The Bitcoin perpetual futures funding price represents the prices merchants incur for sustaining lengthy or brief positions within the perpetual swaps market, with charges transferred between patrons and sellers primarily based on market circumstances.

Optimistic funding charges counsel that lengthy positions dominate, reflecting bullish sentiment, whereas unfavorable charges point out bearish sentiment as brief positions dominate.

Modifications in funding charges present perception into dealer positioning and market threat. Will increase in funding charges typically precede corrections, signaling elevated hypothesis and overindebtedness. Conversely, unfavorable or impartial funding charges throughout consolidations can sign potential entry factors for strategic buyers.

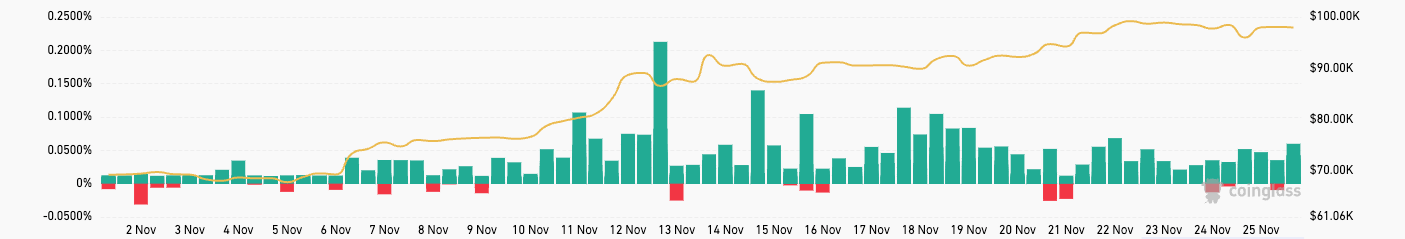

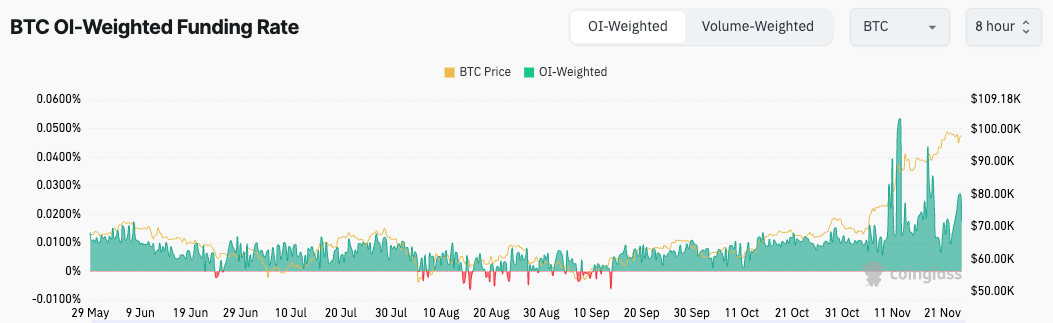

Bitcoin's present funding price follows the sturdy rally seen in November. Because the starting of the month, volume-weighted funding charges and open curiosity (OI) have remained constantly constructive, reaching their highest ranges in over a yr. This sustained positivity exhibits the dominance of lengthy positions, with merchants paying a premium to keep up these positions.

Market sentiment has been decidedly bullish, as evidenced by merchants' willingness to tackle greater funding prices in anticipation of continued value will increase. The rise in funding charges exhibits that leveraged lengthy positions have contributed to the rally.

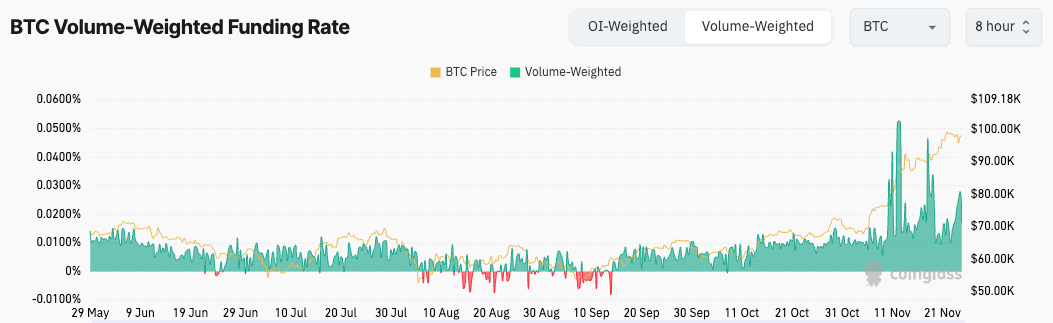

The amount-weighted funding price confirmed larger volatility than the OI-weighted price, suggesting that buying and selling volumes had a pronounced impression throughout these speedy value will increase. This volatility displays speculative exercise, with merchants opening positions aggressively to capitalize on Bitcoin's momentum.

Nonetheless, earlier within the yr the state of affairs was markedly totally different. From late June to mid-September, the market noticed quite a few situations of unfavorable funding charges, significantly within the volume-weighted measure. This mirrored bearish sentiment as Bitcoin value struggled to interrupt out of a restricted section.

Throughout these months, merchants closely favored brief positions, a cautious outlook that aligned with average value motion. The shift to constantly constructive funding charges on the finish of the third quarter marked a turning level, signaling a broader shift towards bullish sentiment because the Bitcoin value recovered.

The amount-weighted financing price was discovered to be extra delicate to market hypothesis than the OI-weighted price. This distinction turned significantly evident during times of excessive exercise. Whereas the OI-weighted measure, being extra fluid, displays broader traits in market leverage, the volume-weighted price captures short-term fluctuations brought on by speculative merchants.

The rise in each indicators between late September and October revealed a gradual rise in bullish sentiment. This pattern means that Bitcoin's rally shouldn’t be solely as a result of spot market exercise, but in addition the rising affect of leverage in derivatives markets. The alignment of constructive funding charges with sustainable value positive factors highlights the position of leveraged merchants in reinforcing uptrends.

Regardless of this upward momentum, the persistence of excessive financing charges in November raises considerations about overheating of the markets. When funding charges stay excessive for prolonged intervals of time, it typically signifies extreme leverage, making a fragile market surroundings. Overindebtedness will increase the danger of cascading liquidations if costs immediately reverse. Durations of excessive funding charges typically precede sharp corrections, as overextended merchants are pressured out of positions.

Conversely, the unfavorable funding charges seen in July and September supplied contrarian shopping for indicators. Throughout these intervals, extreme bearish sentiment paved the way in which for value rebounds, highlighting the worth of funding charges as a predictive instrument.

Extraordinarily Excessive Bitcoin Funding Charges Present a Leveraged However Bullish Market appeared first on forexcryptozone.