Bitcoin broke above the $30,000 mark as on-chain knowledge exhibits whales making vital outflows over the previous day.

Bitcoin Whales Made Main Buying and selling Flows At present

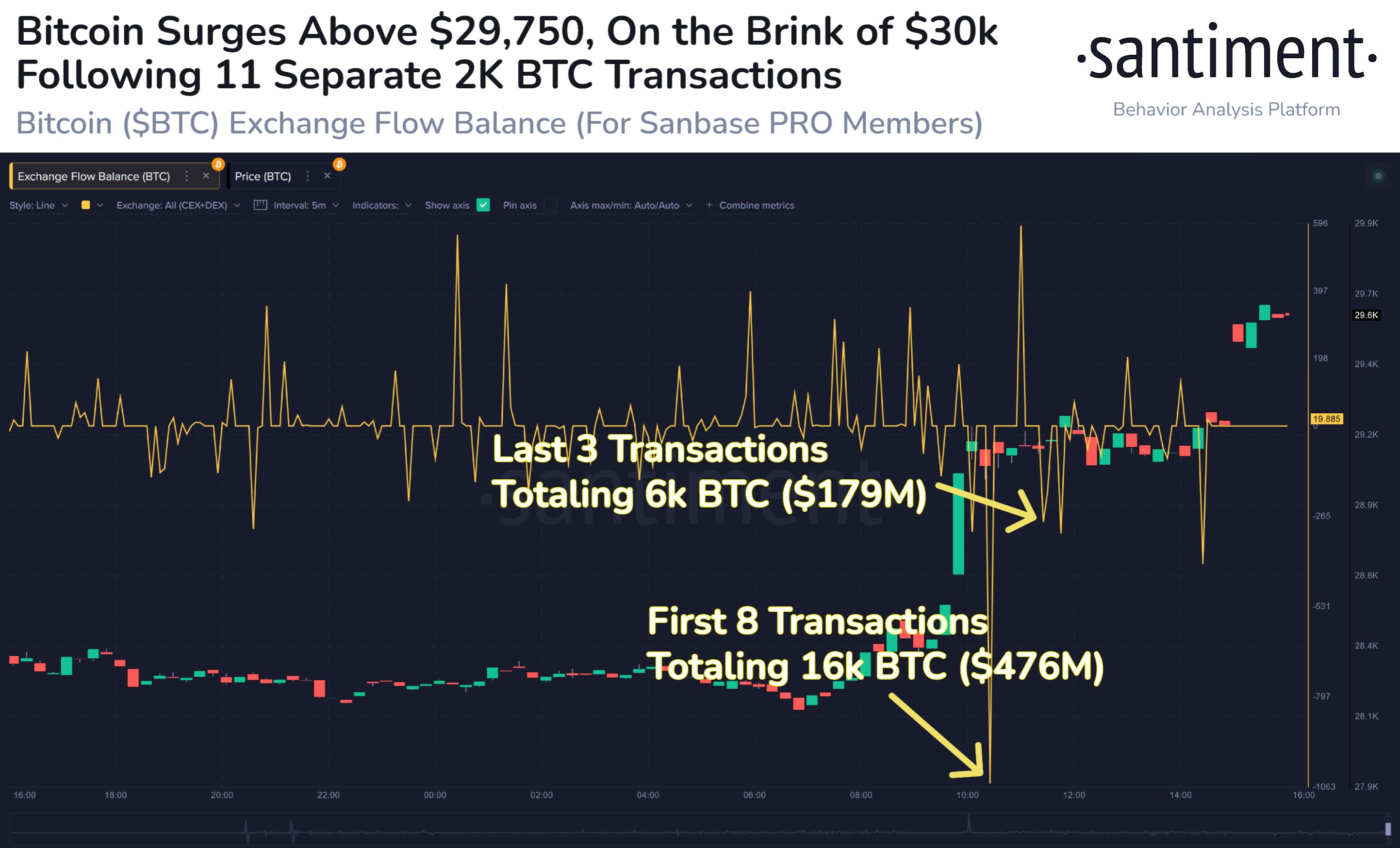

In line with knowledge from the on-chain analytics firm Saniment, 11 main BTC outflows had been made out of exchanges as we speak. The related indicator right here is the “trade move stability”, which measures the online quantity of Bitcoin getting into or leaving the wallets of all centralized exchanges.

When the worth of this metric is constructive, it signifies that a web variety of cash are at the moment being transferred on these platforms. As one of many major causes buyers might use trades is for promoting functions, the sort of development can have bearish implications for value.

Alternatively, unfavourable values of the indicator recommend that holders are at the moment withdrawing some cryptocurrency from exchanges. Such a development could also be an indication of accumulation on the a part of buyers.

Now, here’s a graph that exhibits the development of the Bitcoin trade move stability during the last day or so:

Appears just like the metric has seen some extremely unfavourable values not too long ago | Supply: Santiment on Twitter

As proven within the chart above, Bitcoin’s trade move stability has seen vital unfavourable spikes over the previous day. The most important of those spikes got here from eight transactions of two,000 BTC every that came about concurrently.

Three extra simultaneous transfers of two,000 BTC every came about an hour after this batch of eight transactions. Which means that a complete of twenty-two,000 BTC (price round $661 million at the moment) left exchanges with these exits.

These extraordinarily massive sudden releases could be a signal of huge purchases from whales. Moreover, the timing might recommend that this shopping for strain might be behind the sharp bullish transfer the cryptocurrency has seen as we speak, during which it has now crossed the $30,000 mark for the primary time. since June 2022.

Bitcoin commerce quantity knowledge can also be displaying excessive ranges, which can recommend that this value motion could also be sustainable in the meanwhile.

The indicator has sharply surged in the course of the previous day | Supply: Santiment

The graph above additionally shows knowledge for “energetic addresses”, a metric that measures the every day variety of distinctive addresses that take part in sure transaction exercise on the Bitcoin blockchain.

Plainly this metric has not proven vital spikes over the previous day, regardless of the sturdy value enhance. This can be additional proof that the worth spike is as a result of massive actions a small variety of whales made as we speak.

Excessive participation from the typical investor has all the time accompanied long-term value actions, so whereas buying and selling quantity could also be adequate to gasoline the surge for now, it’s not sure that the motion can proceed. if the energetic addresses proceed to stay low.

BTC value

As of this writing, Bitcoin is buying and selling round $30,000, up 6% up to now week.

BTC has shot up over the previous few hours | Supply: BTCUSD on TradingView

Featured picture by Thomas Lipke from Unsplash.com, charts from TradingView.com, Santiment.web