- The final Bitcoin halving happened in April, when the block reward fell from 6.25 Bitcoin to three.125 Bitcoin.

- Jesse Myers mentioned the worth of Bitcoin should rise for a “worth supply-demand” stability to happen

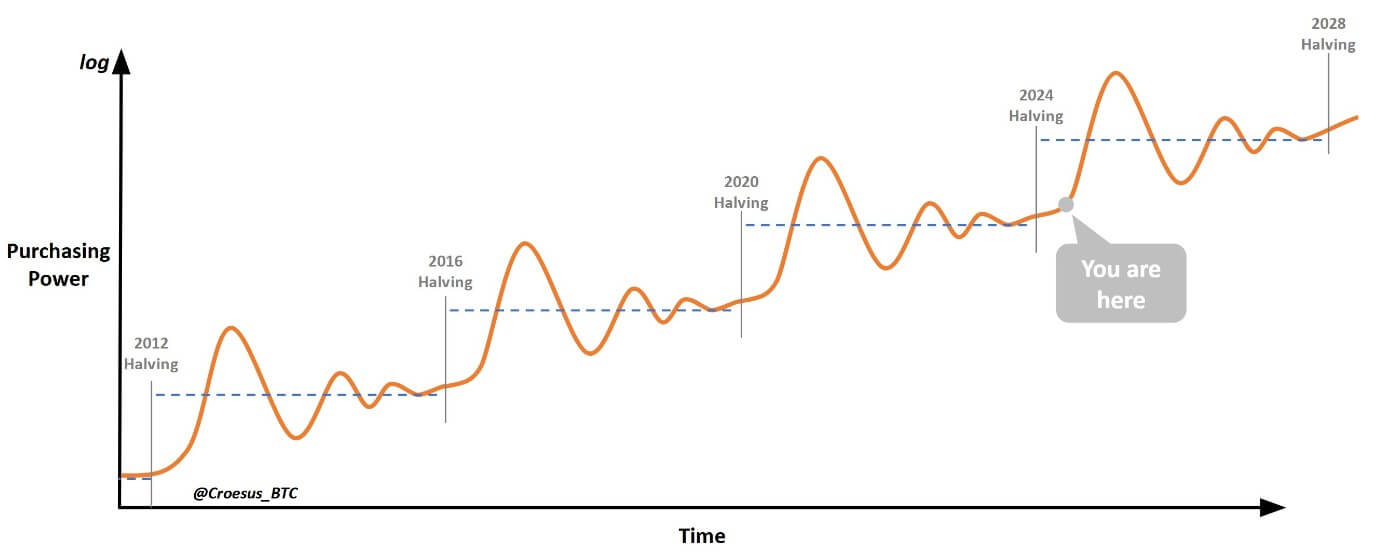

- When this occurs, the market will “fly into insanity and a bubble,” which is what occurred throughout the Bitcoin halving occasions of 2012, 2016, and 2020.

Donald Trump's re-election to the White Home just isn’t the “predominant story” behind Bitcoin's latest worth rally, says Onramp Bitcoin co-founder.

In an article on

Happening each 4 years, the final Bitcoin halving happened in April, when the block reward fell from 6.25 Bitcoin to three.125. In consequence, every new block turns into tougher to unravel with a decrease reward.

A discount within the provide of Bitcoin typically means a rise within the worth of Bitcoin. The following Bitcoin halving is anticipated to happen in 2028.

Based on Myers, a “provide shock has constructed up,” that means “there may be not sufficient provide out there at present costs to fulfill demand,” including {that a} “stability between provide and demand have to be restored.

Nevertheless, Myers believes the one method for that to occur “is that if the worth goes up, which is able to trigger a insanity and a bubble, however that's how this factor works.”

Submit-bubbles halve

Offering a chart, Myers indicated that the market is presently in the beginning of the post-halving bubble. Primarily based on his information, Bitcoin worth will proceed its upward trajectory earlier than reaching new highs and falling to present ranges.

“It appears loopy to say there will likely be a dependable, predictable bubble each 4 years,” Myers mentioned. “However there has by no means been an asset on the planet the place the creation of recent provides is reduce in half each 4 years.”

Submit-halving bubbles occurred throughout Bitcoin halvings in 2012, 2016 and 2020, Myers mentioned.

Bitcoin's latest worth rally comes amid Trump's re-election to the White Home. Primarily based on his marketing campaign path earlier than Election Day, Trump seemed to be pro-crypto in comparison with present Vice President Kamala Harris.

Final week, Senator Cynthia Lummis additionally reaffirmed the US' intention to ascertain a strategic reserve of Bitcoin. If handed, the senator's Bitcoin invoice would suggest directing the U.S. Treasury to buy one million of them over the following 5 years.