Though Bitcoin is commonly thought of a hedge in opposition to inflation, it has a constructive inflation price of 0.83%. Bitcoin inflation is extraordinarily low in comparison with the greenback's peak of 9.1% in 2022. Nonetheless, once we examine the cumulative inflation price of Bitcoin and the US greenback, we see the true energy of Bitcoin's position in preservation of wealth.

From 2020 to 2025, Bitcoin rose roughly 960%, whereas the US Greenback Index (DXY), which measures the US greenback in opposition to a basket of different currencies, rose solely 12%. in nominal phrases.

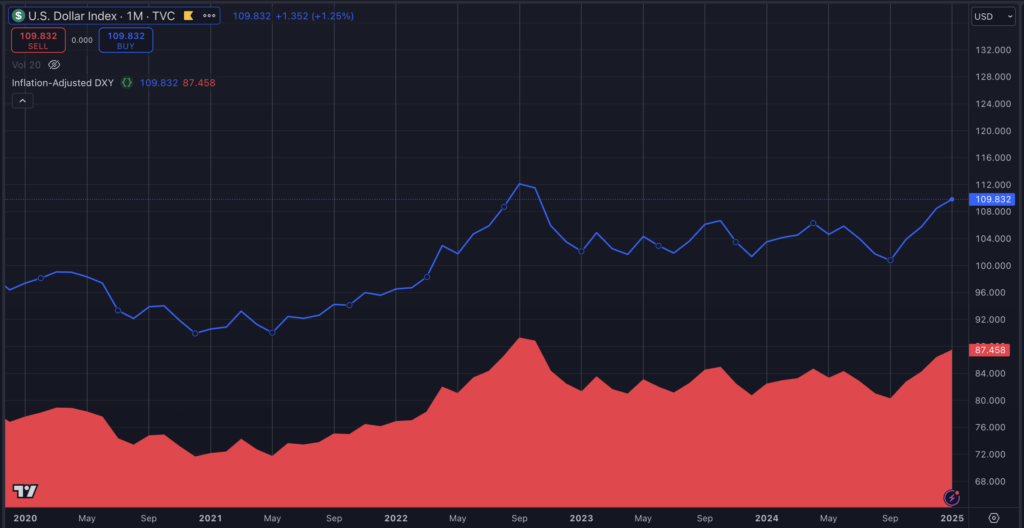

Bitcoin's inflation-adjusted value and the inflation-normalized DXY present important insights into the dynamics of the actual worth of each property. Whereas the nominal DXY displays the relative energy of the forex, its inflation-adjusted worth highlights the continued erosion of buying energy.

The nominal DXY presently stands at 109.8, reflecting world demand for the greenback amid macroeconomic uncertainty. Nonetheless, when adjusted for cumulative inflation in the USA since 2020 – averaging above 2% per yr and peaking above 8% in 2022 – the actual worth of the DXY falls to 87.5. This represents a distinction of twenty-two.3 factors, or roughly 20.3% of nominal worth, illustrating the greenback's substantial lack of buying energy over time regardless of its relative energy in comparison with different currencies.

The nominal value of Bitcoin, then again, is round $91,000. Adjusted for low provide inflation – 1.74% per yr from 2020 to 2024 and 0.83% in 2025 – its inflation-adjusted value involves about $84,365. The $6,635 distinction represents solely 7.3% of its face worth, highlighting Bitcoin's relative stability and talent to protect its buying energy over time in comparison with fiat currencies. This extra modest adjustment highlights Bitcoin's scheduled shortage and low inflation as key components in its resilience.

The divergence between inflation-adjusted metrics for DXY and Bitcoin emphasizes a broader narrative. As fiat currencies just like the greenback face vital devaluation as a consequence of inflation, Bitcoin's managed provide forces place it as a hedge in opposition to forex depreciation. The extra pronounced inflationary impression on the DXY highlights the problem of sustaining buying energy in a fiat system, significantly in periods of excessive inflation.

The distinction between nominal and inflation-adjusted measures is vital to assessing the long-term worth of property. DXY's nominal energy masks the elemental erosion of the greenback's buying energy, whereas Bitcoin's inflation-adjusted value displays its capability to keep up its worth over time. This info reinforces the significance of inflation-adjusted analyzes in creating efficient methods for navigating the macroeconomic panorama.

Moreover, inflation within the comparator currencies used to ascertain the DXY should even be taken into consideration to determine the exact divergence. Nonetheless, the figures above give a tough evaluation of Bitcoin's elevated energy in opposition to the greenback past nominal phrases.

Merely put, should you invested $100 in Bitcoin in 2020 and $100 in DXY immediately, your BTC would have a buying energy of $927, whereas your DXY could be value $91 in actual phrases.