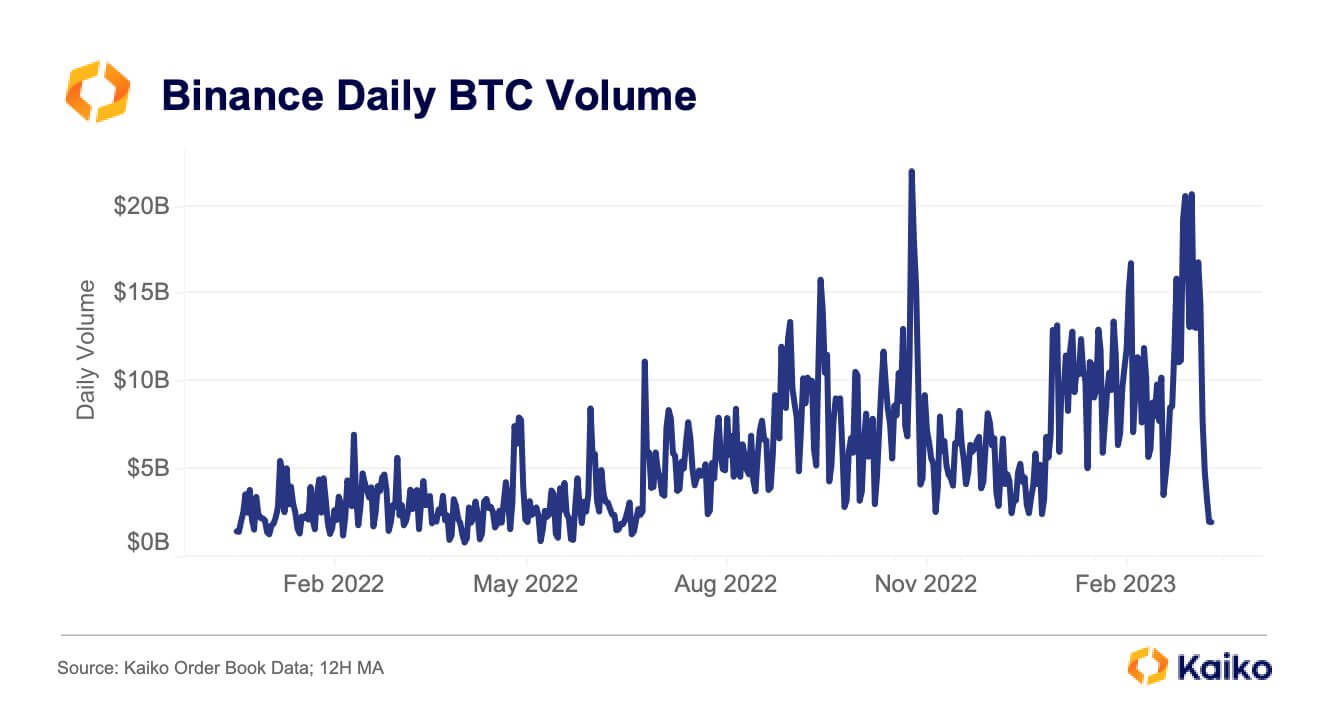

Binance’s each day Bitcoin (BTC) buying and selling quantity fell to its lowest degree since July 4, 2022, following the tip of its fee-free buying and selling for all buying and selling pairs besides TrueUSD (TUSD) , in response to knowledge from Kaiko.

Researcher Kaiko Riyad Carey underline that the final time Binance quantity fell this low was two days earlier than the introduction of no-fee buying and selling choices. In accordance with him, the drop in volumes coincided with the tip of free commerce.

Binance ended the free buying and selling possibility for many of its BTC stablecoin pair on March 22, citing current regulatory points going through the house. The free-trading possibility helped the trade enhance its market share from 50.5% to 72% – it additionally accounted for round 61% of its complete quantity.

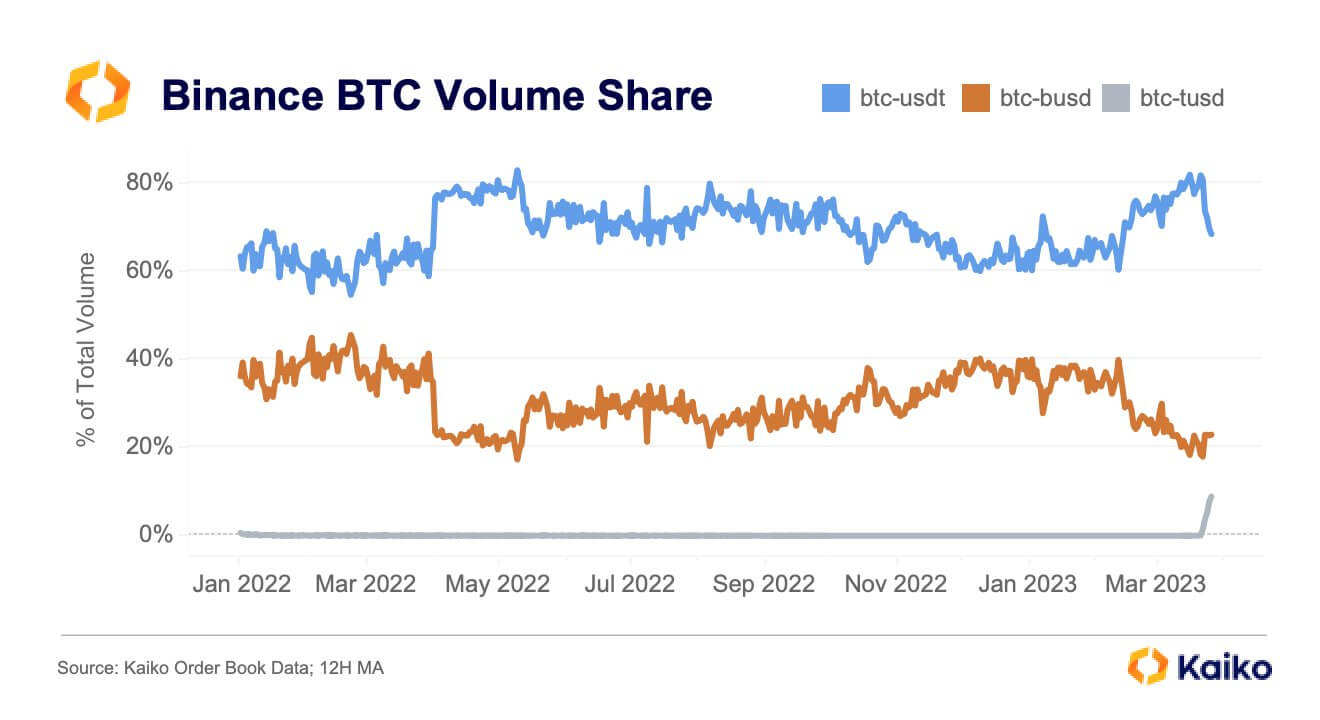

In the meantime, Binance’s BTC-TUSD market share elevated to round 10% whereas BTC-USDT quantity on the trade fell to 68% from 81%.

Since Binance phased out fee-free buying and selling, TUSD’s liquidity has elevated by over 250% – whereas the liquidity of stablecoins like Tether’s USDT and Binance USD (BUSD) has shrunk by over 60%. respectively.

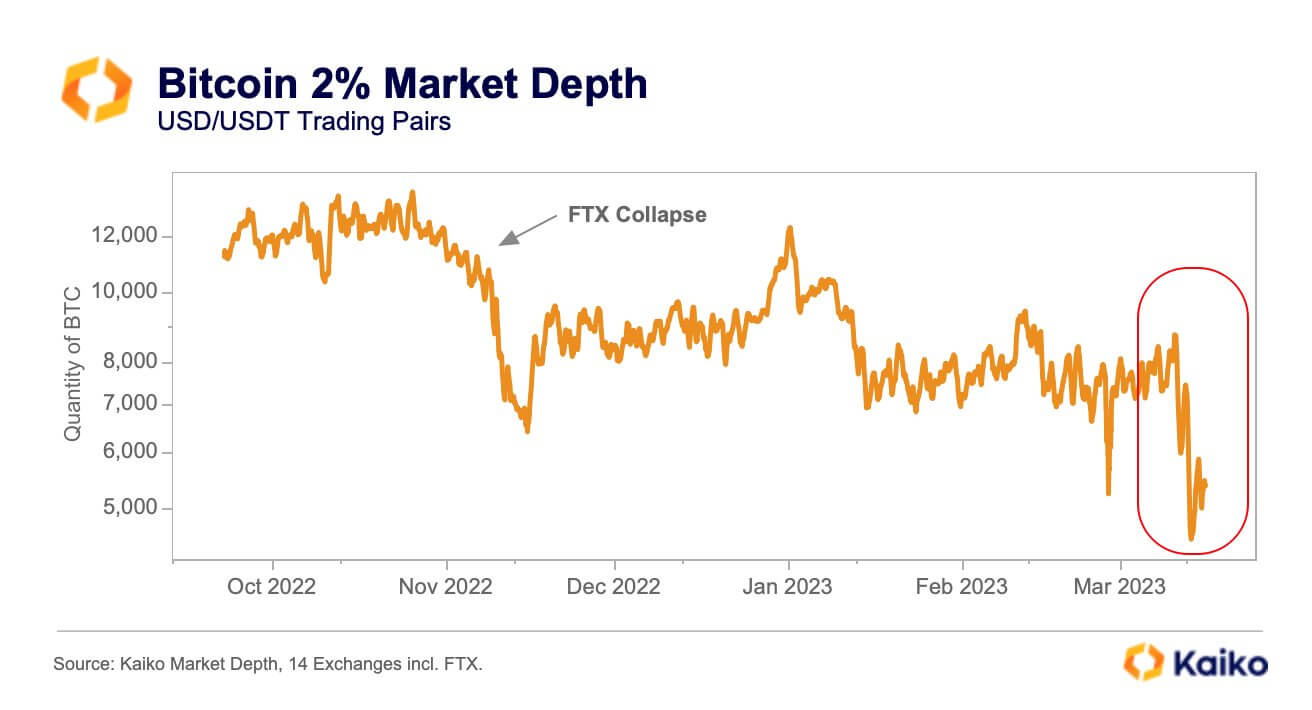

Bitcoin’s declining liquidity

As Bitcoin has risen round 70% within the present yr, market liquidity surrounding the flagship digital asset has fallen to its lowest degree in 10 months. Market liquidity is the convenience with which an asset might be traded with out affecting the worth.

Kaiko’s Conor Ryder famous that the current collapse of crypto-friendly banks has deeply affected US-based exchanges as a result of shutdown of US greenback fee rails. He added that “market makers within the area (are) going through unprecedented challenges to their operations.”

In accordance with Ryder, USD pair spreads have suffered extra volatility as a result of uncertainty surrounding the crypto trade in america. Additionally, the slippage of US-based exchanges has elevated resulting from these points.

For context, the slippage on a BTC-USD 100,000 promote order on Coinbase was up 2.5x from what it was in early March whereas Binance’s barely budged.

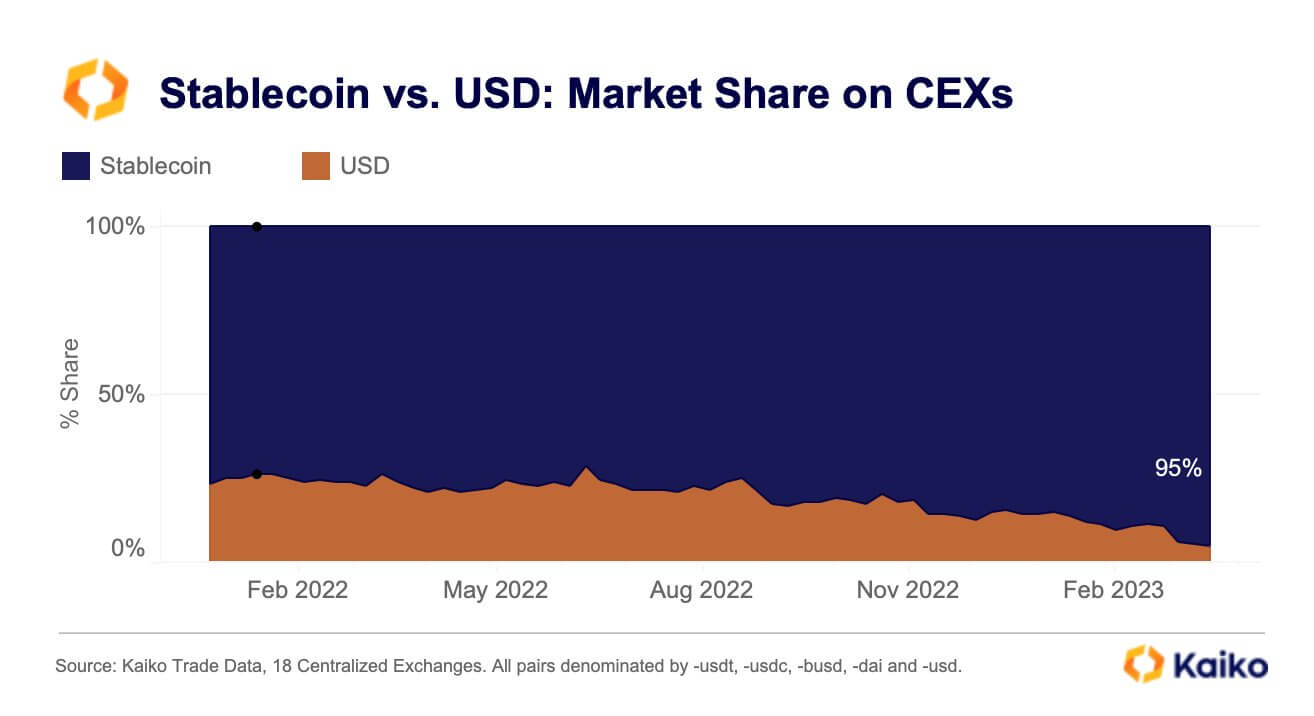

In the meantime, the additional tightening of USD entry has seen exchanges pivot in the direction of stablecoins. In accordance with knowledge from Kaiko, stablecoins now account for 95% of buying and selling volumes on centralized exchanges.

Ryder famous that whereas the pivot to stablecoins mitigates the impression of US banking points, it impacts liquidity within the nation and will not directly harm.