- Bitcoin may be very near the 20 -day EMA which quantities to $ 97,141.

- Bitcoin is at present in a bullish part of the cycle and will quickly go as much as a brand new ATH.

- If BTC recovers the 20 -day EMA and leaves the higher BB, $ 100,000 are seemingly.

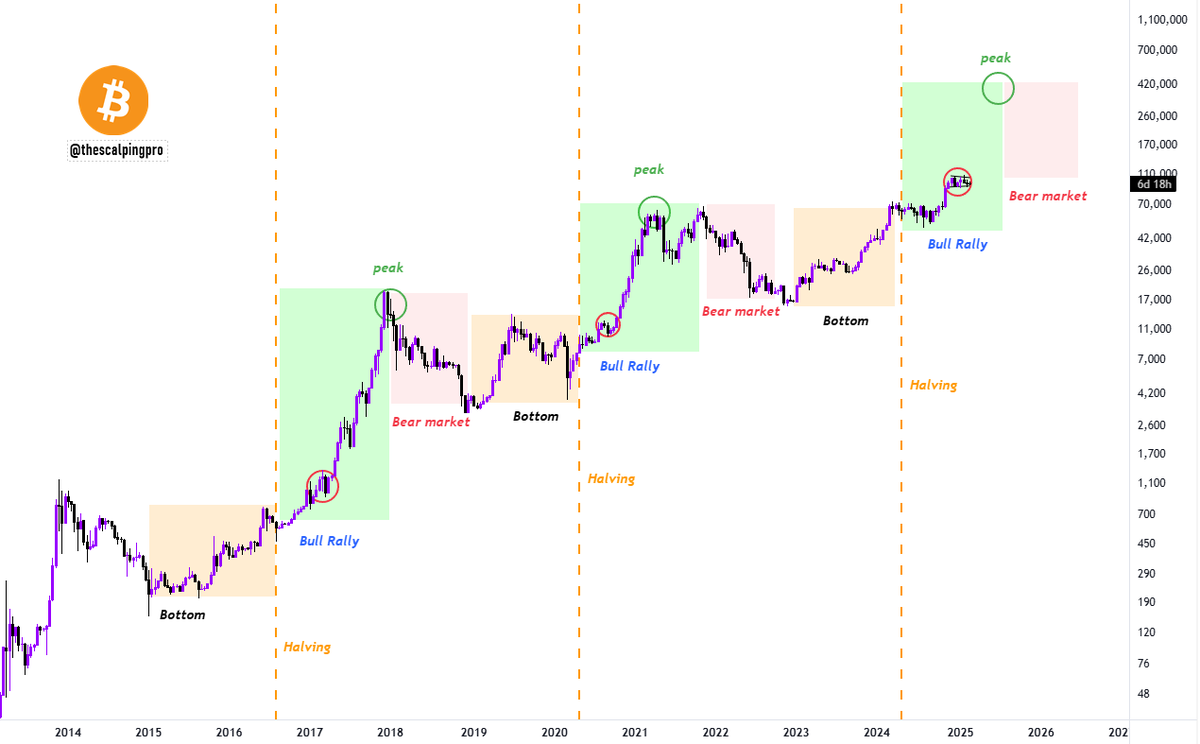

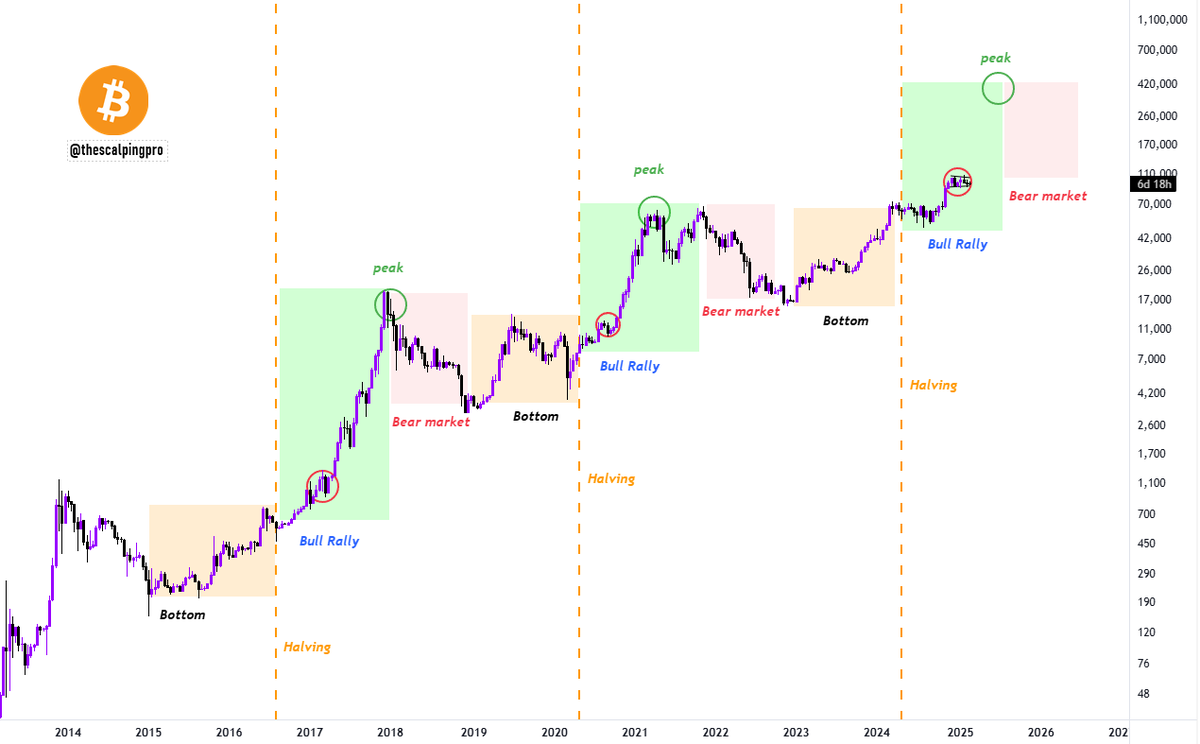

Bitcoin (BTC) is once more at a turning level. The final graph shared by “Mags” on the X platform takes a have a look at the long-term cycle of Digital Asset and at its subsequent doable part. The zero graph within the cyclic nature of Bitcoin, specifically its value strikes round occasions in half.

In keeping with a Magazine put up, Bitcoin usually follows a reasonably predictable mannequin. It begins with the occasion in half, then a robust rally, hitting a peak earlier than a decrease market takes over.

Lastly, as soon as the cryptocurrency hit the underside of the rocks on the bear market, it turns into up with the following occasion in half.

Half occasions: gas cyclical bitcoin gatherings

This cycle happened a number of instances up to now, and evidently BTC is within the Taurus rally part after the discount by half of 2024. Traditionally, every downstream within the provide, typically resulting in a Large gathering earlier than costs peak, adopted by a decrease market.

Wanting on the “Mags” graphic, BTC approaches a part much like the earlier bull races, pointing in the direction of a possible value wave.

In relation: Feeling of adverse crypto: Bitcoin booster?

If historical past is repeated, Bitcoin may goal a brand new prime of all time (ATH) earlier than the following bear market.

At the moment, BTC is negotiated about $ 95,600, down virtually 1% within the final day and 12.5% in comparison with its $ 109,000.

Bitcoin value evaluation: key ranges to watch

You will need to notice that the speedy resistance of Bitcoin is across the 20 -day exponential cell common, at present at $ 97,141. If BTC can return above this degree and ensure it as assist, traders may see the market chief climb over $ 100,000 quickly.

The graphic offered by TradingView exhibits that the Bitcoin value path is at present close to the center of Bollinger strips. The higher BB is at $ 98,090 and the decrease BB is $ 95,152.

Apparently, the worth stability close to the middleman strip suggests a doable escape in each instructions. The higher BB acts as resistance, whereas the decrease BB acts as a assist.

The relative resistance index (RSI) is at present at 43.29, which implies that BTC is neither onbough nor prevalence. If the RSI rises above 50.

In relation: Ethereum, buying and selling of the Bitcoin vary, may benefit, say analysts

This might level out a stronger bullish momentum. Nevertheless, if it drops under 40, BTC may endure a brief -term value drop.

Non-liability clause: The knowledge introduced on this article is just for informational and academic functions. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be liable for the losses suffered on account of the usage of the content material, services or products talked about. Readers are suggested to be cautious earlier than taking motion -related measures.