What’s the sentiment of the crypto market at the moment and the way are essentially the most high-profile crypto property trending: Bitcoin and Ethereum?

You will discover all the small print about it under.

Bitcoin and Ethereum Pattern In the present day: Bull Market?

Based mostly on the newest knowledge, we see that an on-chain metric reveals bull market alerts even supposing Bitcoin costs are falling proper now. Particularly, the RHODL on-chain indicator is in an analogous place at the beginning of the final two main Bitcoin bull markets.

As well as, the indicator, which was created by Philip Swift in 2020, makes use of a ratio of HODL waves of realized worth. Yesterday Swift mentioned that when he created the indicator, one factor that struck him was the way it confirmed the formation of a brand new uptrend.

The analyst added that this was when the worth of the newest coin ratio began to rise. Lastly, Swift mentioned:

“That is the place we’re proper now. Do not panic about small value pullbacks. Zoom out.”

As for the efficiency of Ethereum, it may be seen that its value has been on the rise for the reason that starting of 2023. The digital asset is presently buying and selling at $1,813.68a 51% enhance from its value at the beginning of the yr.

Nevertheless, one wonders if with the bear market across the nook, ETH will be capable to cross the $4,000 threshold. It is very important point out that $4000 is used as a benchmark as a result of Ethereum was in a position to attain such highs over the past bull run.

Actually, the cryptocurrency hit an all-time excessive value of $4,891.70 in November 2021. Nevertheless, lower than a yr later, Ethereum was hit exhausting by the cryptocurrency winter.

In any case, as the worth of ETH has been recovering strongly for the reason that begin of 2023, specialists consider that when the market totally recovers, Ethereum will hit the $4,000 mark and even proceed to beat its earlier ATH.

Zoom on Bitcoin (BTC) value: will it come again to $24,000?

Relating to the development and the worth of Bitcoin, we see that it got here out of the buildup zone on the finish of February, which may sign the emergence of a new space of hypothesis.

Moreover, Bitcoin broke via a number of long-term on-chain indicators in latest months and remained above them. Particularly, it broke via the 200-week shifting common in mid-March and nonetheless sits above, suggesting a long-term development change.

The 200wma is presently at $25,818, in accordance with knowledge from Woo Charts. Furthermore, the realized value of Bitcoin is barely $19,914. That is the worth of all BTC in circulation on the value they final moved.

Nevertheless, Bitcoin market sentiment is presently impartial because the cryptocurrency correction continues. BTC’s Worry and Greed Index has fallen to 50 as bulls and bears battle for supremacy.

The identical index hit an area excessive of 69 final month when BTC rose above $30,000 for the primary time in virtually a yr. Subsequently, BTC costs are presently consolidating across the $27,000 vary.

Because of this the quintessential crypto hasn’t moved a lot for the reason that weekend, however has misplaced 5.3% over the previous two weeks. Furthermore, the asset has misplaced 12% since its 2023 excessive in mid-April. Analysts have instructed he may return to $24,000 throughout this correction, the shopping for stress appeared to have evaporated.

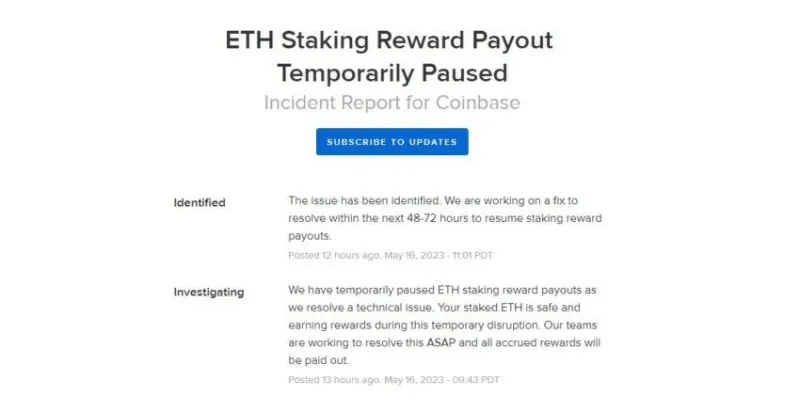

Ethereum Trending In the present day: Coinbase Suspends ETH Staking Rewards

Crypto trade Coinbase has briefly suspended reward funds for its ETH Staking service as a consequence of a technical complication, including that it’s going to take three days to resolve the problem.

Nevertheless, the trade assured customers that it’s nonetheless accumulating rewards and can problem their payout as soon as the problem is resolved, which is predicted throughout the subsequent 48-72 hours.

As we all know, Ethereum staking is in excessive demand and well-known, akin to Coinbase, and others, permits customers to deposit their ETH and earn staking rewards, the speed of which is presently 6%.

The benefit of Coinbase’s Ethereum staking service, which has led to its rising recognition, is the truth that it doesn’t require a minimal of 32 ETH to start staking.

It must also be famous that the discontinuation of the staking service has nothing to do with the USA Securities and Change Fee (SEC) actions towards ETH staking, in contrast to what occurred to Kraken.

In any case, ETH rewards have been blocked on Coinbase final week as a result of its techniques didn’t assist ETH addresses from exterior validators. The crypto neighborhood has taken to social media for clarification on this, with numerous withdrawals caught within the queue.

Coinabse additionally launched the Coinbase Wrapped Staked ETH utility token (cbETH), which is a 1:1 illustration of ETH in stakes. This token permits holders to make use of it as collateral within the DeFi market.

Lastly, we see that Coinbase additionally sees a enhance in ETH inflows as a consequence of elevated staking rewards. That is primarily as a consequence of memecoins taking on the Ethereum community, akin to PEPE, which has clogged the community and pushed up fuel costs.