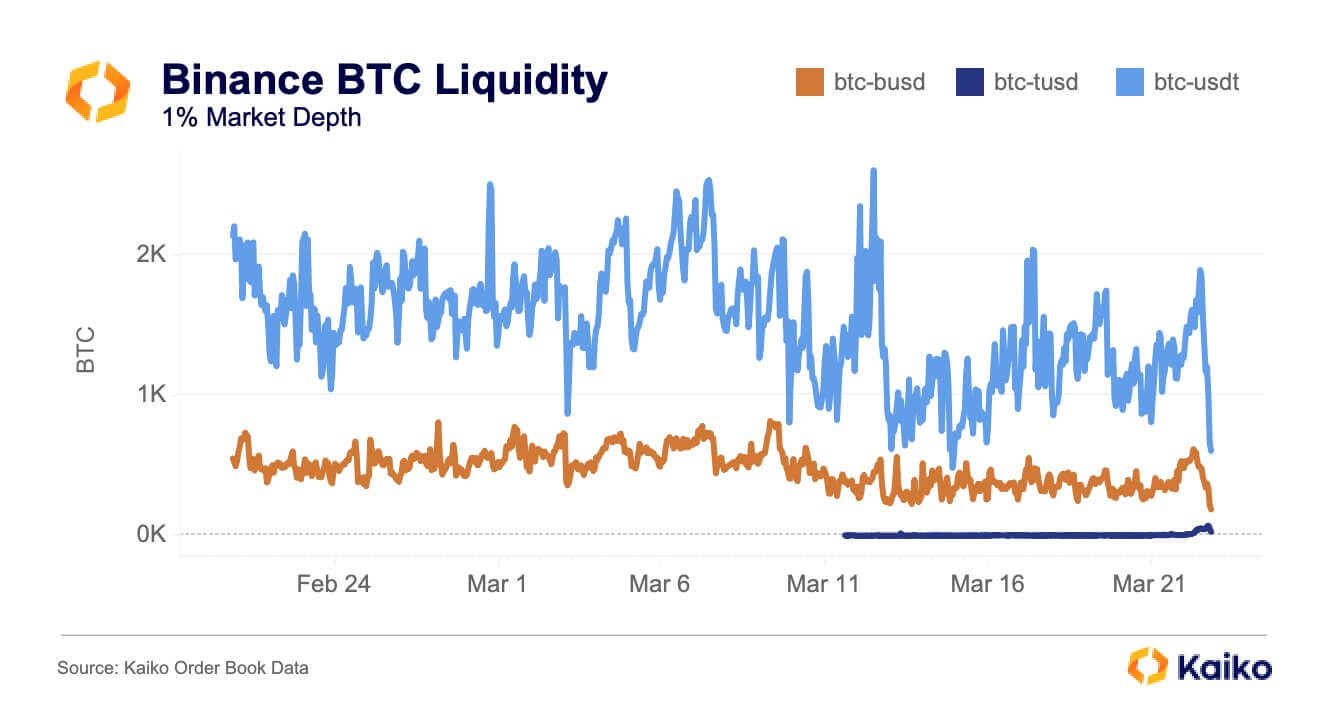

Binance’s Bitcoin (BTC) liquidity for its TrueUSD (TUSD) surged greater than 250% on March 22 after phasing out its fee-free buying and selling for different stablecoins.

Kaiko Knowledge researcher Riyad Carey identified that the alternate’s BTC liquidity for Binance USD (BUSD) and Tether’s USDT decreased by 60% and 70%, respectively.

In the meantime, the alternate’s liquidity for TUSD dropped from 9 BTC to 29 BTC inside hours.

On March 15, Binance introduced that it was transferring the fee-free BTC buying and selling characteristic from BUSD to TUSD on March 22. On the time, CEO Changpeng ‘CZ’ Zhao blamed the regulatory upheaval that different stablecoins had been going through for the corporate’s determination.

Will this determination have an effect on Binance’s market share?

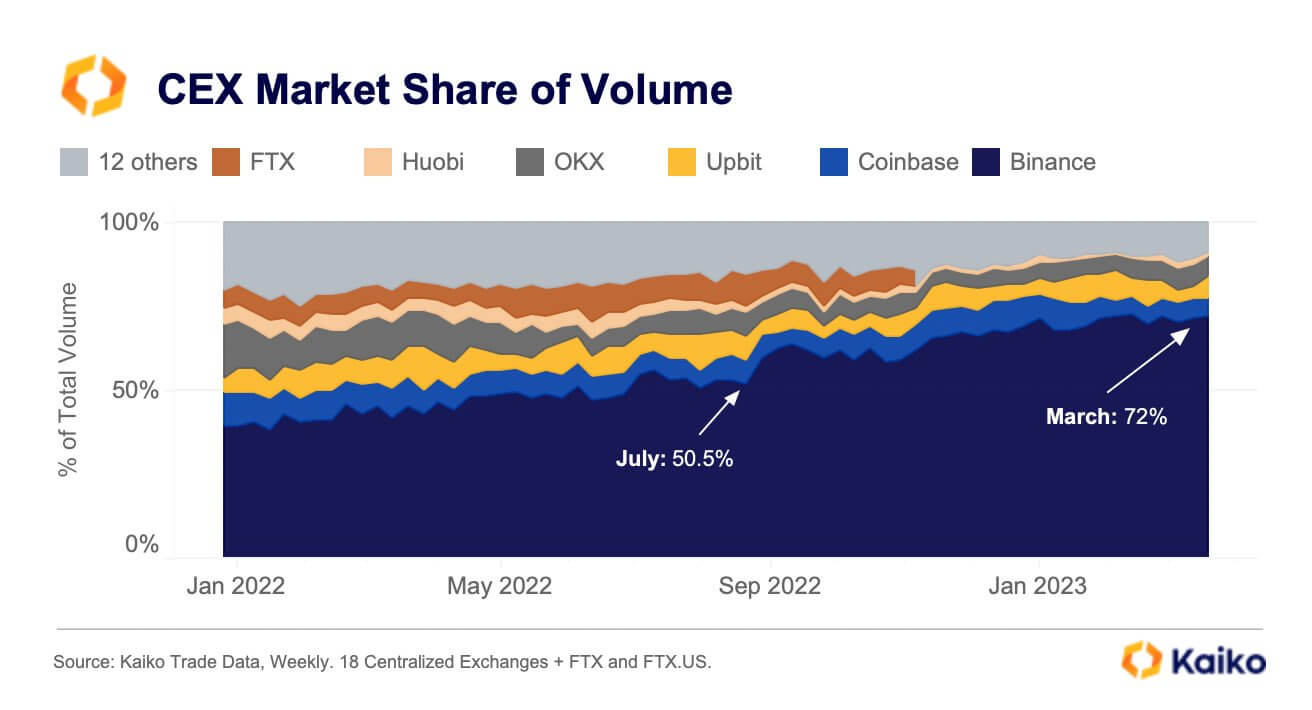

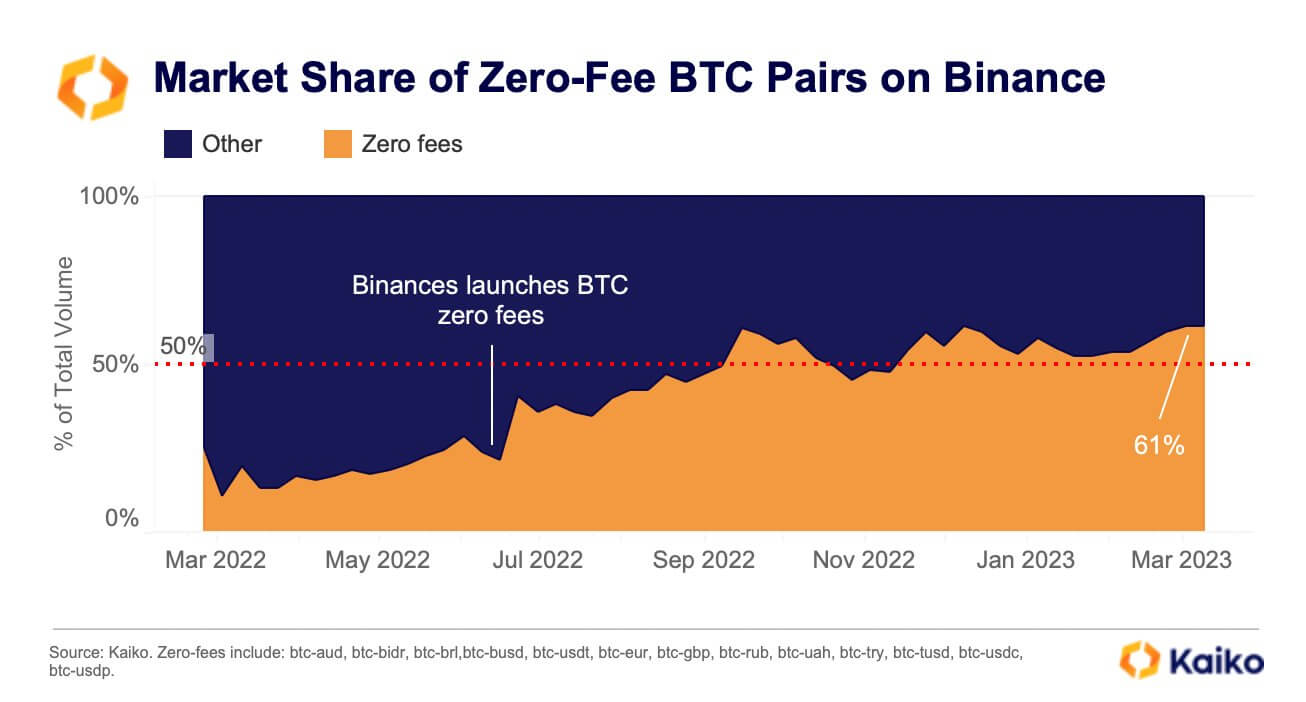

Kaiko’s Director of Analysis, Clara Medalie, highlighted the function performed by the zero buying and selling price choice in enhancing Binance’s market share.

Based on Medalie, the free buying and selling choice has helped Binance acquire a further 20% of the market since its introduction in July 2022. Again then, Binance solely managed 50.5% of the market; nevertheless, market management of the alternate elevated to 72% after FTX collapsed in November 2022.

Further data from Kaiko identified that the zero buying and selling choice accounted for 61% of the entire quantity on Binance the earlier week.

Binance customers drawn to the alternate due to its no-fee performance may go away for different rival platforms, Medalie famous.

TUSD continues to develop

Binance’s transfer would vastly profit TUSD, rising as a giant winner from the current debacle of its rivals.

Carey added that Binance’s transfer confirmed that it made an obvious transfer to advertise TUSD because the successor to BUSD.

For the reason that BUSD crackdown, TUSD has seen its circulating provide double to over $2 billion and turn out to be the second-largest stablecoin on the Tron community. In the course of the interval, Binance minted extra TUSD stablecoins and added new buying and selling pairs for the asset.

In the meantime, Protos researcher Bennett Tomlin underline that TUSD is among the weirdest stablecoins within the crypto market. Based on the researcher, TUSD has undisclosed relationships with Justin Solar, and the bankrupt Alameda Analysis was additionally a prime investor within the asset.