Binance’s regulatory challenges in numerous jurisdictions in June seem to have led to a big drop in person crypto belongings.

Binance customers withdraw belongings.

The change’s newest reserve proof snapshot, taken on July 1, confirmed customers’ Bitcoin deposits fell 3.5% to 592,450 BTC from the 614,800 recorded on June 1. Because of this platform customers withdrew round 22,000 BTC from the platform throughout the interval.

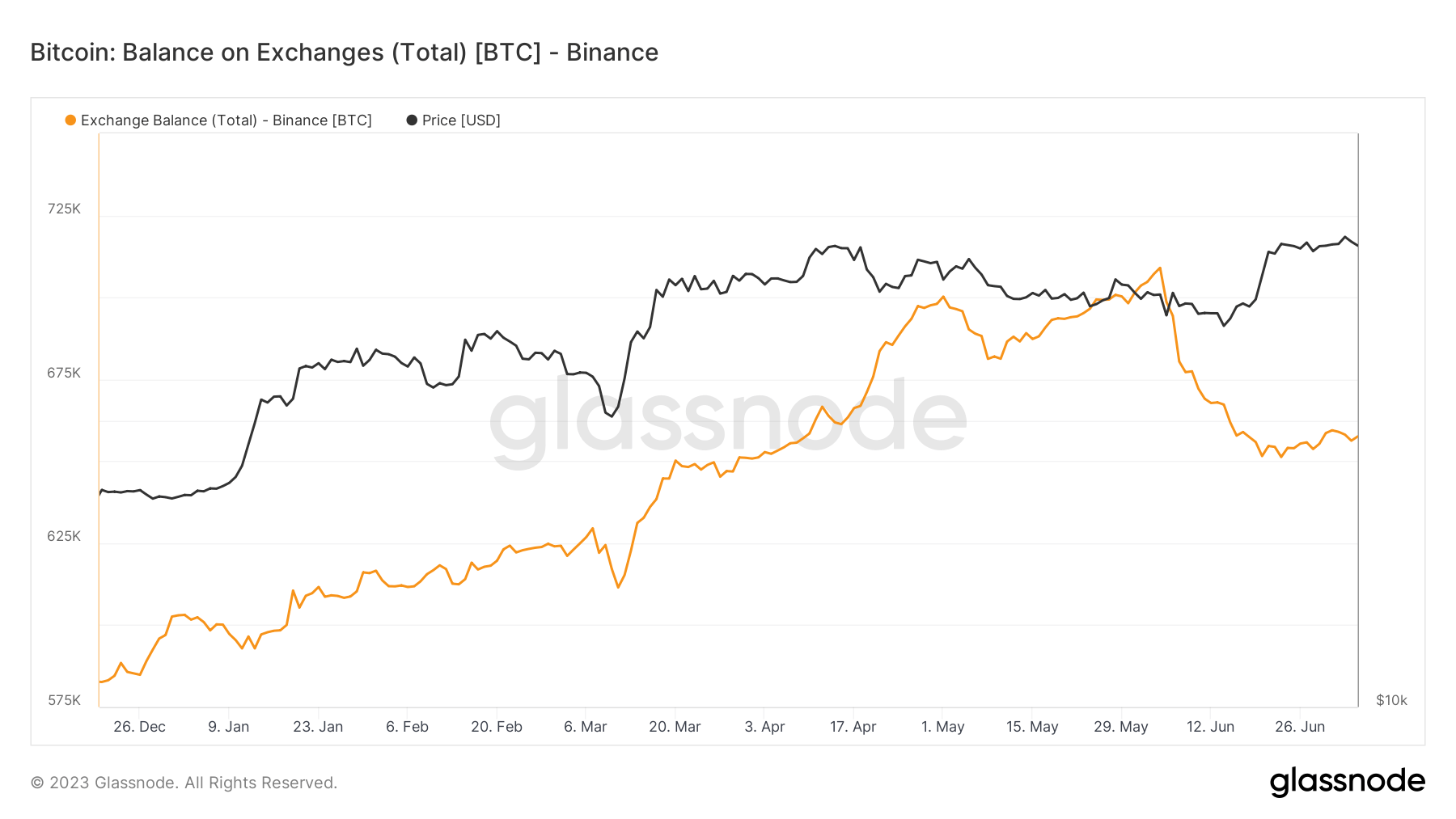

Knowledge from Glassnode corroborates that Binance’s BTC change has declined considerably. In accordance with the information aggregator, Binance’s BTC buying and selling stability fell from a peak of 709,001 BTC on June 4 to a low of 651,275 BTC on June 23 earlier than reaching its present stability of 657,536 BTC as of July 6.

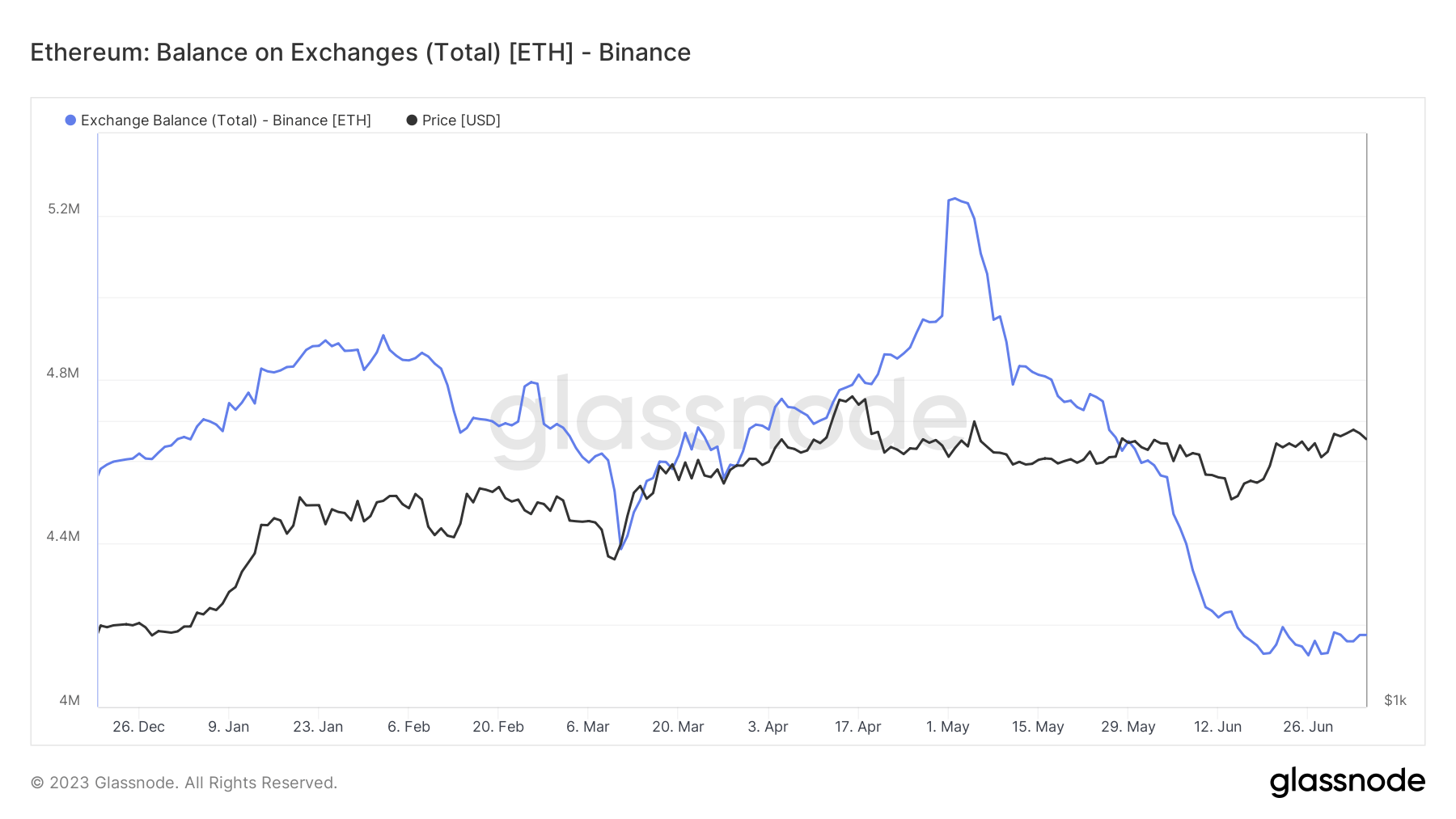

Ethereum deposits from change customers fell 4.4% to 4.16 million ETH on July 1 from the 4.35 million ETH held for customers on June 1. Because of this customers of the change withdrew almost 200,000 ETH from the platform over 30 days.

In the meantime, knowledge from Glassnode exhibits that Binance’s ETH stability has been on a downward development since early Could, coinciding with a interval when the whole variety of ETH held throughout all exchanges fell to an all time low. 5 years.

One other main crypto asset that has seen its deposits plummet over the previous month is Tether’s USDT. The stablecoin stability on Binance decreased from 1.61 billion to fifteen.47 billion, a lower of 9.45%.

In the meantime, Binance’s BNB stability bucked the downward deposit development, rising 6.6% to 29.7 million BNB as of July 1. Different belongings that noticed a rise in deposits embrace Ripple’s XRP, USD Coin (USDC) and others.

Binance Regulatory Points

In June, Binance confronted vital regulatory hurdles in a number of jurisdictions. The US, numerous European nations and Nigeria have elevated their surveillance of the change’s actions.

The US Securities and Change Fee (SEC) alleged that Binance violated federal securities legislation with its operation, including that the change provided cryptocurrency tokens to Individuals.

Whereas Binance has pledged to problem the claims, CEO Changpeng ‘CZ’ Zhao referred to as the lawsuit greater than a company authorized battle — he sees it as an assault on the broader crypto trade.

The change misplaced its euro cost companion in Europe and left a number of regional markets, together with Austria, the Netherlands, Cyprus and Germany. Throughout these outings, French authorities raided the bureau de change in France and a stop and desist order was issued towards it in Belgium.

Regardless of these points, a Binance spokesperson mentioned forexcryptozone that the corporate’s aim was to make sure compliance with the upcoming European rules on the Crypto Asset Markets (MiCA).