MicroStrategy Government Chairman Michael Saylor has urged Microsoft to undertake Bitcoin as a part of its technique, in accordance with a three-minute presentation to the corporate's board of administrators shared on X (previously Twitter).

Within the presentation, Saylor positioned Bitcoin as a vital a part of the subsequent wave of know-how. He warned that failing to combine Bitcoin into Microsoft's operations may depart the corporate lagging behind its opponents.

Saylor highlighted Bitcoin's outperformance, noting that it has generated annual returns ten occasions these of Microsoft inventory. He argued that redirecting sources from inventory buybacks to Bitcoin investments would generate larger worth.

He declared:

“Microsoft can not afford to overlook the subsequent wave of know-how and Bitcoin is that wave… It makes way more sense to purchase Bitcoin than to purchase again your personal shares.”

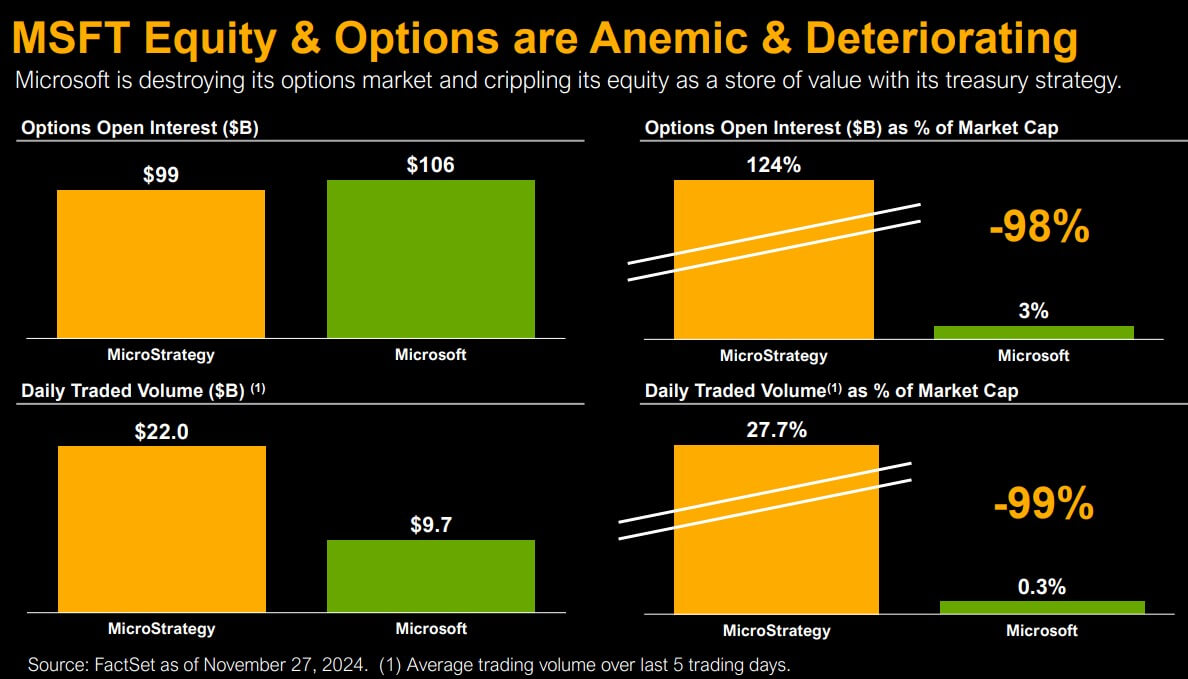

He says Microsoft's present money technique weakens its inventory and choices markets and erodes its place as a retailer of worth.

Saylor additionally outlined a change roadmap for the Bitcoin ecosystem in 2025. This consists of widespread adoption of Bitcoin ETFs on Wall Road, pro-fair worth accounting guidelines, pro-crypto management in Congress, and a shift regulatory perspective. He believes this evolving panorama makes Bitcoin adoption not solely useful however important.

He stated:

“You’ve gotten a option to make: maintain on to the previous or embrace the long run. Divest billions of {dollars} and sluggish your progress fee, make investments billions of {dollars} and speed up your progress fee.

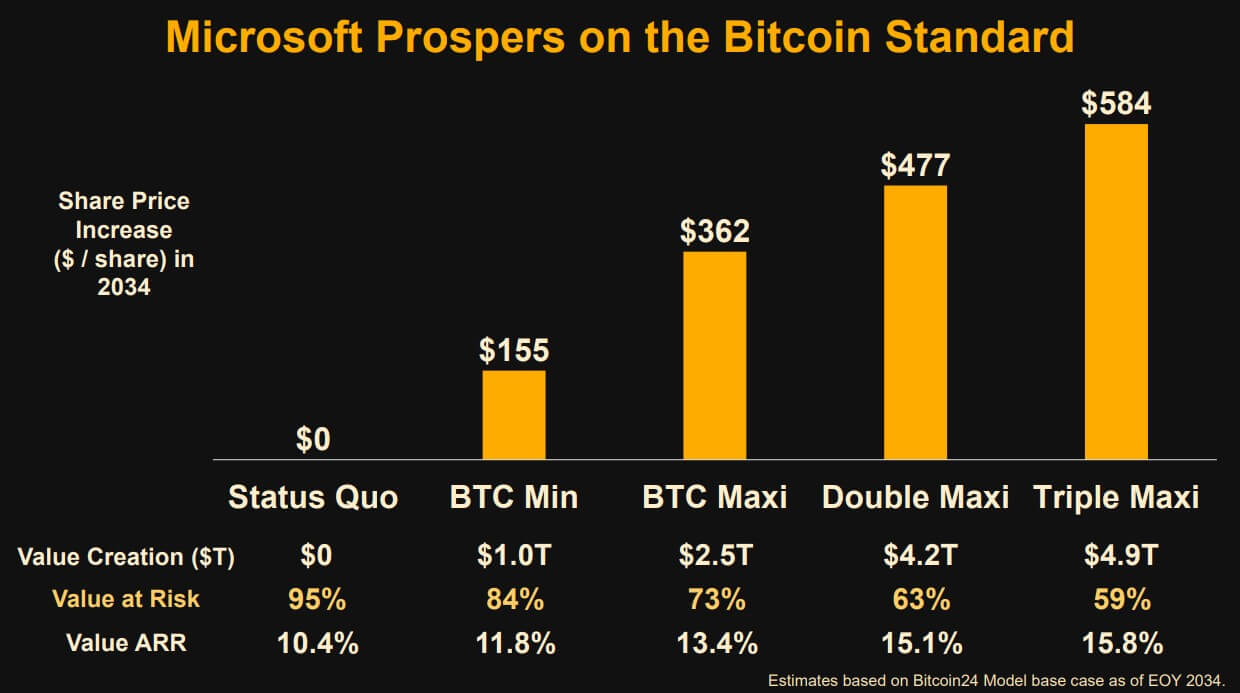

Including $5 Trillion to Microsoft's Market Cap

As a part of his speech, Saylor predicted that an aggressive Bitcoin technique may add round $5 trillion to Microsoft's market capitalization over the subsequent decade.

He proposed changing Microsoft's money movement, dividend funds, and inventory buybacks into Bitcoin. He argued that it will add a whole bunch of {dollars} to the corporate's inventory value whereas minimizing the chance to shareholders.

Based on his projections, if Bitcoin reaches $1.7 million per coin by 2034, Microsoft may acquire $4.9 trillion in enterprise worth.

Saylor additionally steered investing $100 billion per yr in Bitcoin as a substitute of inventory or bond buybacks. He described Bitcoin as an asset free from counterparty danger, providing unparalleled safety and progress potential.