A analysis agency has defined how the value of Bitcoin has reacted to purchases Michael Saylor’s MicroStrategy has made over time.

MicroStrategy’s Bitcoin Buys Had been Adopted by Damaging Value Motion

K33 Analysis, previously Arcane Analysis, has revealed a brand new analytical article that examines the market influence of every shopping for spree performed by MicroStrategy.

The analysis agency discovered that Bitcoin has typically seen an increase in periods when MicroStrategy has been shopping for. Observe that in right here means the precise dates of the purchases and never when the bulletins had been made.

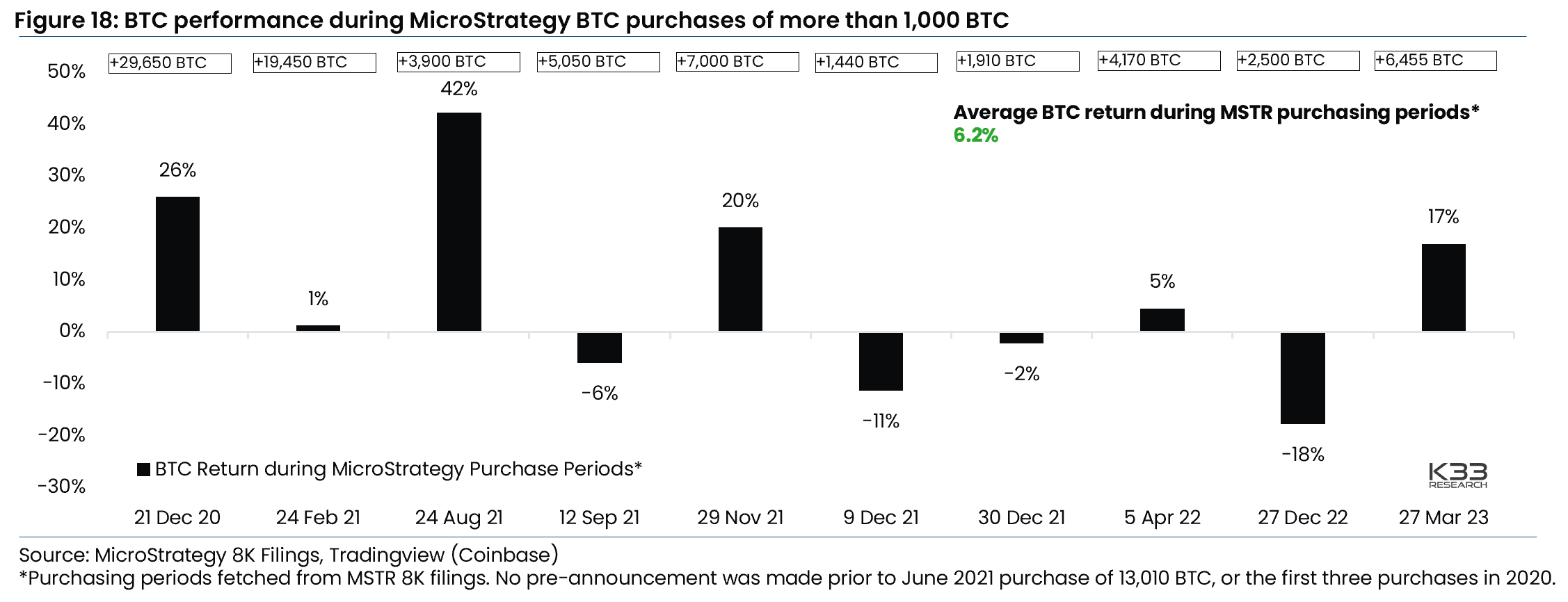

Here’s a chart that shows Bitcoin’s returns throughout every of the time intervals that MicroStrategy purchased at the least 1,000 BTC over the previous few years:

Appears to be like like the best constructive return was registered again in August 2021 | Supply: K33 Analysis

Because the chart above reveals, though it hasn’t been the case each time, these intervals have at all times tended to generate constructive returns for the cryptocurrency. The most recent buy, the place the corporate acquired 6,455 BTC (and in addition paid off its Silvergate mortgage in full), noticed the coin improve by 17%.

On common, Bitcoin noticed constructive returns of round 6.2% throughout these shopping for intervals. This development naturally is sensible, because the analysis agency famous that MicroStrategy’s purchases act as a continuing shopping for presence out there.

Now, essentially the most attention-grabbing development turns into seen when wanting on the asset returns that adopted instantly after MicroStrategy formally introduced its purchases. The chart under reveals how BTC carried out on the identical day as these bulletins, in addition to the way it carried out per week after, for the previous few years.

BTC has typically seen crimson returns after these bulletins | Supply: K33 Analysis

Not like purchase intervals, bulletins made by MicroStrategy have typically seen a unfavorable market response. On the times the corporate made these bulletins, the value was hit by a mean of two.2%. Taking a look at weekly returns following the bulletins, common returns had been unfavorable, however solely marginally at -0.2%. Following the agency’s newest buy announcement, Bitcoin noticed a 3% drop

As to why such crimson returns have sometimes been seen following such bulletins, K33 Analysis explains, “This market response could also be attributable to market individuals absorbing data {that a} identified massive purchaser has accomplished, which implies much less liquidity on the purchase aspect to additional assist the upside.”

In September, MicroStrategy signed a sale settlement with Cowen and BITG, which allowed them to concern and promote shares at an mixture value of as much as $500 million.

Thus far, the corporate has issued and offered $385.8 million value of inventory, which implies it could solely concern and promote inventory value $114.2 million to purchase extra. of Bitcoin.

“So whereas MicroStrategy efficiently pay as you go its Silvergate mortgage at a 25% low cost, the market is pricing {that a} identified massive purchaser has much less gunpowder within the close to time period to generate bullish momentum,” the corporate notes. of analysis.

BTC value

As of this writing, Bitcoin is buying and selling round $27,900, up 1% prior to now week.

The worth of BTC has seen some drawdown in latest hours | Supply: BTCUSD on TradingView

Featured picture of Kanchanara from Unsplash.com, charts from TradingView.com, K33.com