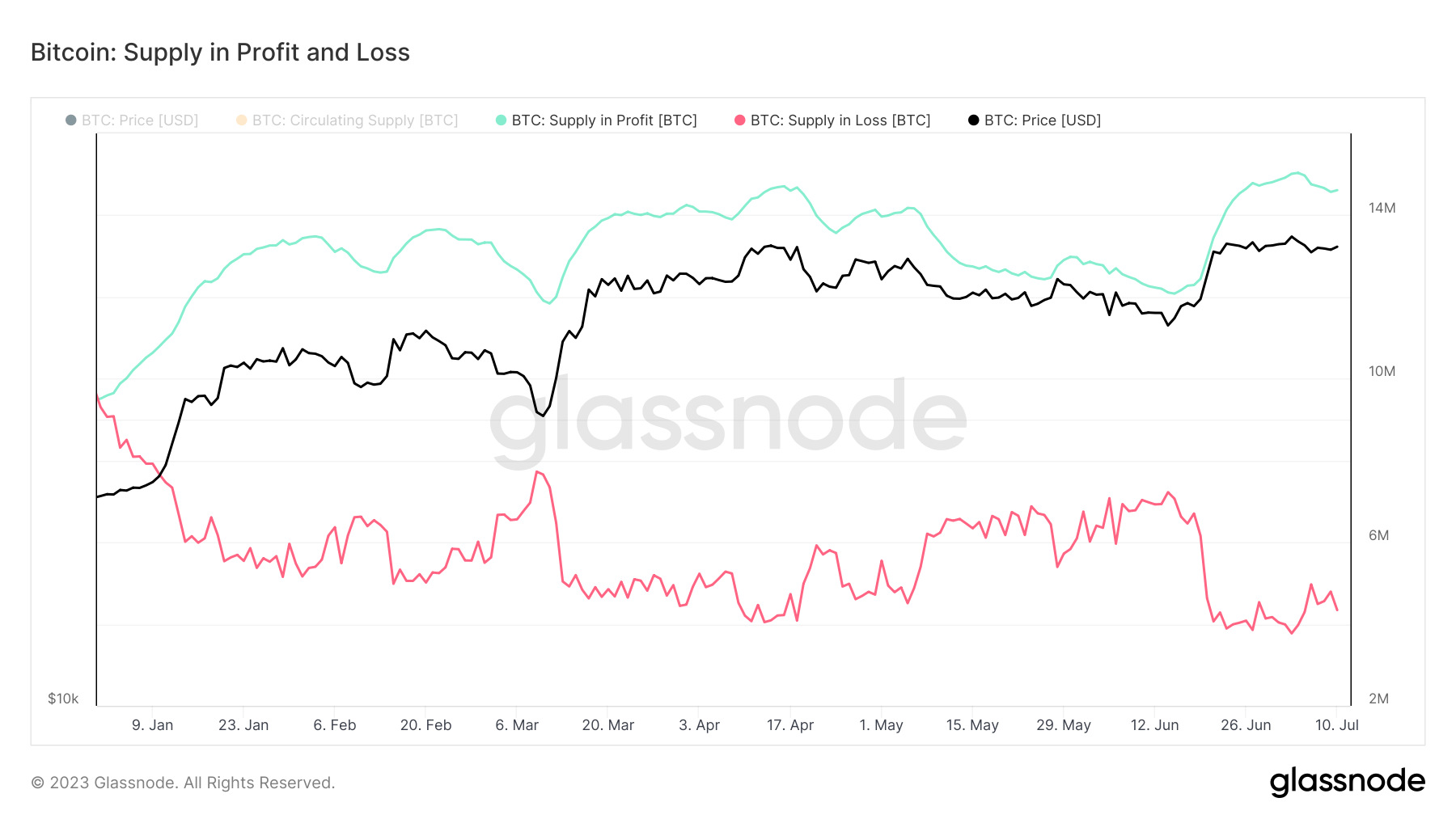

Nevertheless, the panorama has modified for the reason that begin of 2023. In-profit bids diverged, with in-profit bid share growing by greater than 53%. In line with information from Glassnode, 14.61 million BTC is at present in revenue, whereas 4.34 million BTC is in loss.

As of July 11, 75% of the provision is in revenue, leaving solely 25% in loss. This important stability is harking back to eventualities seen in the course of the 2016 and 2019 market cycles. Glassnode information additional revealed that fifty% of Bitcoin buying and selling days noticed a better profit-to-loss stability and 50% a decrease stability. .

The present accumulation section and the ensuing 75% of the circulating provide of Bitcoin is a promising signal for the cryptocurrency. If historic patterns proceed, this could possibly be the midpoint of Bitcoin’s present market cycle, suggesting {that a} backside has been reached and the market is at present gearing up for a rally.

Nevertheless, it’s essential to think about that whereas historic patterns present helpful context, they don’t all the time predict future actions. As we speak’s Bitcoin market is influenced greater than ever by a large number of macro elements, akin to regulatory developments and broader financial circumstances.

The put up Heavy Accumulation Places 75% of Bitcoin’s Circulating Provide in Revenue appeared first on forexcryptozone.