- Arbitrum One’s efficiency has seen the community surpass 200 million transactions, attracting consideration.

- The drop in hype across the community has led to a lower in community exercise and buying and selling quantity.

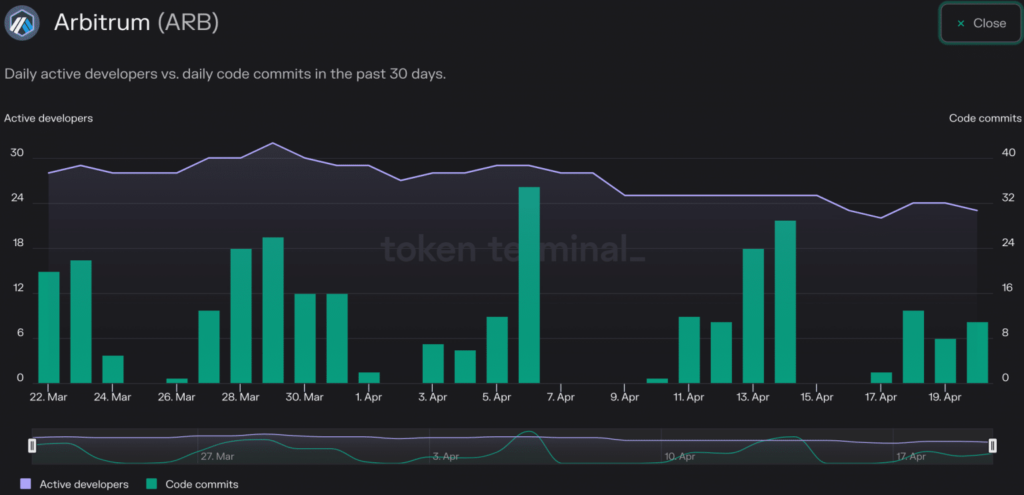

- Regardless of excessive exercise, the variety of energetic builders and code commits on GitHub has decreased.

The Arbitrum protocol lately reached over 200 million transactions. Specialists say that the mainnet of the protocol, the efficiency of Arbitrum One is the rationale. What can the market anticipate relating to the Arbitrum token airdrop?

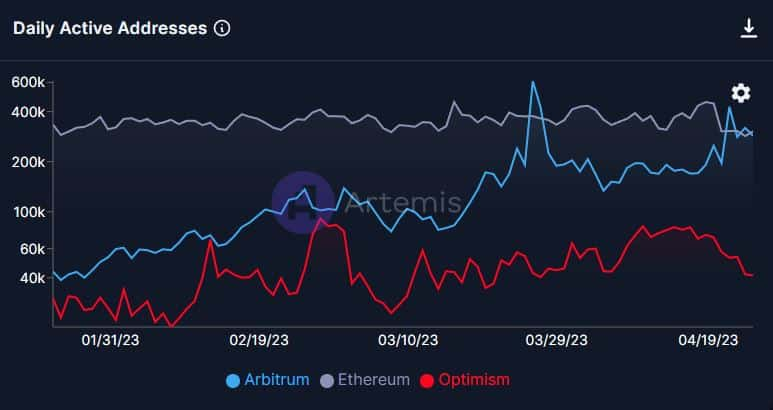

Initially, Arbitrum generated appreciable curiosity when it introduced the discharge of its long-awaited token airdrop. The protocol even surpassed Ethereum by way of each day energetic addresses as a result of pleasure surrounding the occasion. Nevertheless, over time, the excitement surrounding the Arbitrum community started to wane.

Subsequently, the decline in hype surrounding Arbitrum led to a decline in community exercise and buying and selling quantity. Moreover, the transient interval during which Arbitrum overtook Ethereum by way of each day exercise was dismissed as a singular occasion.

Nevertheless, Arbitrum has as soon as once more overtaken Ethereum by way of each day exercise. This current growth means that the elevated stage of exercise on the Arbitrum Community might be a sample moderately than a one-time occasion.

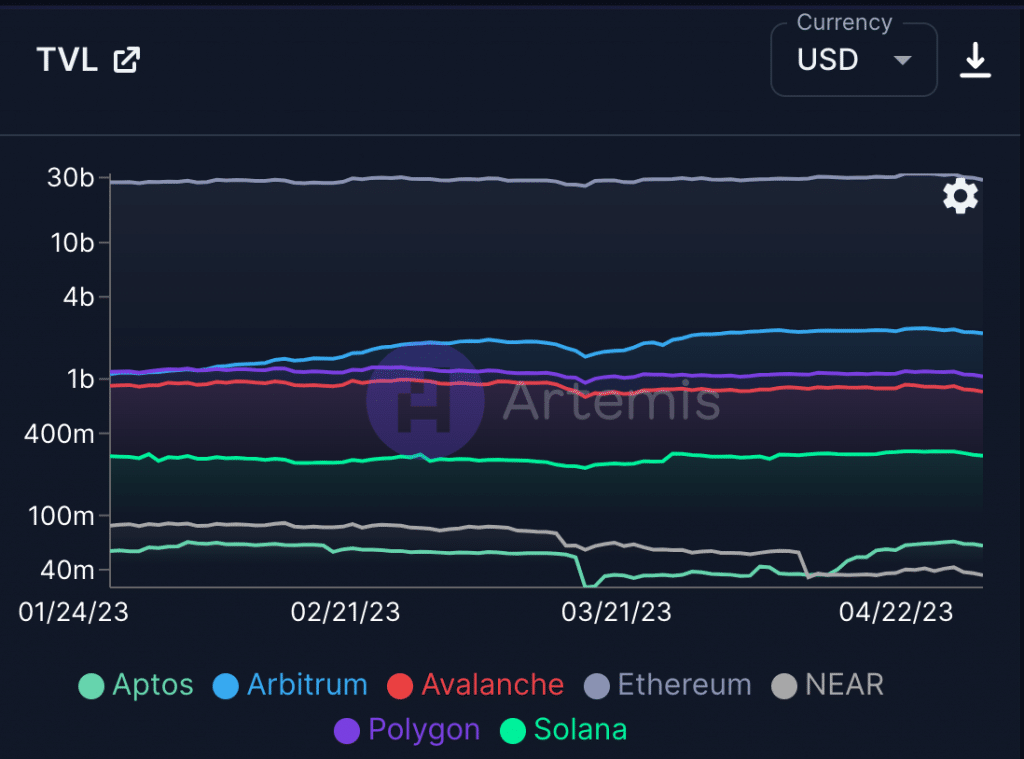

The mass adoption of the Arbitrum protocol has corresponded to a big enhance within the whole worth locked (TVL) in its good contracts. In keeping with knowledge from Artemis, except for Ethereum, the Arbitrum protocol has outperformed most different initiatives on this regard, with its TVL presently standing at $2.2 billion.

Though Arbitrum’s protocol has seen excessive exercise, the identical can’t be stated for its GitHub. Knowledge from Token Terminal confirmed a big drop within the variety of energetic builders on the community over the previous few months. Moreover, the variety of code commits on Arbitrum’s GitHub has dropped by 51.4% up to now 90 days.

If this pattern continues, Arbitrum may take longer than different protocols to introduce new options and upgrades, which may result in a lack of its dominant place available in the market.

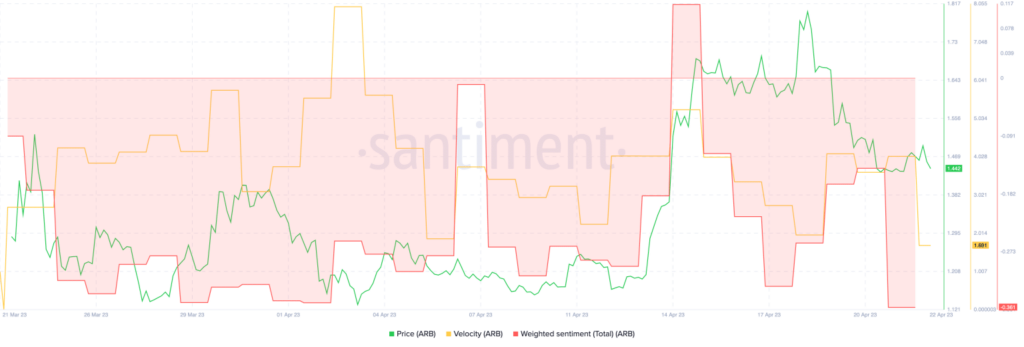

Regardless of the protocol’s optimistic efficiency, the final sentiment round ARB has been unfavorable. Knowledge from Santiment indicated a pointy decline in weighted sentiment over the previous few days, accompanied by a drop within the velocity of the ARB token. This decline in sentiment and buying and selling frequency brought about the worth of ARB to drop on the charts.