For builders plying their commerce in right now’s fast-paced, blockchain-independent setting, choosing the proper method to executing sensible contracts is paramount.

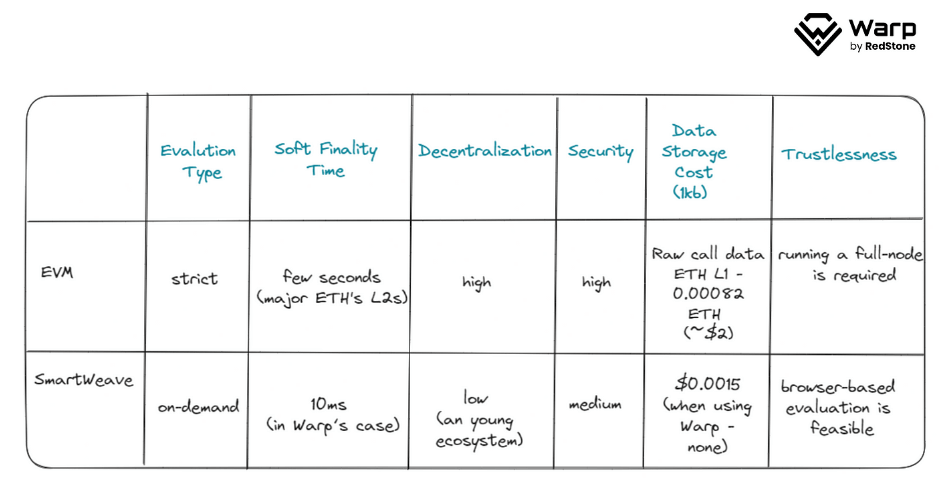

On this article, I’ll evaluate EVM (Ethereum Digital Machine) and SmartWeave credentials as two separate choices for builders to think about. Full disclosure, let’s dive deep! Earlier than we start, here’s a comparability desk to provide you an concept of the 2 runtimes:

Key Issues for Utilizing EVM

EVM, initially applied by Ethereum, is now the selection for many sensible contract platforms, spanning Avalanche, BNB Chain, and L2 like Arbitrum, Optimism, and extra. Utilizing EVM requires information of Solidity, which may be characterised as blockchain’s reply to JavaScript. Because the language of EVM, Solidity has develop into the de facto programming language for sensible contracts on distributed networks, making it the go-to computing language for builders within the blockchain area.

Though Solidity has a novel construction and syntax that may show tough for these planning to develop Web3, it continues to draw a big inflow of recent learners. Moreover, the EVM has an intensive ecosystem of sources, instruments, instructional supplies, and enthusiastic builders.

Despite the fact that EVM is broadly thought to be the gold customary for constructing decentralized purposes, it has strict limiting parameters, which newly found builders should be taught to work with. A senior Solidity developer’s potential to optimize code for stringent computational limits (within the type of gasoline limits) units them other than kind builders recent out of the academy. The draw back of this mannequin is that it places an enormous emphasis on block area, which may develop into an especially costly setup.

Moreover, the requirement for consensus-based computation synchronization at each block provides a layer of complexity to the EVM design, appearing as a major obstacle to scaling efforts, particularly given sequential analysis of all sensible contract interactions.

A notable consideration is the distinctive storage mannequin inside the Ethereum digital machine. In most programming languages, understanding the low-level knowledge illustration is just not essential, however Solidity deviates from this norm. Given the numerous price related to accessing storage on Ethereum-based networks, understanding how knowledge varieties are represented is crucial. The shared international storage mannequin throughout all contracts, no matter how they work together, poses challenges.

The design introduces inefficiencies, forcing contracts to wade by superfluous knowledge, slowing transaction occasions, and incurring pointless computational prices. These prices contribute to an elevated monetary burden for storing knowledge on the platform, affecting builders and customers. Moreover, the shared nature of storage might inadvertently amplify coding errors or vulnerabilities, resulting in unintended penalties for unrelated contracts and probably elevated remediation prices.

Introducing SmartWeave

Throughout the aisle, SmartWeave is a paradigm for evaluating sensible contract states on an immutable knowledge layer like Arweave. SmartWeave’s distinct worth proposition has large potential to boost the creation of extremely efficient dApps for a large number of particular use circumstances – serving as a complementary framework to fill the void the place EVM fails. Since a knowledge layer doesn’t carry out arbitrary calculations, it locations the accountability for evaluating the present state of the contract on the caller utilizing “lazy analysis”.

To “lazy” consider the present state of a contract, the caller checks and executes all contract interactions (Arweave transactions) from the inception of the contract till right now, replicating the present state of the contract from zero.

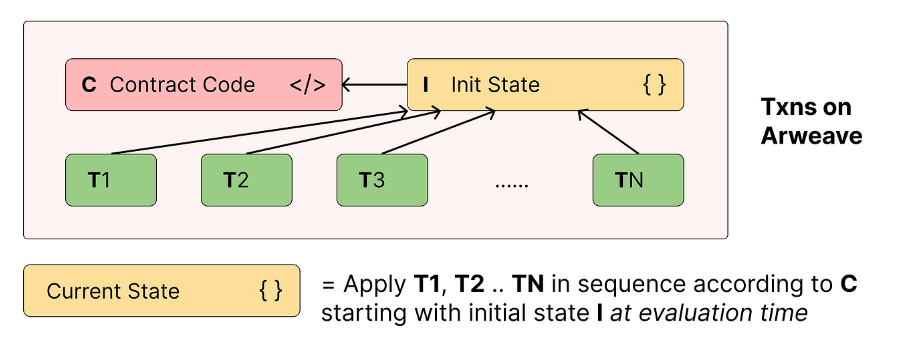

Primarily, Arweave sensible contracts encompass an ordered set of actions (C, I, Ts), “C” being the half containing the code of the contract, “I” being the fraction containing the preliminary state and “T” being a sequence of transactions that work together with the contract. When the shopper evaluates the state, it makes use of the code of C, the preliminary state of I, and applies every transaction after (offered it’s legitimate) primarily based on the code of the contract. Obtained it? GOOD! Here’s a visible overview of the structure to assist crystallize the idea:

SmartWeave is an structure to create a dependable, quick and production-ready sensible outsourcing engine on Arweave. Its hottest implementation, Warp Contracts, is concentrated on reaching this precise purpose. Warp is commonly described as “SmartWeave contracts on steroids” resulting from its potential to beat among the most important hurdles related to the default implementation of the SmartWeave protocol.

These obstacles embrace the dearth of caching which leads to poor efficiency, the dearth of a dependable SmartWeave transaction gateway, and the lack to supply contract safety and determinism. Along with its principal perform, the Warp SDK features a finely tuned caching layer that significantly improves the effectivity of lazy analysis.

The stack additionally consists of easy-to-use deployment and upkeep strategies, customizable plugins that permit customers to increase the SDK in any path they select, a devoted sensible contract explorer, a set of nodes for outsourcing execution and several other different important options. The Warp core group has created a variety of proprietary plugins, together with transportable EVM instruments, EVM pockets assist, native EtherJS assist within the SmartWeave setting, and extra. As of now, Warp helps JavaScript/TypeScript and WASM languages with Rust assist.

Distinguishing EVM from SmartWeave Structure

The safety of the EVM is intrinsically linked to the consensus expertise of its underlying blockchain. Equally, SmartWeave additionally will depend on the safety and last finality of the Arweave blockchain, which is achieved by together with blocks finalized utilizing the SPoRa (Succinct Proofs of Random Entry) protocol.

By design, EVM implements the payment market into the core protocol. The market payment system makes use of a first-price public sale mechanism to find out transaction charges, the place the best bidder sees their transaction processed first. The challenges related to community scaling develop into notably obvious throughout occasions of excessive demand, as seen within the design of the worldwide Ethereum digital machine payment market.

For instance, when a person contract experiences appreciable exercise, akin to a extremely anticipated NFT mint, it inadvertently impacts all community customers by rising transaction prices, even for these indirectly concerned within the exercise at sturdy demand.

Arweave presents another method to the standard payment market by utilizing a single reward pool and a merkle root for all knowledge, referred to as endowment. Including new knowledge to the system updates the Merkle tree and provides $AR tokens to the reward pool with out inflicting a rise in computational overhead. To resolve the fee processing bottleneck for knowledge storage, Arweave makes use of a recursive bundle system to settle a number of transactions in a single fee over the community.

Finally, this might result in infinitely deep bushes permitting all internet knowledge to be ingested in a single transaction, eliminating the necessity for paid marketplaces. Arweave’s transaction system permits customers to execute transactions with out block inclusion charges, making storage prices the one expense for executing transactions no matter demand.

SmartWeave is a sequenced set of Arweave transactions that profit from the dearth of a payment marketplace for together with transaction blocks. This distinctive property permits limitless transaction knowledge at no further price past storage prices. Moreover, SmartWeave’s open design permits builders to write down logic in any programming language, offering a refreshing different to the customarily inflexible Solidity code base.

Half 2 will arrive tomorrow, masking:

- Lazy Execution: An Various Perspective

- Assessing the suitability of EVM and SmartWeave

- Market adaptation of SmartWeave

Visitor put up by: Jakub Wojciechowski, CEO and Founding father of Warp Contracts and RedStone