Tesla is retaining its remaining Bitcoin holdings regardless of current pockets transfers which have sparked hypothesis a couple of potential sale, in accordance with blockchain analytics platform Arkham Intelligence.

In an October 23 article on X (previously Twitter), Arkham Intelligence clarified:

“We consider the Tesla portfolio strikes we reported on final week had been portfolio rotations with Bitcoin nonetheless held by Tesla.”

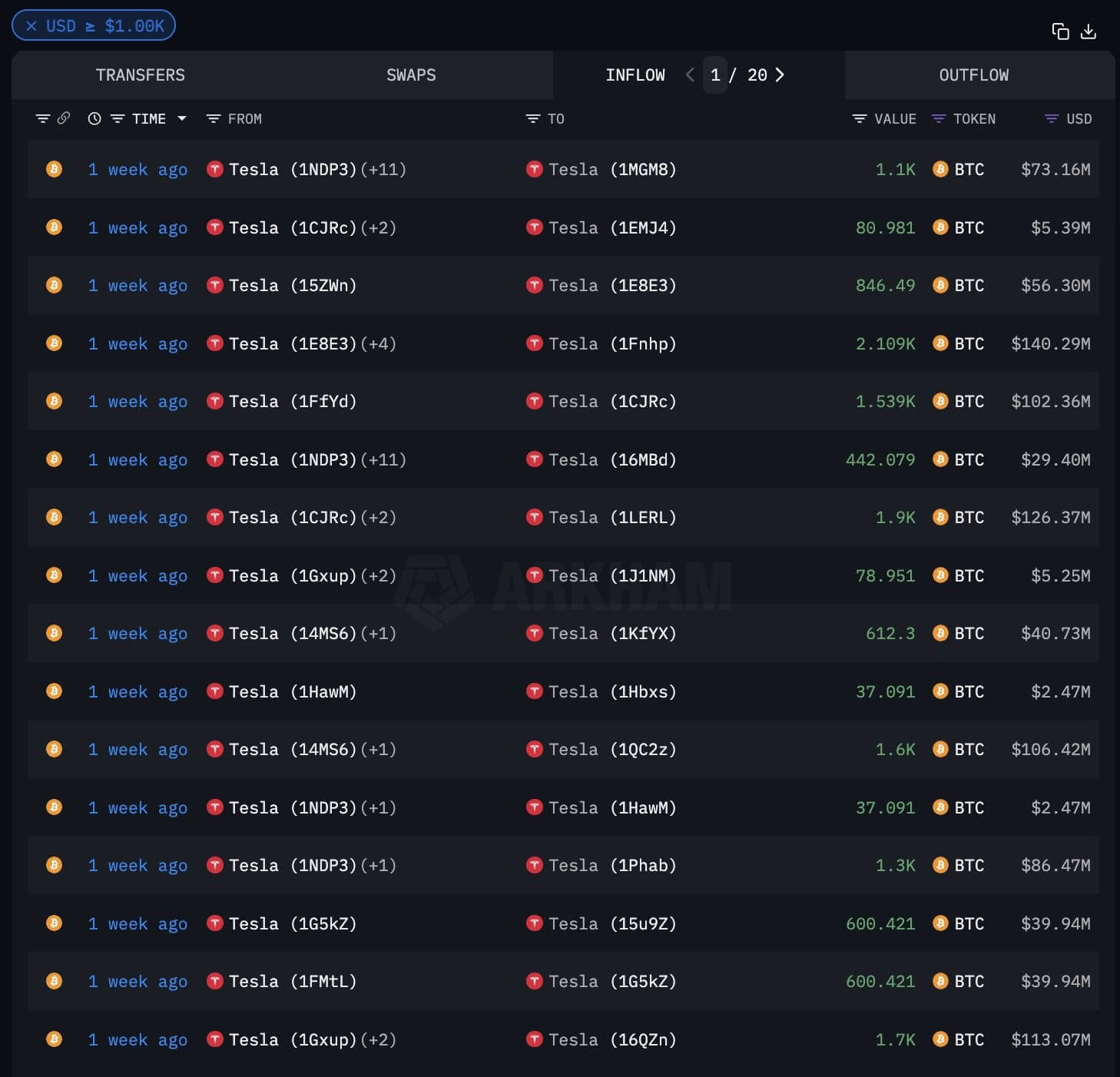

Arkham famous that the switch concerned sending Bitcoin to seven totally different wallets, every containing between 1,100 and a pair of,200 BTC. Earlier than the ultimate switch, take a look at transactions had been carried out on all wallets, and all however one now maintain spherical Bitcoin balances.

On-chain information reveals that 5 wallets maintain Bitcoin price over $100 million every, specifically $142 million, $128 million, $121 million, $114 million, and $107.8 million. {dollars}. The remaining two portfolios comprise $87.6 million and $74.1 million, respectively.

This replace follows Tesla's sudden switch of its remaining 11,509 BTC, valued on the time at roughly $768 million, final week. The transfer sparked rumors of a possible sale, as Tesla had already liquidated its Bitcoin holdings.

In February 2021, the corporate offered 4,320 BTC shortly after investing $1.5 billion to evaluate the liquidity of its market. Tesla made one other massive sale in June 2022, offloading 29,160 BTC.

Since then, nonetheless, the corporate has maintained its Bitcoin holdings. Arkham Intelligence speculated that the current transfers could possibly be linked to a Bitcoin-backed mortgage. He declared:

“Some have speculated that this was a switch to a custodian, for instance to safe a mortgage towards BTC.”

As of press time, Tesla has not launched an official rationalization for the transfers. Nonetheless, the truth that Bitcoin stays intact within the new wallets has eased speedy fears of a market sell-off.

Market analysts at the moment are trying to Tesla's upcoming third-quarter earnings report to raised perceive the corporate's current actions.