- Binance retains 34.7% of the CEX market, sustaining its dominance regardless of international regulatory challenges.

- Upbit emerges as a robust contender, pushed by compliance and the expansion of South Korea's crypto market.

- Leveraged buying and selling tendencies are boosting Binance and Bybit, attracting skilled merchants with superior instruments.

The cryptocurrency market continues to develop and centralized exchanges (CEX) are important to allow buying and selling for strange and huge buyers. Knowledge reveals that Binance leads the rankings with virtually 35% market share, adopted by Crypto.com, Upbit and different main gamers.

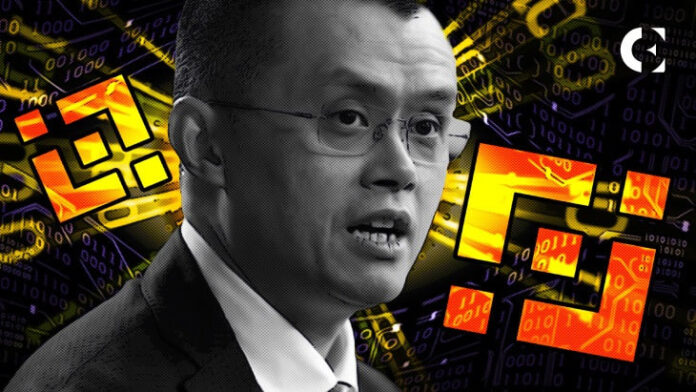

Binance: the market chief

Binance continues to be the king of centralized exchanges, holding a whopping 34.7% market share. With $18.27 billion in each day transactions, Binance is on high due to providing tons of cryptocurrencies, superior buying and selling instruments, and low charges. Even with regulatory points in international locations like america and Europe, Binance is a world power, offering providers equivalent to staking, futures, and NFT markets. Greater than 82 million individuals go to it each month, exhibiting its broad attain.

Associated: Binance Tops Crypto Survey As AI and Blockchain Take Middle Stage

New gamers make strikes

Crypto.com and Upbit maintain 11.2% and 9.8% market shares, respectively. Crypto.com is turning into standard due to user-friendly options like crypto debit playing cards and loyalty applications. Upbit is a frontrunner in South Korea, helped by following the foundations and integrating into the regional monetary system.

Bybit, with 8.9% of the market, is a success with derivatives merchants as a result of its excessive leverage choices and dependable infrastructure. US-based Coinbase has 6.5% of the market, attracting retail and institutional buyers with a deal with compliance and an easy-to-use interface. Different platforms like Gate.io (6.8%), Bitget (6.4%), OKX (6.2%), MEXC (6.1%) and HTX (3.3%) are rising by providing distinctive options equivalent to copy buying and selling and early entry to new cryptocurrencies. initiatives.

Associated: Binance CZ Responds to Memecoin Hype: No Buys, However No Opposition Both

The place the crypto trade trade is heading

Centralized cryptocurrency exchanges are the principle gamers, with Binance and Crypto.com being the worldwide leaders. Compliance with rules is a serious downside, significantly in america and Europe.

Platforms centered on person expertise and innovation, like Crypto.com and Bitget, are elevating the bar. Crypto.com's loyalty applications and Bitget's social buying and selling options are altering the best way customers work together with exchanges, offering worth past simply buying and selling.

Leveraged buying and selling and derivatives are actually main tendencies, making platforms like Binance and Bybit much more engaging. With superior instruments and excessive liquidity, these exchanges are most well-liked by skilled merchants.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be accountable for any losses arising from the usage of the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.