The Bitcoin and crypto market is dealing with a short-term “bullish vacuum”. Within the wake of inflation figures (CPI and PPI) considerably beneath expectations and the extremely anticipated pivot from the Federal Reserve in the US, the worth of Bitcoin was in a position to proceed its upward pattern of the previous few weeks and reached a brand new excessive. annual $30,968 final Friday.

After the previous few weeks have at all times been full of vital macro information, there are hardly any key information factors within the subsequent two weeks. This can solely change on Might 3, when the US Federal Reserve’s subsequent Federal Open Market Committee (FOMC) is scheduled.

Thus, there’s a bullish vacuum till early Might, wherein it appears probably that the broader crypto and Bitcoin market will proceed their rally. Nonetheless, there are a number of occasions which might be prone to affect the market this week as nicely. As we do each week on Mondays, we take a look at a very powerful dates.

This can be essential for Bitcoin and Crypto

On Tuesday, April 18, all eyes can be on Washington DC when U.S. Securities and Trade Fee (SEC) Chairman Gary Gensler should justify his regulation of the U.S. bitcoin and crypto business. As reported, Monetary Providers Committee Chairman Patrick McHenry scheduled the listening to.

McHenry needs to look at Gensler’s actions in opposition to the US crypto business. In an interview he mentioned:

This can be our first Securities and Trade Fee oversight listening to. This can be about its regulation and method to digital belongings. It should train broad basic oversight over the SEC. By way of coverage, (it is going to be) a critical method in relation to establishing (…) a regulatory sphere for digital belongings.

Gensler is prone to face intense scrutiny. French Hill (Republican) and Warren Davidson (Republican) are two crypto proponents who chair the Digital Belongings Subcommittee. Davidson is one in all Gensler’s greatest critics and just lately posted a tweet calling for “Fireplace Gary” to turn into a bipartisan motion.

On Thursday, April 20 at 8:30 a.m. (EST), weekly information on preliminary claims for unemployment insurance coverage in the US are due. Final week’s figures have been once more nicely above expectations. This week, 240,000 are screened, up from 239,000 final week.

The sluggish slowdown within the US labor market has already manifested itself with a a lot weaker than anticipated JOLTS jobs report in addition to weak NFP labor market information over the previous few weeks. If the newest figures on the primary jobless claims affirm this pattern, it could be a further alarm sign of a recession in the US.

If the labor market stabilizes once more and unemployment claims cease rising in the intervening time, that may be optimistic for the crypto market. The looming recession may at the least be pushed again a bit or show much less extreme due to a nonetheless resilient labor market.

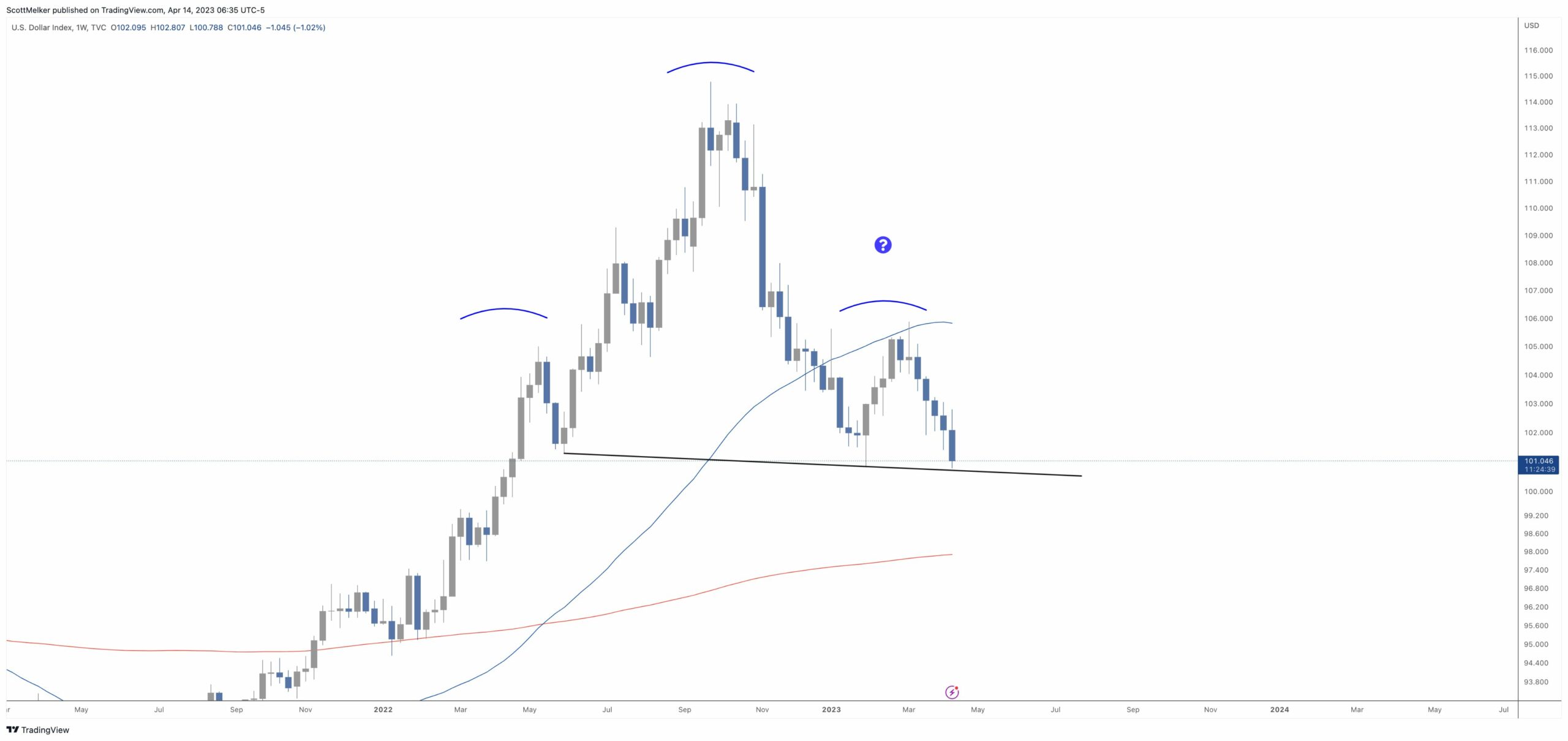

Third, buyers also needs to keep watch over the Greenback Index (DXY). The DXY is at a crucial level and will assist a brand new uptrend in Bitcoin and crypto if it continues to say no. Analyst Scott Melker just lately shared the chart beneath and declared:

2 months later, the proper shoulder has fashioned and the neckline is being examined. Nonetheless only a guess, but when that black line breaks it could affirm and we should always see sustained greenback weak point.

As of press time, Bitcoin value stands at $29,899.

Featured picture from iStock, chart from TradingView.com