- CBOE submitted a 19B-4 file to be approved to listing and change choices on ETF ETHEREUM.

- The proposal follows a excessive demand for FNB Ethereum.

- Nyse American made an analogous proposal, however she has not but acquired approval from the dry.

The CBOE BZX Trade formally submitted a 19B-4 file to the Securities and Trade Fee (SEC) of america, requesting the approval to listing and change choices on the Inventory Trade (ETF) funds.

This determination means a pivotal step for CBOE to increasing traders' entry to Ethereum, reflecting rising demand within the cryptocurrency market.

CBOE seeks to increase its funding instruments

CBOE's proposal goals to broaden the spectrum of funding instruments accessible for market gamers. By permitting choices to barter on Ethereum FNB, traders would receive an accessible means to have interaction with the worth actions of Ethereum.

The 19B-4 deposit consists of funds resembling these managed by Bit throughout Bit and grey ranges, together with Ethereum belief in grey ranges and the Ethereum Mini Belief grey scale, which maintain Ethereum as the primary energetic.

The change postulates that these choices is not going to solely function one other avenue for traders to acquire an publicity to Ethereum, but in addition as an important hedging instrument in opposition to the inherent volatility of the cryptocurrency market.

Particularly, the filling of CBOE follows the heels of an analogous proposal from NYSE American, which has not but acquired approval from the SEC, the regulator citing considerations regarding market manipulation, the safety of traders and the Insurance coverage of an equitable buying and selling surroundings.

The hesitation of the SEC is rooted in article 6 (b) (5) of the Trade Act Securities of 1934, which emphasizes the safety of traders and the upkeep of honest and ordered markets.

Regardless of these challenges, CBOE's proposal is taken into account to be a aggressive response to the initiative of NYSE, suggesting a possible eagerness of the market to see these monetary merchandise materialize.

CBOE's method within the file stresses that ETF ETF choices are ruled by the identical strict guidelines as different fund sharing choices on its platform, together with registration necessities, margin guidelines and stops negotiation. This regulatory alignment goals to reassure the drying of the proposal for the present executives, just like these utilized to Bitcoin ETF choices, which have been authorised in an analogous regulatory management.

The curiosity of traders in ETFE ETHEREUMS

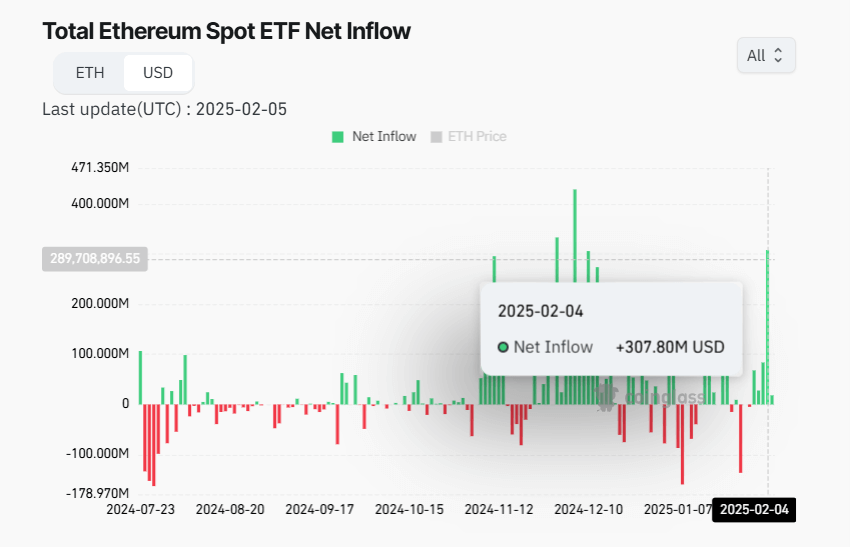

The time of the CBOe deposit coincides with a rise in traders' curiosity in ETHEREUM ETF. Not too long ago, these funds have skilled unprecedented negotiation volumes and web entries.

For instance, on February 4, 2025, ETFE ETHEREUM recorded web entries of $ 307.77 million, the best intrigue of sooner or later of the 12 months, demonstrating stable confidence of traders.

This efficiency not solely helps the justification behind the introduction of elective buying and selling, but in addition underlines market preparation for such monetary improvements.

The introduction of Choices on ETHEREUM may doubtlessly stabilize the worth of Ethereum by enhancing market liquidity.

The choices present subtle danger administration instruments for institutional traders, which permits them to cowl themselves in opposition to value fluctuations. Retail retailers may reap the benefits of these choices for speculative features.

This might result in a extra mature and secure market surroundings for Ethereum, selling better institutional adoption and contributing to the standard monetary integration of cryptocurrency.

Business specialists, resembling Nate Geraci of the ETF retailer, mentioned the approval course of may comply with a calendar just like that of Bitcoin Spot, which has taken about 8 to 9 months from launching to the approval of buying and selling buying and selling of choices.

If this precedent holds, we may see choices on ETHEREUM to turn into a actuality within the close to future, doubtlessly from subsequent month, assuming that regulatory obstacles are eradicated.

(Tagstotranslate) Markets (T) crypto-monnrency Information (T) Ethereum Information