The information reveals that the mixed transaction quantity of Bitcoin and altcoins hit the bottom worth in over a 12 months. Here is what that might imply.

7-day volumes within the cryptocurrency market have fallen not too long ago

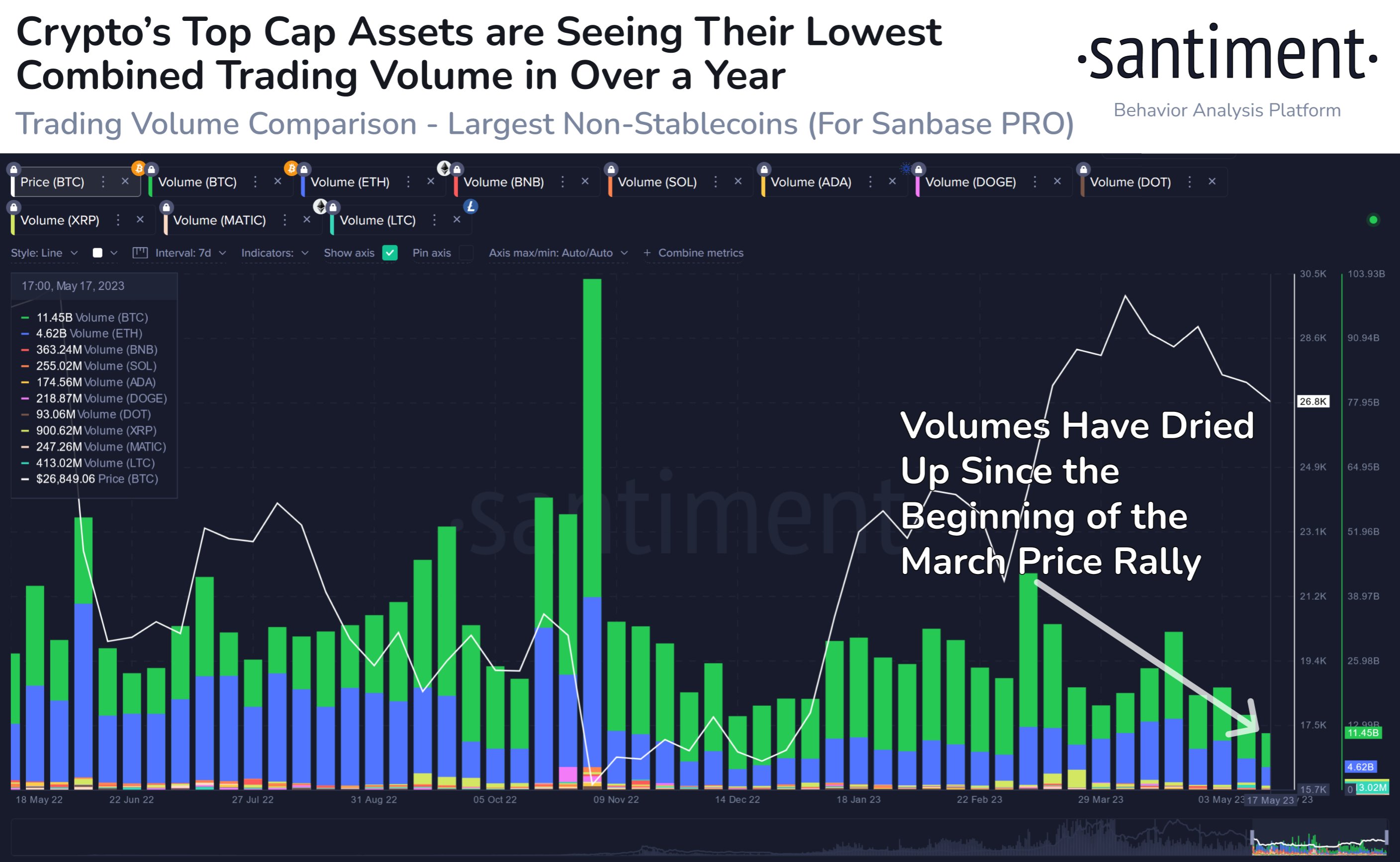

In keeping with knowledge from the on-chain analytics firm Saniment, volumes had been final at vital ranges in March of this 12 months. “Buying and selling quantity” is an indicator that measures the whole every day quantity of a given asset that’s moved on the blockchain.

When the worth of this metric is excessive, it implies that the cryptocurrency in query is observing the motion of a excessive variety of cash for the time being. Such a development means that traders are actively buying and selling the market proper now.

Then again, low values of the indicator could also be an indication that there’s not a lot curiosity within the asset amongst traders for the time being, as they don’t seem to be concerned in any vital buying and selling exercise on the community.

Now, here is a chart that reveals the 7-day buying and selling quantity development for a number of the largest belongings by market cap within the trade over the previous 12 months:

The worth of the metric appears to have noticed some decline in latest days | Supply: Santiment on Twitter

As you possibly can see within the chart above, the mixed 7-day buying and selling quantity of those high belongings surged in March when Bitcoin and different cash noticed a robust rally from a neighborhood low.

Since then, nevertheless, the indicator has seen a basic downward development, and now the metric has reached fairly low values. Which means within the final seven days, the belongings have noticed transactions of a really small quantity.

The present mixed buying and selling quantity for these large-cap belongings is definitely the bottom in over a 12 months. From the chart, it’s seen that on these cash solely Bitcoin (highlighted in inexperienced) and Ethereum (coloured in blue) nonetheless have considerable volumes.

The worth of the indicator for the altcoin market has all the time been fairly low in comparison with Bitcoin and Ethereum, however not too long ago the buying and selling volumes have actually dried up.

Naturally, the present low volumes of main belongings may counsel that there is not a lot curiosity left in cryptocurrency buying and selling among the many basic investor.

Sometimes, a robust value transfer, akin to a rally or a crash, attracts numerous customers to the market, as these actions are often thrilling for them. Such strikes are additionally solely sustainable if they’ll proceed to attract consideration to cryptocurrency, as numerous merchants are wanted to gasoline strikes like this.

Nevertheless, actions that fail to draw significant consideration ultimately fade away. Because of this, the most recent low volumes could also be a worrying signal for the sustainability of the value rally for Bitcoin and different belongings.

BTC value

As of this writing, Bitcoin is buying and selling round $27,300, up 1% up to now week.

Seems to be like BTC has been transferring sideways | Supply: BTCUSD on TradingView

Featured picture of Kanchanara from Unsplash.com, charts from TradingView.com, Santiment.web