Bitcoin (BTC) was caught in a decent buying and selling vary, fluctuating between $30,000 and $31,000. Whereas some on-chain metrics present that this continued sideways motion was seen earlier than Bitcoin’s earlier bull runs, there isn’t any indication {that a} important change could happen quickly.

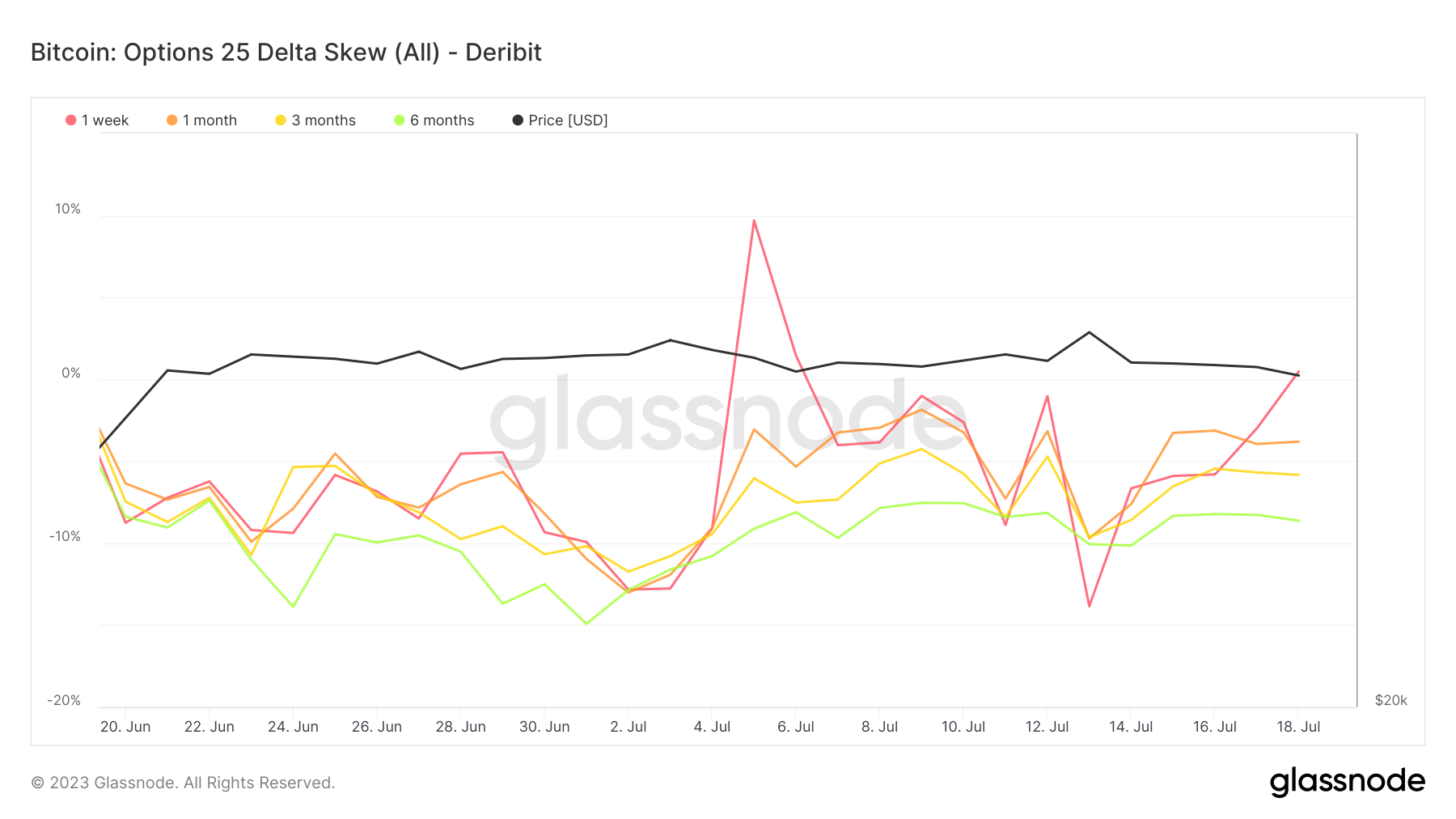

The derivatives market, notably the choices market, reveals combined sentiment about Bitcoin’s efficiency. This break up is obvious when analyzing the delta skew of Bitcoin choices. The delta skew for choices contracts expiring in a single week, one month, three months and 6 months from now are 0.48%, -3.8%, -5.83% and -8.62%, respectively.

Delta skew, also referred to as “skew” or “threat reverse”, is a measure of market sentiment usually used within the choices market. It measures the distinction in implied volatility between out-of-the-money (OTM) put choices and OTM calls.

If the market is bullish, OTM name choices (name choices above the present value) could have larger implied volatility than OTM put choices (put choices beneath the present value) as a result of merchants are keen to pay extra for the choice of shopping for the asset at a better value sooner or later, anticipating the value to rise. This example ends in a constructive delta skew.

Conversely, if the market is bearish, OTM put choices could have larger implied volatility than OTM name choices, leading to a damaging delta skew. On this case, merchants are keen to pay extra for the chance to promote the asset at a better value sooner or later, as they count on the value to fall.

The 0.48% delta skew for bitcoin choices expiring in a single week is barely constructive, indicating considerably flat bullish sentiment for BTC within the quick time period. Nonetheless, the delta bias for choices expiring in a single month, three months, and 6 months is damaging (-3.8%, -5.83%, and -8.62%, respectively), suggesting that market sentiment turns into increasingly bearish in the long run. Merchants are keen to pay extra for the power to promote Bitcoin at a better value sooner or later, anticipating the value to fall.

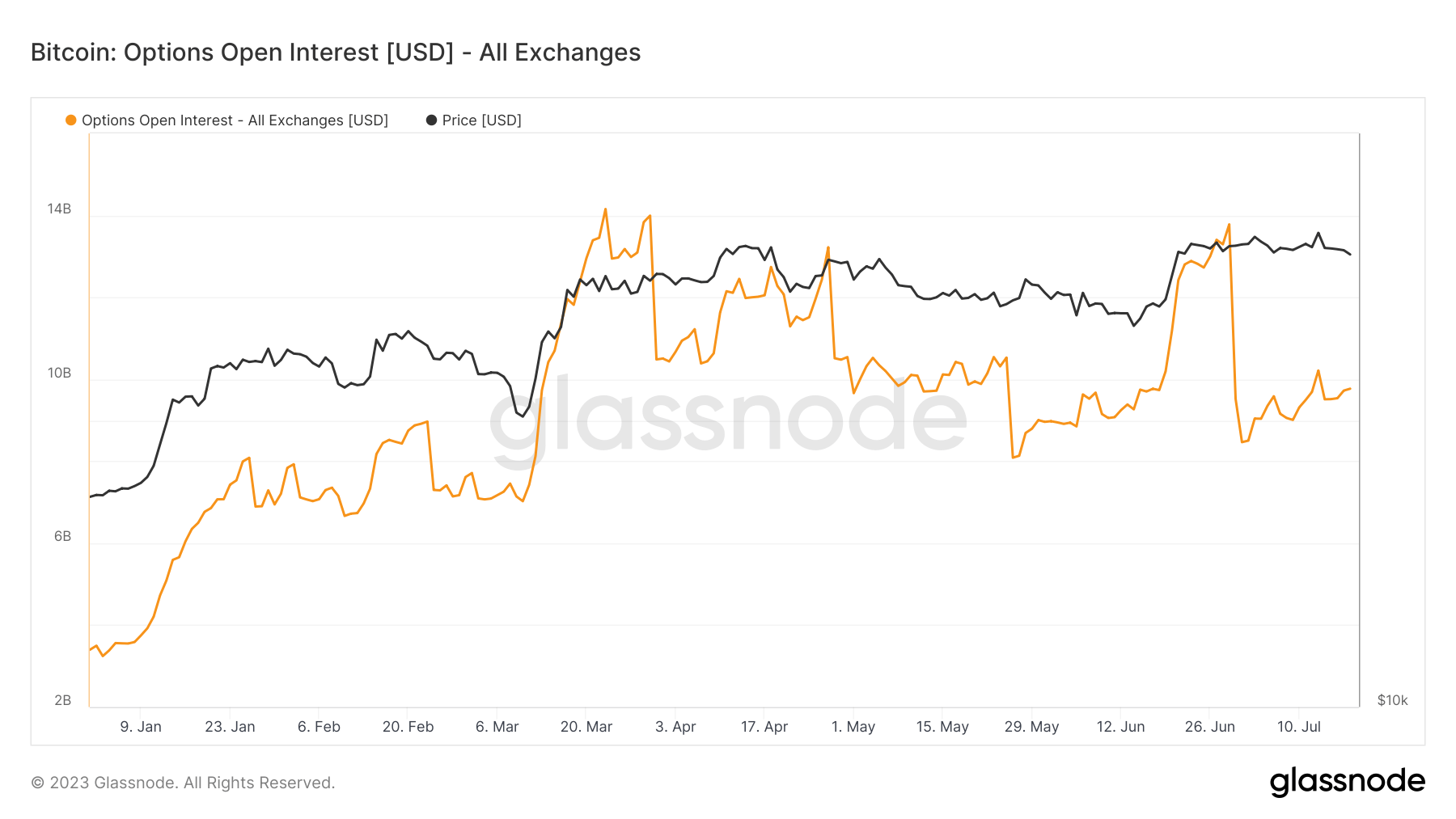

This divided sentiment stands in distinction to the construction of the overall open curiosity for Bitcoin name choices, which stands at $9.7 billion. Open curiosity refers back to the whole variety of excellent choice contracts that haven’t been settled. This can be a essential metric that displays the movement of cash to the derivatives market.

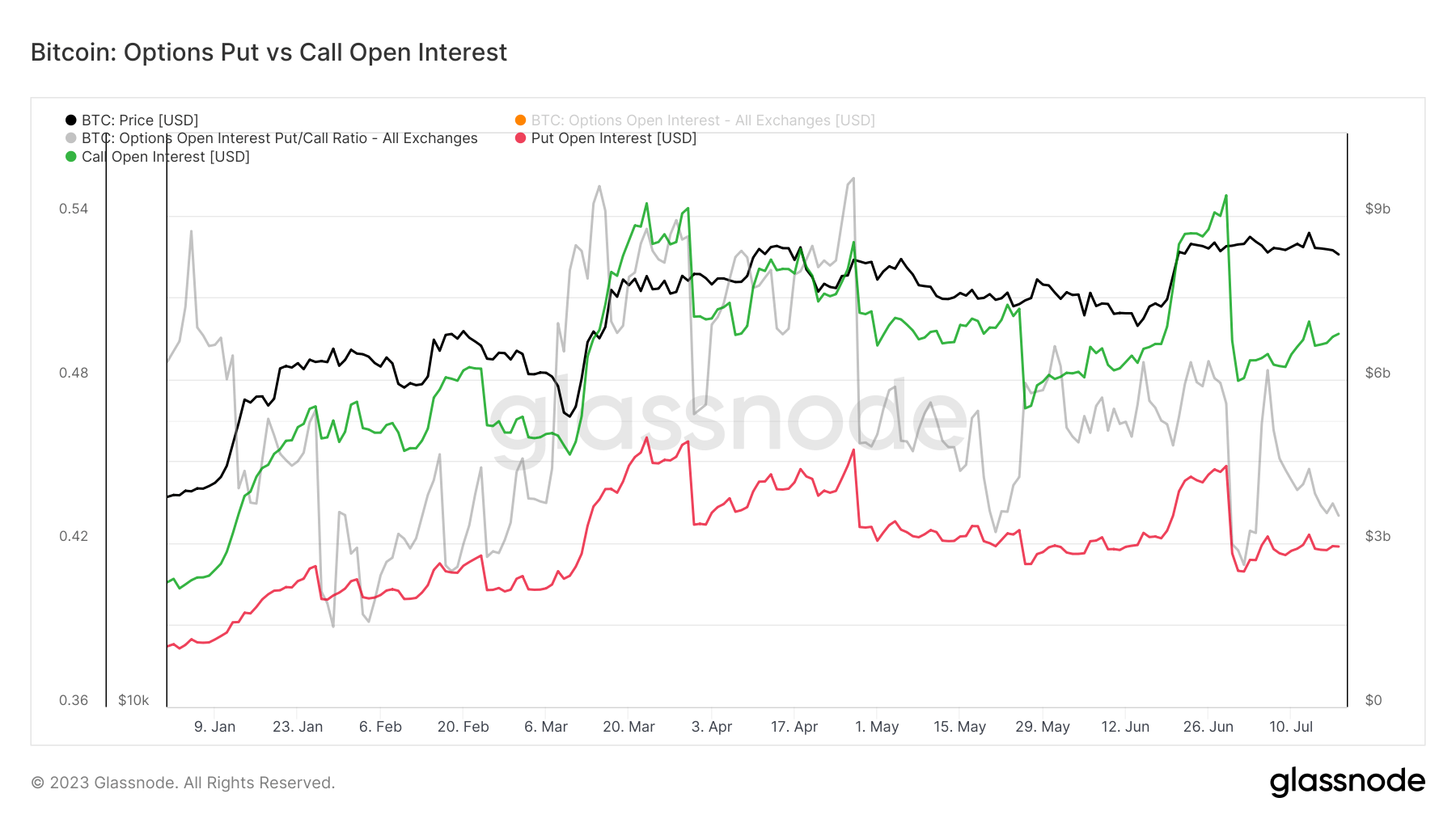

The overall open curiosity for Bitcoin calls is $6.93 billion, considerably larger than the open curiosity for put choices, which is $2.83 billion. This discrepancy may recommend that merchants are usually extra bullish on Bitcoin, anticipating the value to rise, therefore the upper variety of name choices.

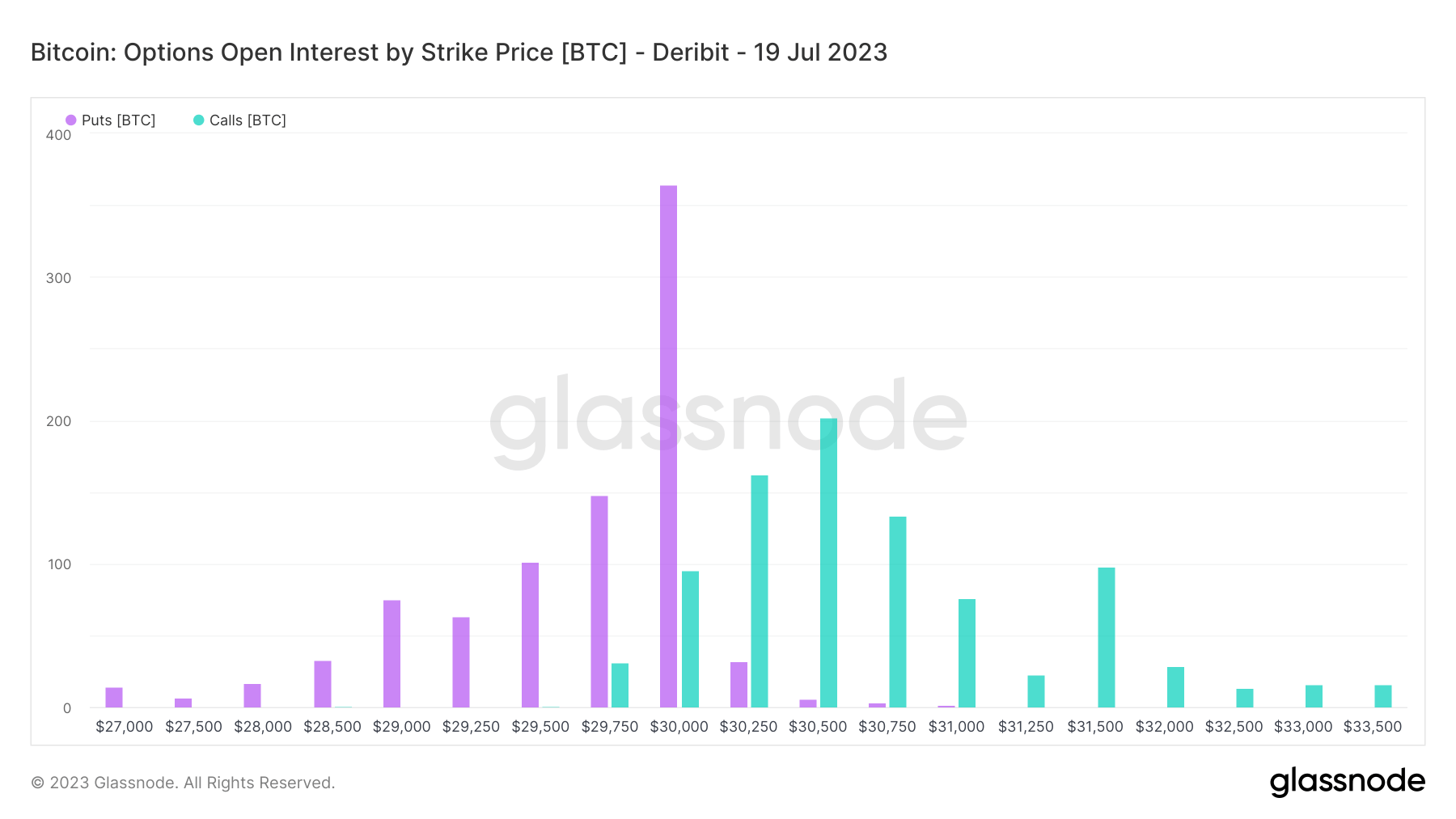

Nonetheless, name and put choice open curiosity by strike value for choices contracts expiring on July 19 reveals a unique story. An equal quantity of open curiosity, 365.4 BTC, is betting that BTC will fall beneath $30,000 and rise above $30,250 to $30,500. This stability of pursuits signifies a stalled market, reflecting Bitcoin’s present value stage.

In conclusion, the undecided derivatives market is retaining Bitcoin flat. Whereas some merchants are bullish, anticipating value to rise, an equal quantity are bearish, betting on falling value. This break up helps Bitcoin in a slim buying and selling vary, with little indication of a big change within the coming days.

Opposite to the bearish sentiment mirrored within the choices market, long-term forecasts from some consultants recommend a extra bullish view, with merchants wanting set to climate the present market in anticipation of future value will increase.

The put up Undecided Choices Market Retains Bitcoin Flat appeared first on forexcryptozone.