- Binance leads with 40% Bitcoin reserve share amid rising market confidence and demand.

- Bitcoin approaches $100,000, strengthening Binance's institutional adoption and market management.

- Regulatory scrutiny fails to sluggish Binance's development as crypto adoption accelerates.

The crypto market has seen an influence shift, with Binance changing into a dominant participant within the world change community.

Regardless of challenges similar to regulatory scrutiny and market volatility, Binance has consolidated its place, capturing a rising share of the Bitcoin reserve market amongst proof of reserve (PoR) exchanges.

Binance Bitcoin Reserves Market Share Will increase Since 2017

Knowledge from CryptoQuant founder Ki Younger Ju highlights Binance's development from mid-2017 to the tip of 2024. Beginning with a small market share in 2017, Binance grew quickly, reaching round 10% market share. market in early 2018.

After a declining section from 2018 to 2020, the change started to extend its dominance in 2021, coinciding with a rise in world adoption of cryptoassets.

As of mid-2021, Binance's market share has grown steadily, surpassing 40% in 2024. This development displays its potential to draw customers by broad liquidity, an increasing consumer base, and aggressive companies. .

Binance's rise has additionally occurred amid intense market competitors and elevated demand for clear reserve administration.

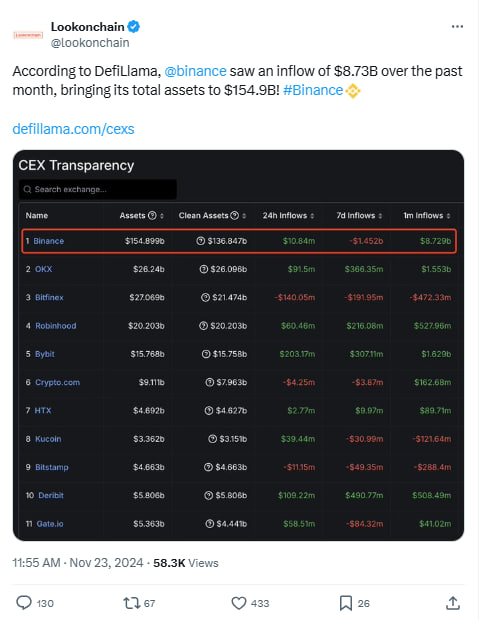

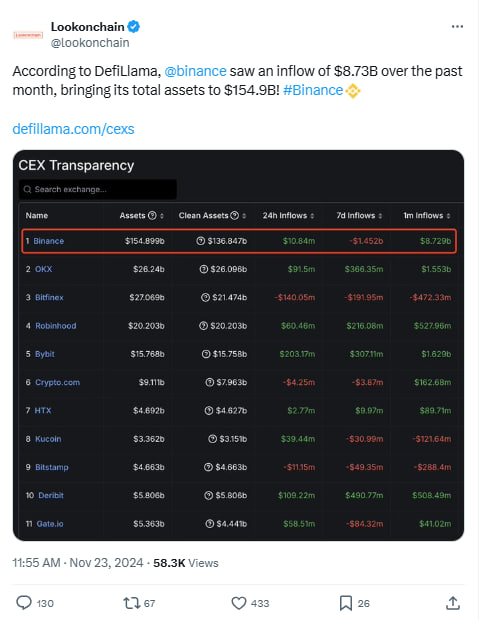

Binance data asset inflows of $8.73 billion in 2024

In November 2024, Binance recorded an asset influx of $8.73 billion, bringing its complete holdings to $154.9 billion. Amid financial uncertainty, customers are turning to platforms providing dependable options, with Binance reportedly attracting customers with companies similar to staking, crypto lending, and institutional asset administration.

Additionally learn: Bitcoin is rising, CZ is launched and Binance is shopping for it!

The corporate attributes its development to a various product line tailor-made to the wants of crypto buyers. Regardless of intense regulatory scrutiny, Binance stays a number one alternative for digital asset administration.

In the meantime, analysts stay optimistic about Bitcoin's efficiency, estimating that Bitcoin might attain $500,000. This bottom-up outlook has gained momentum as a result of rising institutional adoption and Bitcoin's popularity as a uncommon and in-demand asset.

At press time, the worth of Bitcoin (BTC) was $97,808.07, with a buying and selling quantity of $58.52 billion. Whereas its worth fell by 0.47% over the previous 24 hours, it exhibits a rise of seven.93% over the previous week, reflecting continued investor curiosity.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version is just not accountable for any losses ensuing from the usage of the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.