- Bitcoin will print its remaining ATH of this cycle in This autumn 2025.

- Analyst Ignas stated the bull cycle is much from over for BTC.

- Trump being president may result in a “MEGA CRAZY bull run.”

Bitcoin (BTC) hit an all-time excessive of $93,434.36 on Thursday earlier than sliding 1.42% and falling beneath $90,000. Regardless of the setback, crypto analyst Ignas predicts that BTC will attain a brand new all-time excessive in This autumn 2025, persevering with its established market cycles.

In line with an article by Ignas on Talking about market worth predictions, Ignas stated: “BTC goes up, ETH, SOL and different giant caps observe, after which the whole lot else (in all probability most memecoins) goes up. »

Moreover, the analyst highlighted the potential for a “MEGA CRAZY bull run” within the crypto market after pro-crypto candidate Donald Trump received the 2024 US presidential elections. Trump's promise of a Cryptocurrency-friendly regulation may act as a catalyst to extend the adoption of cryptocurrencies, thereby boosting the market.

Additionally learn: A steady $181 billion coin market to put the muse for a $100,000 Bitcoin?

In his article, Ignas highlighted that Bitcoin has overcome bearish challenges together with Grayscale ETF outflows, Mt. Gox dumping on FUD, and uncertainty surrounding the US elections. These headwinds, mixed with world rate of interest cuts, have paved the best way for a promising bull run.

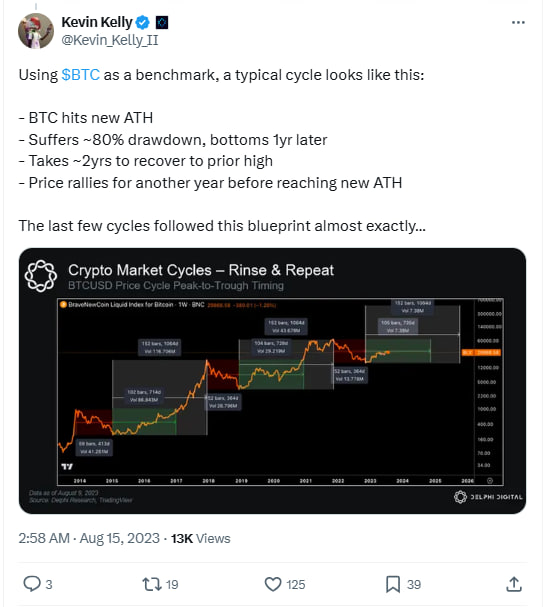

Ignas predicted that BTC would expertise a year-long rally, throughout which the coin's worth and better highs would rise, adopted by a correction section, throughout which costs would decline till they reached attain the bottom.

Bitcoin worth jumped after Trump's victory

The value of Bitcoin reacted positively to Trump's election victory, rising by virtually 9% on November 6, adopted by a 4.82% enhance on November 10. Later, on November 11, the main digital asset soared 10.30%, surpassing $93,000 on November 13.

In line with knowledge from CoinMarketCap, Bitcoin has gained 16.25% over the previous week, adopted by an amazing 31.90% rise over the previous 30 days. The relative power index (RSI) stands at 75, which means the digital asset is overbought. Demand for BTC can be extraordinarily excessive as investor sentiment stays optimistic.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version just isn’t answerable for any losses ensuing from using the content material, services or products talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.