CryptoQuant analyst Burak Kesmeci's current report revealed a big and notable enhance in Bitcoin accumulation addresses, which now exceed 2.9 million BTC.

These addresses have steadily elevated their holdings with out promoting regardless of market uncertainty, doubling their Bitcoin reserves in simply 10 months.

This development highlights broader market sentiment, the place long-term traders, each particular person and institutional, are displaying confidence in the way forward for Bitcoin.

The rise in Bitcoin accumulation in 2024

Within the article uploaded to the CryptoQuant QuickTake platform, Kesmeci's evaluation delves deeper into understanding what defines these accumulation addresses and why they’ve been so lively all through 2024.

Opposite to typical investor habits, the analyst talked about that these addresses by no means skilled Bitcoin outflows, which means they solely gathered. The analyst sees them because the epitome of long-term funding methods, suggesting that they’re absolutely dedicated to the “HODL” mentality. Kesmeci wrote:

These usually are not trade addresses; they’re completely owned by particular person or institutional traders. They’ve made at the very least two transfers and have been lively at the very least as soon as within the final seven years. Basically, these addresses are the residing embodiment of the phrase “hodl”.

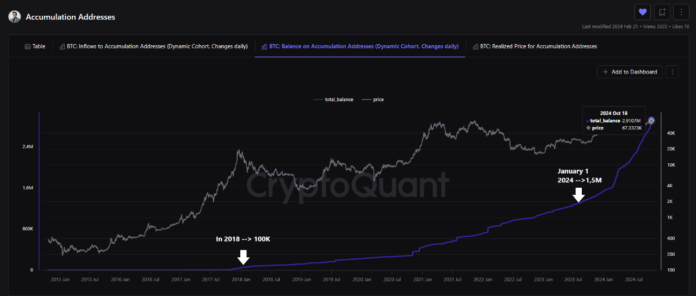

As of January 2024, these accumulation addresses held 1.5 million BTC. Nonetheless, in simply 10 months, this determine has virtually doubled, reaching 2.9 million BTC.

Kesmeci factors out that this accumulation habits will not be new, however what makes 2024 distinctive is the pace and quantity of development of those addresses.

Based on the report, this fixed accumulation in such excessive portions implies that short-term market volatility doesn’t affect these holders. Kesmeci additionally factors out that in 2018, accumulation addresses solely held 100,000 BTC.

In the course of the 2021 bull run, this quantity had elevated to 700,000, and in 2024 the acceleration has been outstanding. This fast accumulation means that these addresses are deeply assured within the worth and long-term potential of Bitcoin. Kesmeci asks, “What do these handle house owners know that the remainder of the market might not know?

What does this imply for the market?

The analyst concluded with a daring prediction: by the top of 2024, these addresses might maintain greater than 3 million BTC, probably price greater than $210 billion at a Bitcoin worth of $70,000.

Notably, in accordance with the CryptoQuant analyst, this is able to place the full worth held in these addresses above main firms like “Basic Electrical, the 61st largest firm by market capitalization”, highlighting the rising affect and power of long-term Bitcoin holders.

Kesmeci factors out that the sort of accumulation might have a big influence Bitcoin Value Stability and Future Development. If the development continues, the market might even see a discount in promoting strain as these massive holders stay dedicated to their positions, which might result in sustained worth will increase in the long run.

Featured picture created with DALL-E, chart from TradingView