- LUNC's elevated buying and selling quantity alerts elevated market participation and volatility.

- Key assist at $0.000094 for LUNC may assist the worth if quantity momentum slows.

- LUNA’s resistance at $0.360 may break if buying and selling quantity stays strong.

Terra Labs is dealing with an intense authorized battle with the US SEC, sparking appreciable curiosity within the pricing of Terra Basic (LUNC) and Terra (LUNA). Traders are carefully watching worth actions and up to date tendencies given the renewed authorized scrutiny.

Apart from regulatory considerations, LUNC and LUNA have proven notable modifications of their enterprise operations, suggesting elevated market curiosity. Worth tendencies, key assist and resistance ranges, and technical indicators supply perception into potential future actions for each belongings.

LUNC Worth Dynamics and Enhance in Buying and selling Quantity

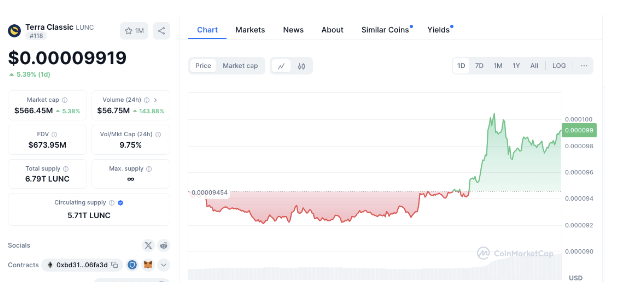

LUNC has lately proven an upward trajectory, rising by 4.43% over the previous day to succeed in 0.0000919. This enhance comes after a interval of consolidation, suggesting renewed investor curiosity.

Buying and selling quantity jumped by 140.46%, indicating increased market participation. These will increase in buying and selling quantity typically sign elevated shopping for or promoting stress, which might enhance volatility.

Key LUNC ranges embody assist at $0.000094, which has remained secure throughout latest consolidations. Moreover, $0.000092 served as a security internet throughout earlier downtrends, stopping deeper declines.

On the resistance facet, $0.000098 is a crucial barrier that LUNC is working to breach. If profitable, the subsequent psychological resistance lies at $0.00010, a threshold that usually results in elevated market exercise.

If buying and selling quantity stays excessive, LUNC may try to interrupt the $0.00010 resistance. Nevertheless, if quantity declines, a retest of assist ranges may observe. Excessive buying and selling quantity relative to market capitalization, which is 9.75% for LUNC, highlights the risky nature of the asset, demonstrating sturdy purchaser or vendor confidence.

LUNA Worth Motion and Potential Resistance

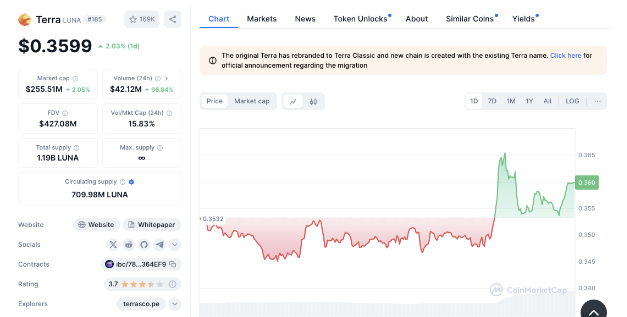

Over the previous 24 hours, Terra (LUNA) noticed its worth enhance by 1.78%, at present price round $0.3596. This follows a part of consolidation, suggesting renewed momentum.

Buying and selling quantity for LUNA additionally elevated sharply, up 93.03%, which may sign elevated buying and selling curiosity. Such quantity spikes often point out a possible pattern change, as a rise in quantity can typically precede upward or downward worth actions.

Key assist for LUNA consists of $0.3532, which has helped stabilize costs throughout latest declines. A stronger assist degree at $0.345 has traditionally prevented additional downward motion.

Conversely, $0.360 is at present a resistance level. A breakout right here may open the way in which to $0.365, a degree marking the latest excessive. If buying and selling quantity stays strong, LUNA may problem this higher resistance. Nevertheless, a drop in quantity may see costs transfer again in the direction of the $0.3532 assist.

Technical Indicators and Implications for LUNC and LUNA

LUNC's present buying and selling quantity to market cap ratio of 9.75% signifies sturdy exercise, typically an indication of conviction available in the market. Likewise, LUNA's quantity/market capitalization ratio of 15.83% demonstrates sustained curiosity.

For each tokens, continued progress in buying and selling quantity may lead costs to interrupt by means of rapid resistance ranges. Nevertheless, if quantity momentum weakens, LUNC and LUNA may pull again to check their respective assist zones.

Associated: Terra $4.5 Billion Effective: A Warning Shot to Crypto Fraudsters

Associated: Terra Collapse: Fallout Reaches the Prime Minister's Workplace

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be accountable for any losses arising from using the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.