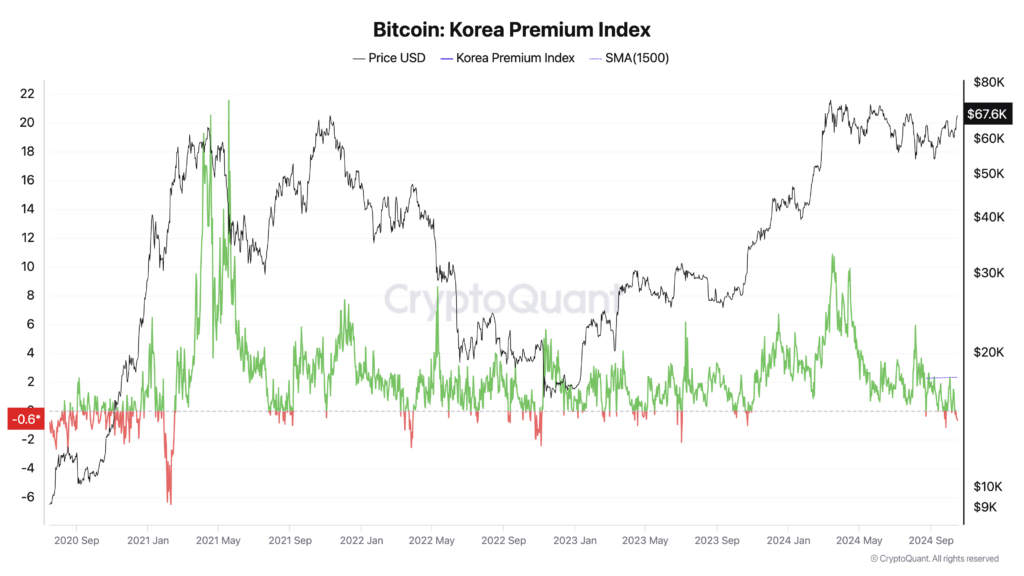

Bitcoin is buying and selling at a reduction on South Korean exchanges, reversing the standard “kimchi premium” that has traditionally signaled bullish market sentiment. By Korean climatethe cryptocurrency's worth is round 700,000 received ($511.73) decrease domestically than on world exchanges, leading to a detrimental premium (low cost) of -0.74% as of Thursday afternoon.

This modification appears to counsel a bearish outlook amongst South Korean buyers. Sometimes, the next kimchi premium signifies robust native demand and constructive sentiment, typically resulting in Bitcoin costs above world charges. In distinction, a decrease or detrimental premium displays weakening enthusiasm and decreased shopping for strain, doubtlessly signaling a market correction or alignment with world valuations.

Analysts attribute the weird hole to subdued investor sentiment in South Korea and elevated demand for digital property on abroad platforms. KP Jang, director of Xangle Analysis, informed The Korea Instances that the restrictions stop overseas and institutional buyers from accessing home exchanges, amplifying the impression of falling demand from retail buyers.

A shift in merchants’ preferences in direction of altcoins can be influencing the market. As Bitcoin rose globally, Korean merchants started accumulating undervalued different cryptocurrencies, anticipating a robust rally within the fourth quarter, as reported within the report. Enterprise Insider. These altcoins, together with Tao, Sei Community, Aptos, Sui, NEAR Protocol and The Graph, are seen as providing greater returns, doubtlessly drawing consideration away from Bitcoin.

Declan Kim, analysis analyst at DeSpread, additionally informed The Korea Instances that the altcoin market, which accounts for a good portion of home buying and selling, continues to battle amid the transition phases of latest rules. The implementation of the Digital Asset Consumer Safety Regulation impacts market forces. Many altcoins should not listed on home exchanges in comparison with overseas exchanges, and the market-making ban makes it tough to make sure liquidity.

The kimchi bounty has all the time been a function of the crypto market in South Korea. When Bitcoin surpassed the 100 million received mark domestically in March, the premium briefly climbed to 10%. A better premium typically signifies robust native demand and bullish sentiment, typically coinciding with or previous Bitcoin worth will increase. Conversely, a decrease or detrimental premium suggests bearish sentiment and decreased shopping for strain.

The info signifies a notable decline in Bitcoin-Korean Gained (BTC/KRW) buying and selling quantity over the previous 40 days, reflecting a shift in investor focus.

Analysts anticipate the reverse kimchi premium to be non permanent. Jang predicts the hole will shut quickly, as these premiums have hardly ever endured for lengthy durations of time. He talked about that ongoing discussions on laws permitting company investments in digital property might enhance liquidity on home inventory exchanges and regularly slender the value hole with overseas markets.

Present buying and selling situations mirror a fancy interaction between home rules, investor behaviors, and world market tendencies, signaling vital adjustments in South Korea's crypto panorama. The detrimental kimchi premium, whereas uncommon, might finally result in a extra balanced and mature market because it extra intently aligns with world digital asset valuations.

The final time the Kimchi premium fell detrimental was in October 2023, simply earlier than the Bitcoin ETF-fueled bull run.