The Ordinals protocol has enabled NFTs and BRC-20 tokens on the Bitcoin community – the place beforehand it was a single-asset community.

Nevertheless, the problem has sparked debate, with critics pointing to skyrocketing transaction charges and chain bloat. In distinction, advocates argue that the idea of permissionless additionally encompasses the liberty to make use of Bitcoin as one needs.

Glassnode information analyzed by forexcryptozone revealed that the nice instances have returned for miners as a result of impression of the Ordinals Protocol.

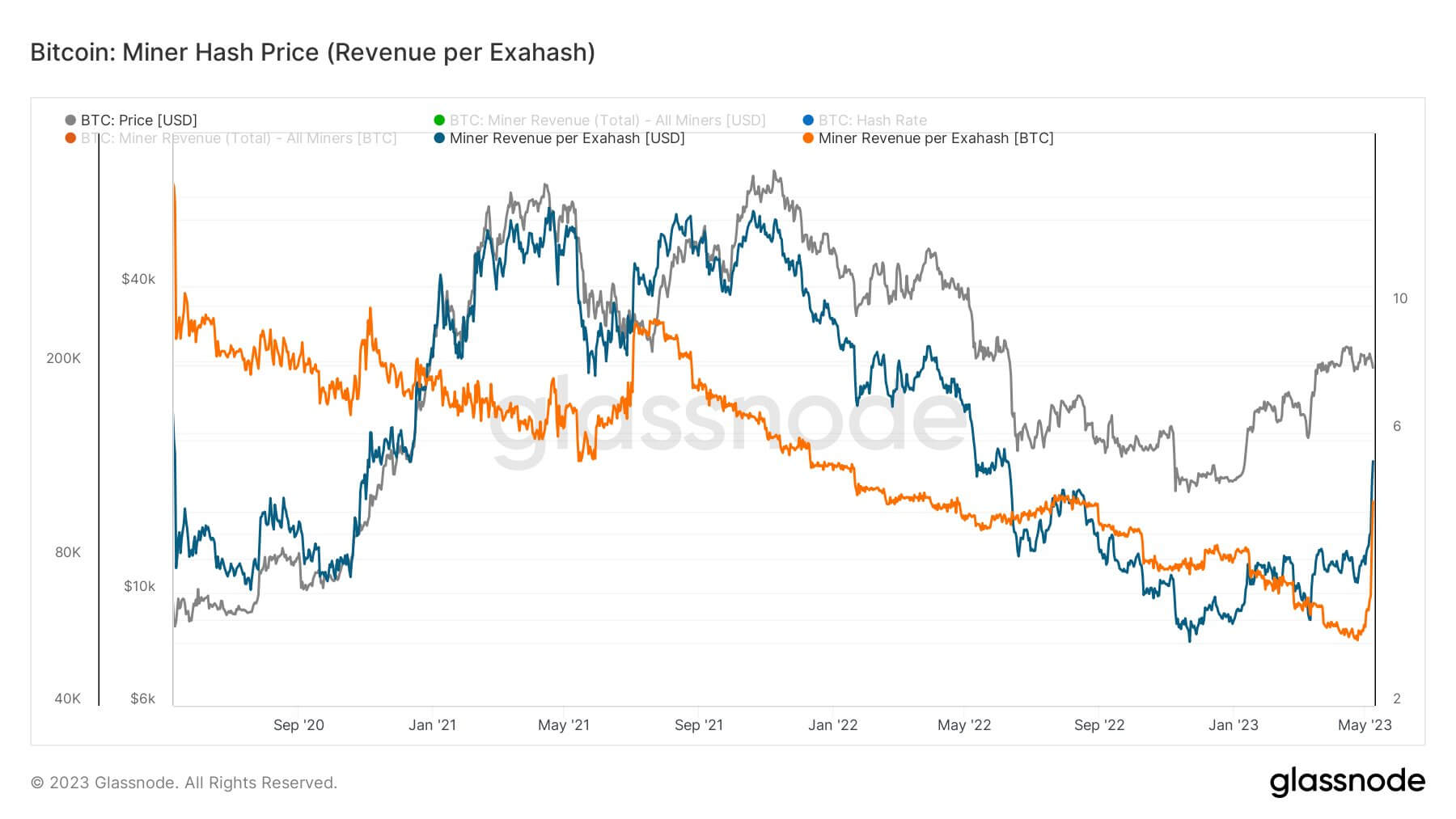

Bitcoin Miner Hash Worth

Miner Hash Worth refers back to the ratio of each day income to mining hash charge, giving income generated on an exahash (EH/s) foundation. He could charge the “consolation” of miners as a relentless concern in relation to different miners.

The chart beneath reveals that Miner Hash Worth has been on a steep upward development since Could – approaching the one-year highs final seen in June 2022. Previous to that, Miner Hash Worth was on a two-year downtrend – which obtained a reprieve with the implosion of Terra LUNA earlier than persevering with the downtrend about 4 months later.

With rising each day earnings relative to mining contribution, miners are seeing a windfall from the decrease common price of manufacturing Bitcoin.

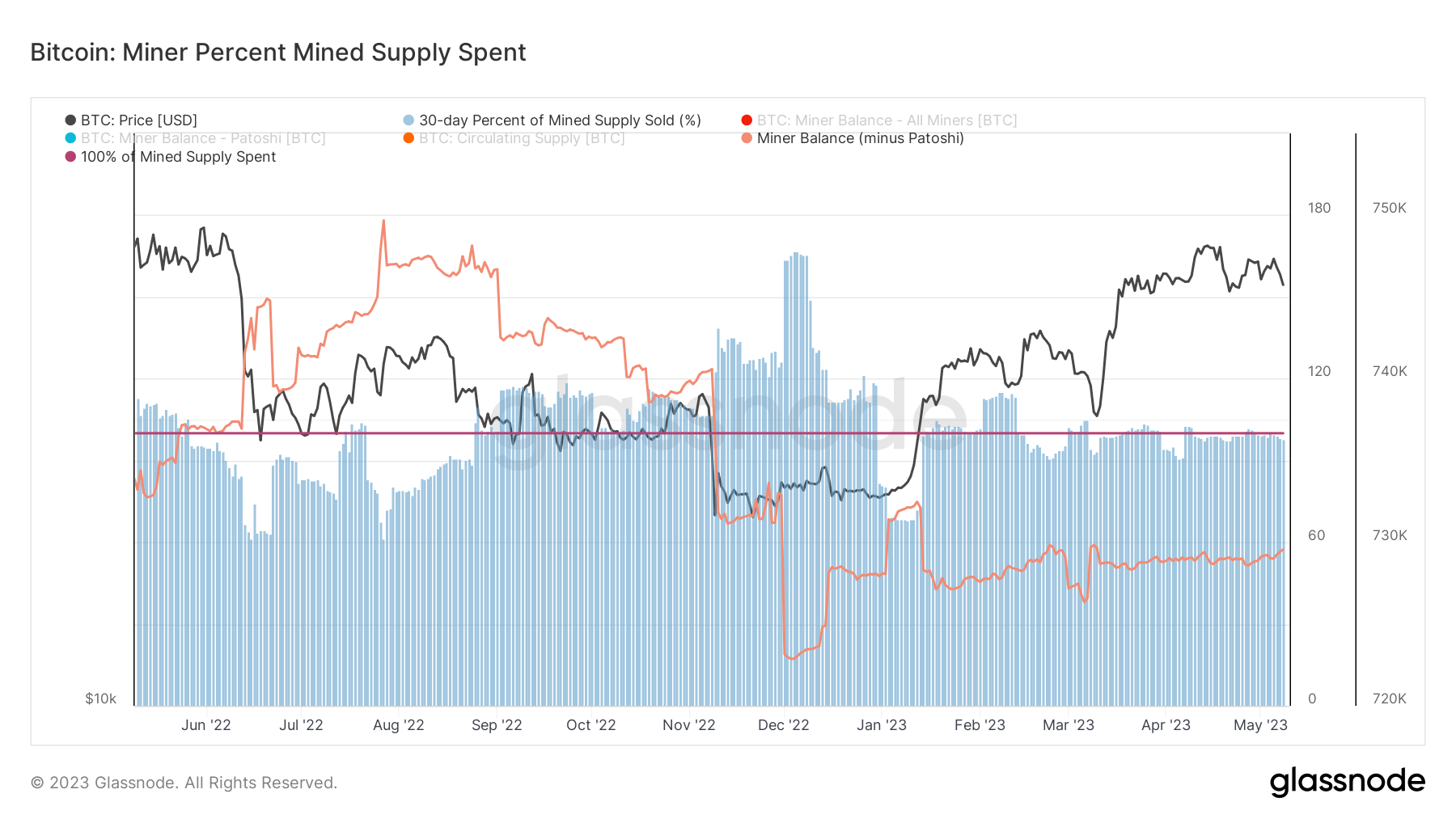

Miner Mined Provide Share Spent

Miner P.c Mined Provide Spent refers to an estimate of the proportion of mined provide that’s spent by miners over a 30-day window.

The mannequin compares the 30-day change within the miner’s steadiness and the full 30-day issuance to find out the proportion of mined cash spent yielding the next three variables at any given time:

- 100% – signifies that the quantity of mined cash is the same as the full mined provide spent within the combination.

- Lower than 100% – miners preserve among the mined provide in money reserves.

- Greater than 100% – miners distribute cash in extra of the mined provide, depleting money reserves.

The chart beneath reveals that the Miner Stability (minus Patoshi) is at the moment displaying 729,554 BTC. Though that is considerably decrease than the July 2022 peak of 750,000 BTC, the steadiness nonetheless reveals a notable upside from the December 2022 lows, which hit a low of 722,000 BTC.

Moreover, the year-to-date sample reveals an general upward development, indicating that miners are assured about future worth will increase, main them to want holding mined cash as steadiness sheet property relatively than holding mined cash as steadiness sheet property. promote.

Patoshi refers to cash mined by Satoshi Nakamoto in the course of the time he was actively concerned within the growth of Bitcoin. On-chain information reveals it holds 1.096 million cash – which stay untouched.

Mixed with evaluation suggesting that the miner capitulation occurred final yr, forexcryptozone expects the upward development in miner steadiness to proceed, which is able to result in a good interval for miners.

Abstract of the impression of Ordinals over the previous week

Because the begin of this week, meme coin mania has seen BRC-20 tokens set off a 24-month excessive in buying and selling charges.

This meant that block 788695, written on Could 7, earned a transaction price of 6.701 BTC, making it the first block in historical past the place the transaction price exceeded the mining reward (at the moment 6.25 BTC).

Equally, the FOMO meme coin led the BRC-20 market capitalization to surpass $1 billion on Could 8. Nevertheless, excessive draw back volatility has since seen a big decline. In consequence, the present market capitalization of the BRC-20 stands at $735.6 million.

The variety of registrations, digital artifacts registered on the Bitcoin blockchain, approached 5 million, leading to miners incomes a cumulative price of 904 BTC.

The put up Analysis: Ordinals, BRC-20 results in monetary boon for Bitcoin miners appeared first on forexcryptozone.