- ETH whales posted a large enhance in buying and selling quantity of 120%.

- The hike was a results of the whales tending to extend their exercise as they method the ARB airdrop.

- Arbitrum’s buying and selling quantity additionally jumped practically 32% to $4.34 billion.

In line with a current evaluation, Ethereum whale buying and selling quantity elevated following the announcement of the favored Ethereum scaling answer Arbitrum on the airdrop of its new ARB token.

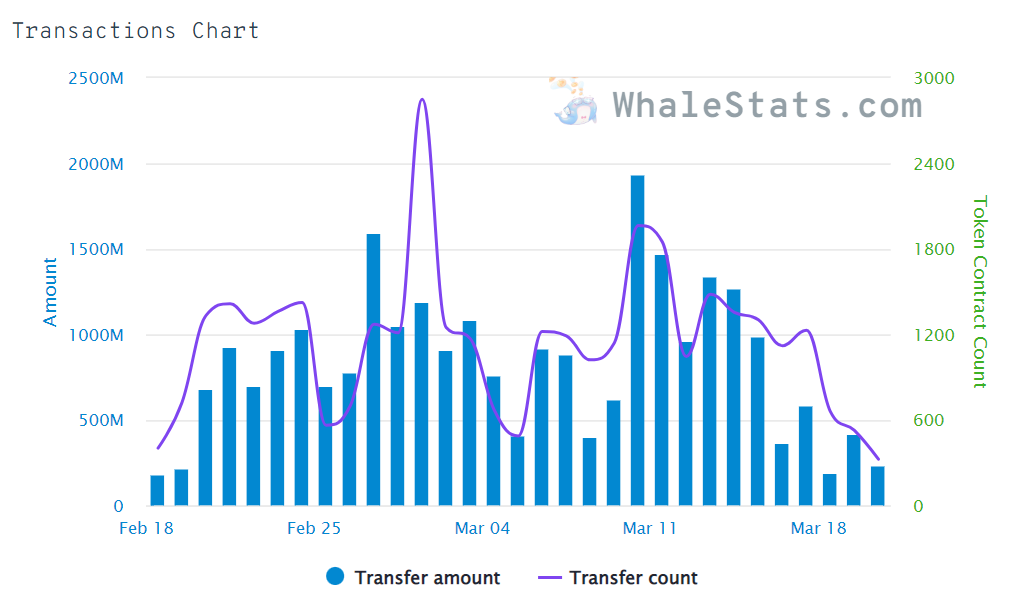

Notably, in keeping with information from analytics platform WhaleStats, ETH whale buying and selling quantity had seen a large surge of just about 120%, surging from $185.7 million to $408.8 million. .

Beforehand, on March 16, the Arbitrum Basis introduced in a message that the platform’s $10 billion ARB tokens could be airdropped into neighborhood wallets as scheduled on March 23.

Following the announcement, the buying and selling quantity of the Arbitrum Decentralized Trade (DEX) recorded a considerable enhance of practically 32% to at present attain $4.34 billion. The present buying and selling quantity of the DEX is at a brand new excessive in two weeks, surpassing the buying and selling quantity of the principle platform BNB Chain.

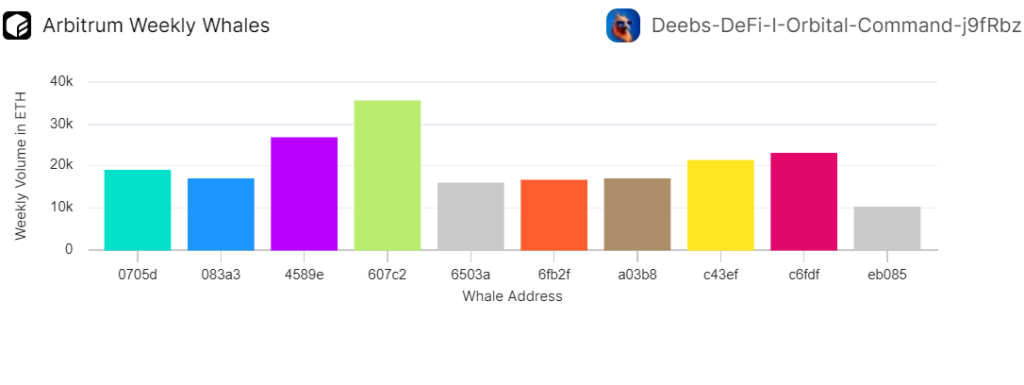

Supposedly, the rise in buying and selling quantity resulted from the tendency of enormous whales to extend their buying and selling actions, similar to the parachuting introduced by the Arbitrum. As predicted by consultants, there’s a important likelihood of huge liquidity following the airdrop.

Miles Deutscher, an on-chain analyst, shared a Twitter thread commenting that the airdrop of the ARB token would “act as a lift to the Arbitrum ecosystem,” leading to entry to further liquidity.

It ought to be famous that the CEO of blockchain creator Offchain Labs, Steven Goldfeder, mentioned that probably the most thrilling a part of the platform’s new initiative is the decentralization. He identified that Offchain Labs would have “no extra management over the way forward for this chain.”