- ARB faces resistance at $1.42 and finds assist at $1.34 over the previous day.

- The growth of the Bollinger Bands suggests a potential reversal within the ARB market.

- Bullish sentiment might be on the horizon for ARB because it touches the decrease Bollinger Band.

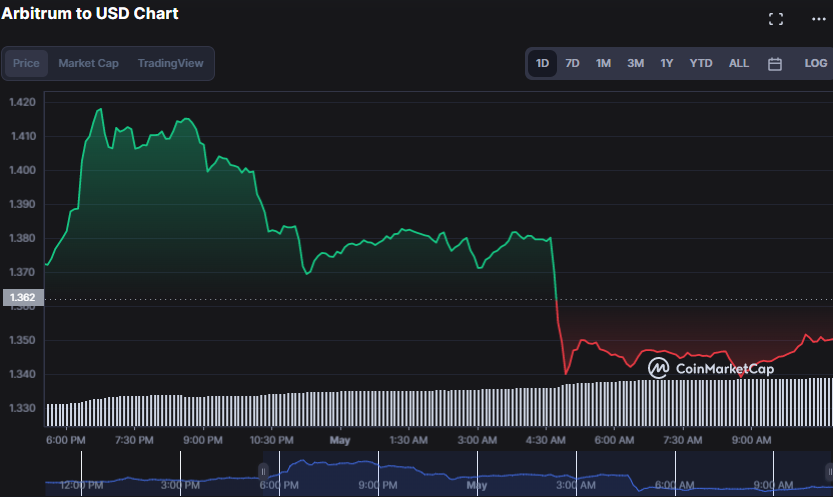

The Arbitrage (ARB) market was managed by bulls for the previous 24 hours till it lately encountered resistance on the $1.42 intraday excessive. Because of the bull’s incapability to interrupt by way of the resistance degree, the bears took over the market and despatched the ARB worth crashing to a 24-hour low of $1.34. The ARB was valued at $1.35, down 0.87% from yesterday’s closing worth, displaying a pessimistic temper out there.

In the course of the correction, the market capitalization fell by 0.89% to $1,723,222,739, whereas the 24-hour buying and selling quantity elevated by 103.16% to $426,351,599.

This distinction displays the acute volatility of the market, with traders instantly promoting their belongings throughout the correction and benefiting from the worth drop to purchase again and enhance buying and selling quantity.

ARB/USD 24-hour worth chart (supply: CoinMarketCap)

The growth of the Bollinger Bands on the ARB/USD 4-hour worth chart and rising buying and selling quantity suggest that the unfavorable momentum is fading and a reversal is feasible.

As worth motion nears the straightforward transferring common line, the huge inexperienced candlestick constructing alerts that the bulls are taking management and the consumers are coming in, signaling a probable shift in market sentiment in the direction of a bullish view.

The MACD line is now at -0.05, indicating slight unfavorable momentum out there, however the formation of a inexperienced candlestick and potential bullish temper shift recommend now could also be a very good time to contemplate shopping for. available on the market.

ARB/USD 4 hour chart (supply: TradingView)

On the 4-hour ARB/USD worth chart, the 100-day MA (orange) studying of 8.16 above the 20-day MA (blue) studying of seven.71 signifies that the long-term pattern is extra bullish than the short-term pattern. pattern, which might imply that potential bullish sentiment might be imminent for ARB.

This transfer reveals that merchants may contemplate shopping for ARB/USD at present costs to capitalize on any constructive sentiment.

Value motion under each transferring averages reveals that the bears are in management. Nevertheless, the bear’s reign might finish as ARB checks the 20-day MA. This worth motion close to the 20-day MA might enhance optimism amongst merchants and traders to affix the market in shopping for the dip to benefit from future positive aspects.

ARB/USD chart (supply: TradingView)

In conclusion, the ARB market is at present in a gentle bearish pattern, however indicators of a possible pattern reversal and bullish sentiment point out that now could be the time for merchants to purchase and benefit from future earnings.

Disclaimer: The views, opinions and knowledge shared on this worth prediction are printed in good religion. Readers ought to do their analysis and due diligence. Any motion taken by the reader is strictly at his personal danger. Coin Version and its associates shall not be accountable for direct or oblique damages or losses