The week forward once more incorporates necessary financial information and occasions for the Bitcoin and crypto market that merchants ought to observe. Bitcoin hit a brand new yearly excessive of $28,921 final week earlier than US Federal Reserve (Fed) Chairman Jerome Powell erased the rally along with his hawkish feedback on the FOMC press convention.

This week, along with some key financial information, the US banking system will as soon as once more be the focus. The banking sector in the US and likewise in Europe (after the bailout of Credit score Suisse) stays underneath stress.

The Fed reported final week that US banks raised $475 billion following the banking disaster. Within the two weeks for the reason that collapse of the SVB, greater than $500 billion has additionally been withdrawn from smaller banks.

Small regional US banks specifically proceed to endure, whereas giant banks are rising from the banking disaster. Almost 200 banks are nonetheless grappling with the identical points as Silicon Valley Financial institution (SVB), in line with the Wall Avenue Journal.

Within the second week of March, deposits at smaller banks fell by $119 billion

Deposits at main banks elevated by $67 billion in the identical week pic.twitter.com/NKxR5p9xsD

— Genevieve Roch-Decter, CFA (@GRDecter) March 26, 2023

Within the meantime, there may be nonetheless no resolution. Final week, Treasury Secretary Yellen stated the US was contemplating supporting all deposits. A day later, she backtracked on her assertion and stated the federal government was not planning to take action.

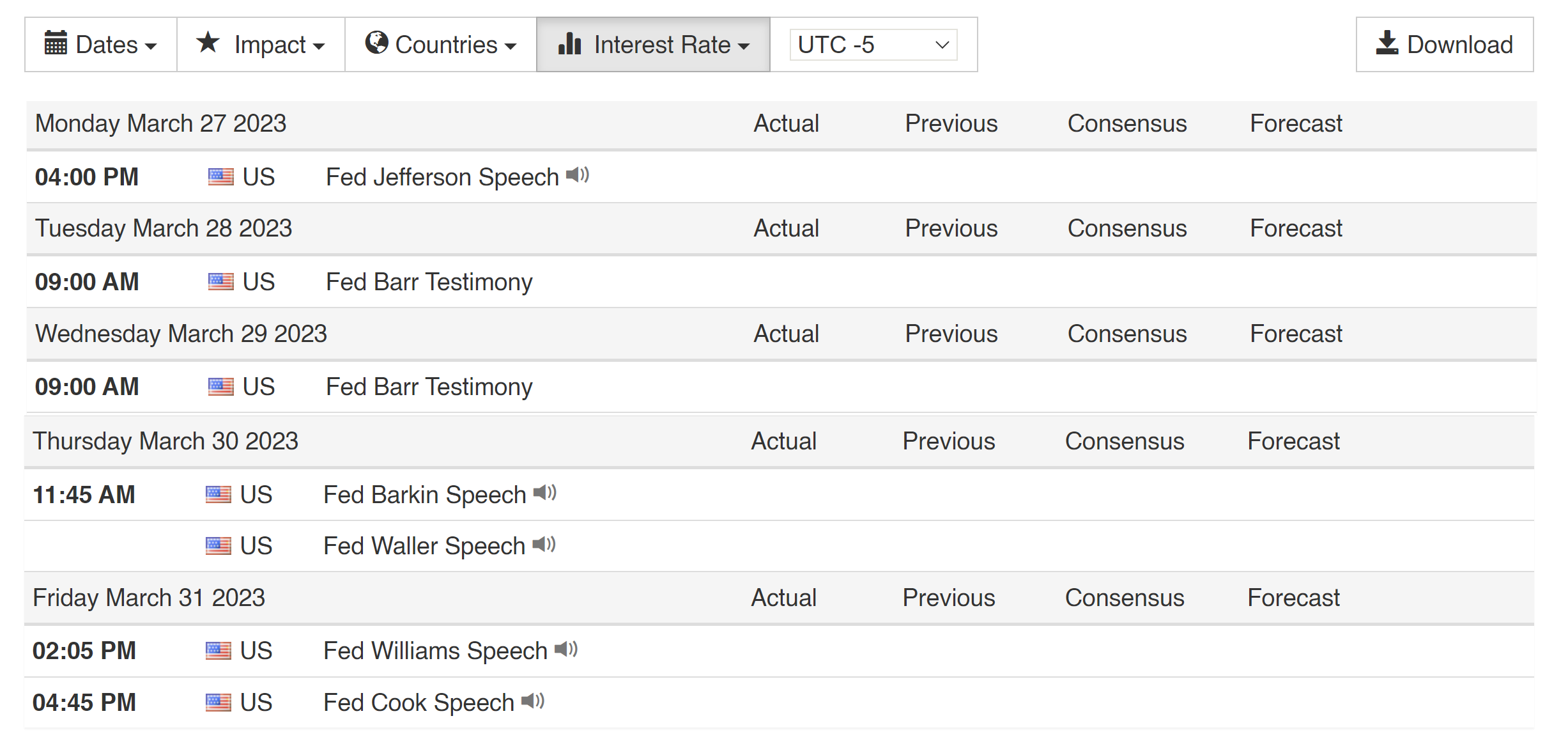

With that in thoughts, the numerous speeches by Fed officers this week could possibly be fascinating and must be watched by merchants. Explicit consideration must be paid to the US Senate Banking Committee listening to on the Silicon Valley banking collapse with the FDIC’s Gruenberg, Vice Chairman of Oversight Michael S. Barr and division officers of the Treasury on Tuesday, March 28.

Financial information that might displace Bitcoin and Crypto

On Tuesday, March 28, The Convention Board (CB) will launch U.S. client confidence numbers for March at 10:00 a.m. EST. The studying got here in at 102.9 in February, effectively beneath expectations of 108.5 and down for the second straight month.

For March, market consultants anticipate an additional decline to 101.0. If the forecast is exceeded, the US Greenback Index (DXY) is prone to proceed its upward motion from the earlier week and will act as a headwind for Bitcoin. A potential decline of a good better magnitude, however, is prone to weaken the DXY and favor the crypto.

On Thursday, March 30, 2023, the ultimate U.S. Gross Home Product (GDP) determine for the fourth quarter of 2022 can be launched at 8:30 a.m. EST. Projections are for financial progress of two.7%.

If the determine is confirmed and even higher, it might sign the resilience of the US financial system and ease considerations a few recession. The response from conventional monetary markets and the Bitcoin market must be constructive.

On Friday, March 31 at 8:30 a.m. EST, the Bureau of Financial Evaluation will current the PCE base fee for the US for the month of February. This information level must be crucial of the entire week, as it’s Jerome Powell’s favourite inflation gauge.

The forecast is for a month-over-month enhance of +0.4%, similar because the earlier month. Final month, the PCE worth index had already exceeded market expectations at +0.6%. In consequence, there was a bearish motion within the monetary markets. Nevertheless, if the underlying inflation fee has elevated much less, the value of Bitcoin is prone to rise in response.

At press time, Bitcoin worth was $27,774.

Featured picture from iStock, chart from TradingView.com