- Litecoin is displaying bullish momentum, holding key assist at $70 and aiming to interrupt above $72.

- Bitcoin SV faces resistance at $52, with elevated quantity signaling upside potential.

- Solana consolidates between $152 and $156, awaiting a breakout for bullish motion.

Over the previous 24 hours, a number of altcoins have seen notable worth actions, attracting the eye of merchants and buyers. Leaders on this surge included Litecoin (LTC), Bitcoin SV (BSV), Beam (BEAM), Solana (SOL), and Arbitrum (ARB). These altcoins displayed a spread of worth motion, with some testing vital assist and resistance ranges.

General market sentiment for these altcoins seems cautiously bullish, as they show regular upward momentum, pushed by rising buying and selling volumes and rising investor curiosity. Let's take a better take a look at every coin to disclose their particular tendencies and potential future strikes.

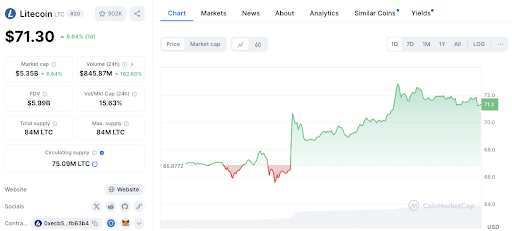

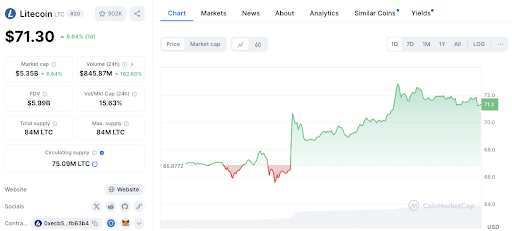

Litecoin (LTC) rallies with excessive assist ranges

Litecoin (LTC) confirmed a transparent upward development, rising by 6.56% to $71.27. Importantly, the worth is holding above the $70 mark, supported by the important thing ranges of $66.87 and $70.

This worth stability has inspired merchants, as LTC has repeatedly bounced from these ranges. Resistance round $72 proved troublesome, with the worth encountering promoting stress when making an attempt to interrupt above this stage.

Nonetheless, the 161.86% improve in 24-hour buying and selling quantity, now at $843.20 million, suggests continued curiosity in LTC. If the worth breaks above $72 and sustains above $72, it might acquire additional bullish momentum. In any other case, a fall beneath $70 might result in a retest of the $66.87 assist.

Additionally Learn: Crypto Market Shakeup: Litecoin, FET and TAO in Transient

Bitcoin SV (BSV) is in a cautiously bullish place

Bitcoin SV (BSV) noticed a reasonable worth improve of two.40%, bringing it to $50.78. The value is at present holding above $49.61, which is a powerful assist stage.

Nonetheless, resistance remained agency at $52, the place BSV confronted a number of rejections. The 35.82% improve in buying and selling quantity to $74.75 million suggests rising curiosity, though worth motion stays cautious.

If BSV manages to interrupt above the $52 resistance, it might sign stronger bullish momentum. Conversely, a decline beneath $49.61 might result in a check of decrease assist round $48.

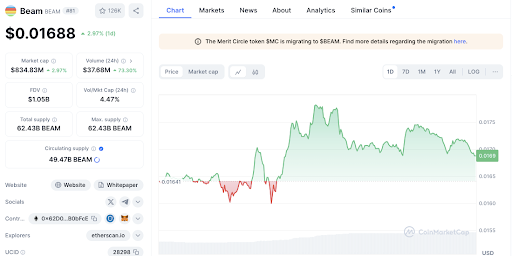

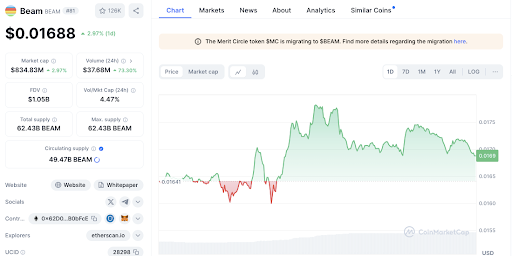

BEAM good points fixed momentum within the face of rising curiosity

Beam (BEAM) gained 3.11%, pushing its worth to $0.01692. The value is holding above key assist ranges at $0.01641 and $0.0160, indicating robust purchaser curiosity.

Nonetheless, resistance round $0.0175 stays an impediment to additional good points. The 72.21% improve in 24-hour quantity to $37.60 million alerts elevated market exercise.

The near-term outlook for BEAM seems cautiously bullish, with a break above $0.0175 probably resulting in additional bullish momentum.

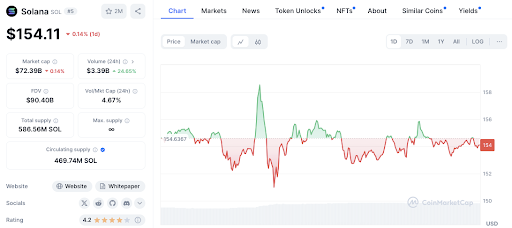

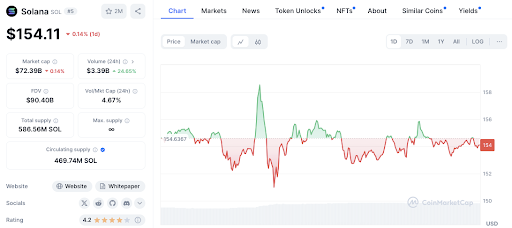

Solana (SOL) faces consolidation section between key ranges

Solana (SOL) is at present priced at $154.05, down barely by 0.41% over the previous 24 hours. Value motion oscillates between $152 and $156 with assist and resistance ranges being examined repeatedly.

24-hour quantity elevated 24.08% to $3.39 billion, demonstrating continued market engagement. Nonetheless, the present development signifies consolidation as SOL strikes between these key ranges. A break above $156 might sign additional bullish motion, whereas a fall beneath $152 might ship the worth decrease.

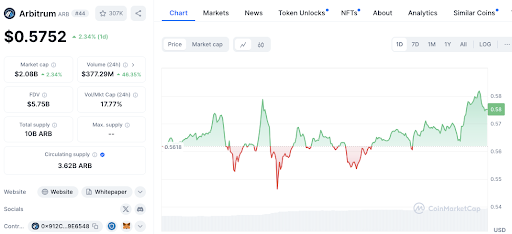

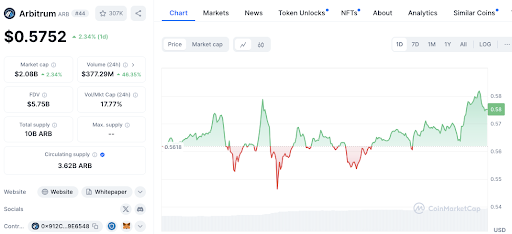

Arbitrum (ARB) consolidates with upside potential

Arbitrum (ARB) noticed a rise of two.60%, taking its worth to $0.5763. It’s at present buying and selling in a good vary, with assist at $0.56 and resistance at $0.58. A forty five.09% improve in buying and selling quantity suggests rising curiosity.

A break above $0.58 might result in additional good points, whereas a fall beneath $0.56 might sign a downtrend. The ARB's subsequent choice will seemingly rely upon whether or not or not it may break this consolidation section.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be answerable for any losses arising from using the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.