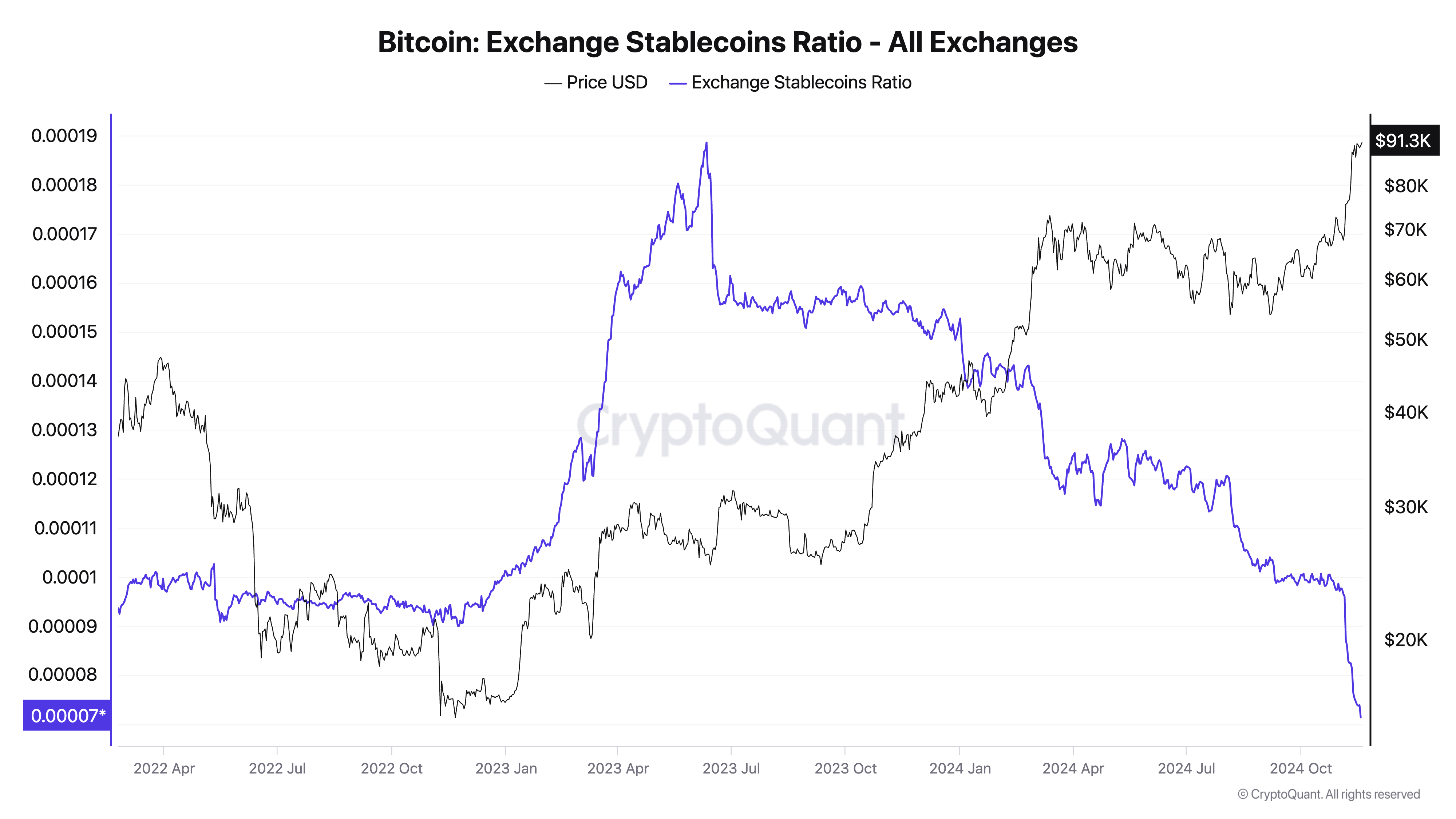

The stablecoin alternate ratio (ESR) is an on-chain metric that signifies the liquidity steadiness between Bitcoin and stablecoins held on exchanges.

The metric is calculated because the ratio of complete Bitcoin reserves to complete stablecoin reserves, primarily exhibiting the shopping for energy and promoting stress of the market.

A low ESR signifies that stablecoin reserves far exceed Bitcoin reserves, suggesting an abundance of liquidity able to circulate into BTC. This disparity is traditionally correlated with bull markets and rallies, as stablecoins have traditionally been most well-liked for buying BTC on exchanges.

Conversely, a excessive ESR means that BTC dominates reserves in comparison with stablecoins, which typically means restricted buying energy on exchanges and the potential for vital promoting stress.

Whereas there are numerous completely different indicators of bull markets, ESR is especially invaluable as a result of it displays the willingness of capital to put money into Bitcoin. Not like remoted value measures, the ratio displays underlying liquidity tendencies and displays investor sentiment.

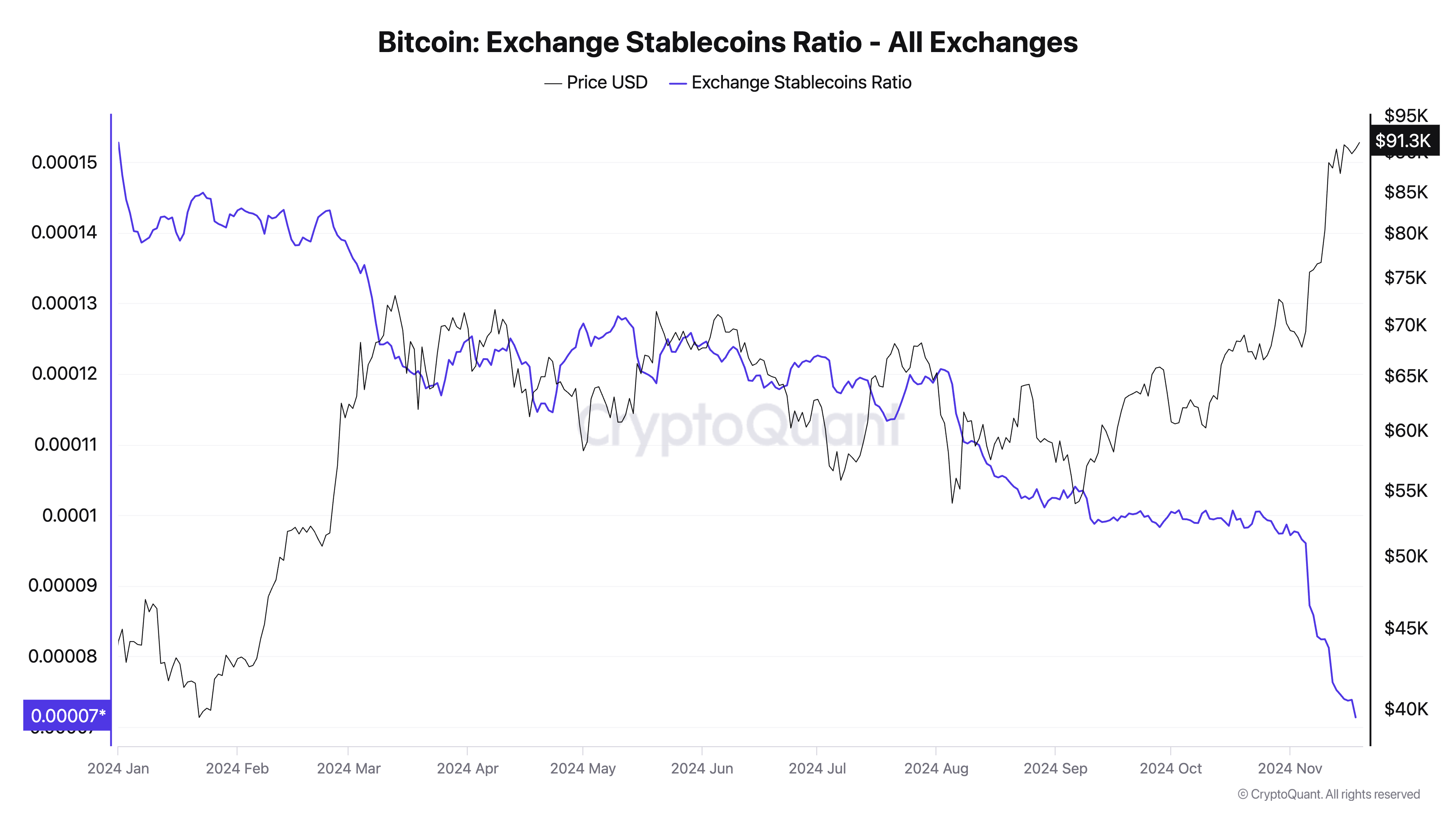

On November 18, ESR fell to an all-time low after a downward pattern that intensified in 2024. Because the begin of the 12 months, ESR has declined by simply over 95%, rising from 0.0015276 on January 1 to a document excessive. time low of 0.00007317 on November 18. Throughout the identical interval, the worth of Bitcoin rose from $44,200 to $90,500, exhibiting a transparent inverse relationship between the ratio and value.

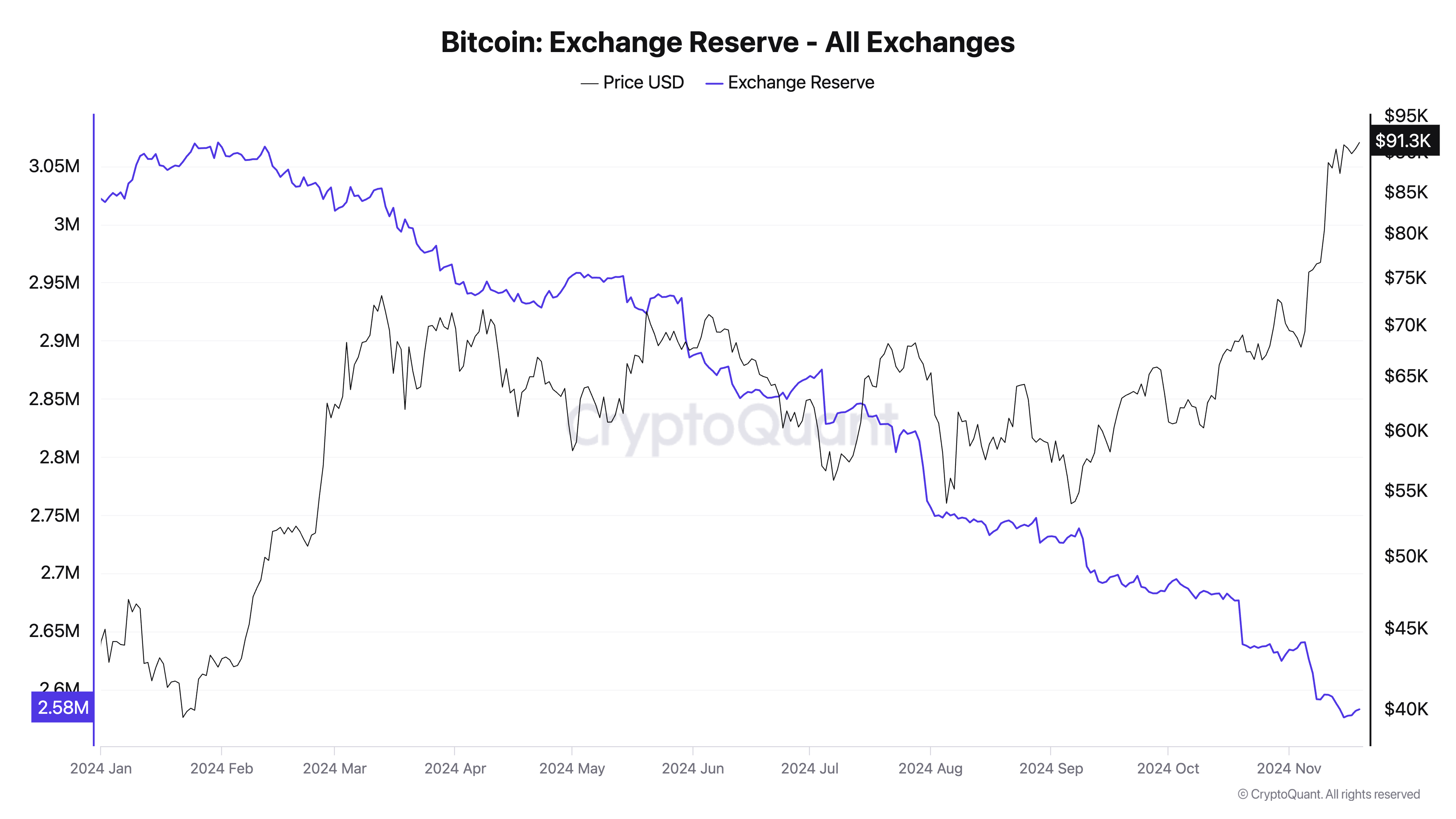

The US presidential election on November 5 had a profound affect in the marketplace, appearing as a catalyst for Bitcoin to skyrocket to its all-time excessive of $93,000. This triggered document buying and selling volumes in spot and derivatives markets as establishments and retail traders rushed to capitalize on Bitcoin's rising narrative as a hedge and retailer of worth. These elevated buying and selling actions triggered the worth of Bitcoin to rise as stablecoin reserves piled up, additional compressing the ESR.

The all-time low in ESR related to Bitcoin buying and selling between $90,000 and $92,000 reveals a market in a singular place. A low ESR throughout a interval of value progress reveals strong demand fueled by giant capital reserves of stablecoins.

Such an surroundings limits Bitcoin's draw back threat, because the abundance of stablecoins creates a kind of liquidity cushion prepared to soak up any promoting stress. On the identical time, the restricted provide of BTC on exchanges exacerbates shortage, driving up costs.

adjustments over the 12 months, the sharpest decline in ESR occurred proper after the US elections, as Bitcoin entered its most aggressive rally this 12 months. This means that the market gathered stablecoins in periods of value consolidation earlier within the 12 months and deployed them to purchase BTC as quickly as sentiment turned bullish.

The interplay we noticed between stablecoin accumulation and rising costs reveals that these reserves have a strategic nature – serving as each a buffer and a catalyst for progress.

The implications of this drop in ESR within the coming weeks and months are vital.

If ranges proceed to stay low or fall additional as the worth of Bitcoin climbs, it’ll imply that the market is closely capitalized in dry powder. In such a situation, we will count on an extra steady upward motion.

Nonetheless, we may additionally see a way more aggressive deployment of stablecoins in BTC. Whereas this might profit the market within the quick time period by driving up costs, it may additionally depart exchanges with diminished stablecoin reserves, resulting in increased volatility sooner or later.

Put up-Swap Stablecoin Ratio Hits Report Excessive, Fueling Bitcoin’s Rise appeared first on forexcryptozone.