Bitcoin value recorded one other optimistic efficiency over the previous seven days, seeking to finish the month and begin October on even stronger footing. Persevering with its resurgence over the previous few weeks, the highest cryptocurrency surged as excessive as $66,000 on Friday, September 27.

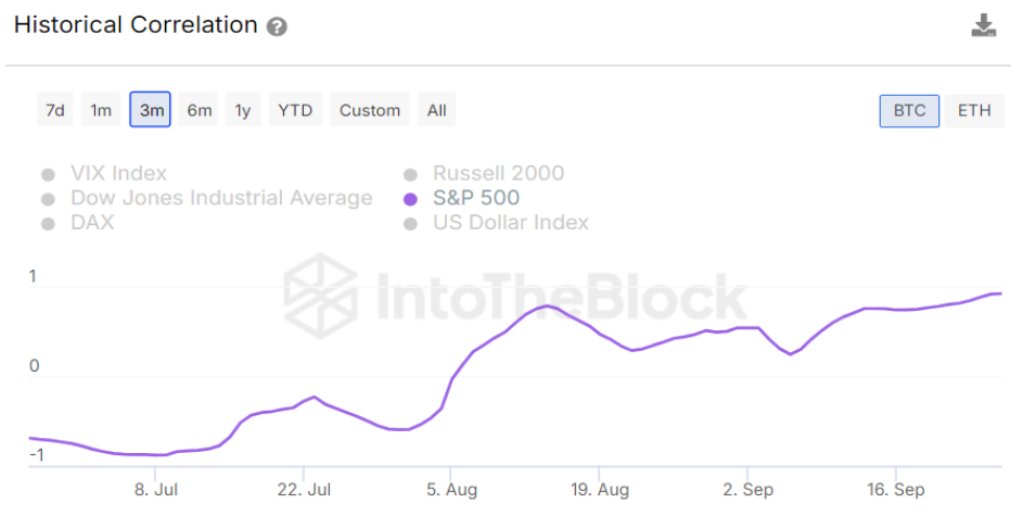

Current knowledge reveals there could also be a rising correlation between the efficiency of the US inventory market and the worth of the world's largest cryptocurrency. The query right here is: how may this affect investor habits?

How Did Bitcoin and S&P 500 Carry out in September?

In a current article on Platform years. For readability, the S&P 500 Index tracks the efficiency of 500 of the biggest publicly traded corporations in america.

The value of Bitcoin recorded a surprisingly optimistic efficiency in September, a traditionally bearish month for the flagship cryptocurrency. In accordance with knowledge from CoinGecko, the worth of BTC has elevated by greater than 11% over the previous month.

Supply: IntoTheBlock/X

On the similar time, the S&P 500 index noticed a fast and powerful restoration, reaching a brand new all-time excessive after an preliminary decline earlier this month. Knowledge from TradingView reveals the index is up nearly 4% in September.

The connection between the inventory market and the cryptocurrency market has at all times been intriguing, as buyers search to make the most of alternatives supplied by both market. Nevertheless, a excessive correlation between these two asset lessons is believed to scale back the diversification alternatives they provide to buyers.

On the time of writing, the Bitcoin value stands at round $66,024, reflecting a rise of simply 1.1% over the previous 24 hours. In the meantime, the S&P 500 index continues to hover round 5.8K, up 0.4% over the previous day.

World liquidity will increase by $1.426 trillion in a single week

Well-liked crypto skilled Ali Martinez took to Platform X to share that there was a notable improve within the quantity of capital in international monetary markets. Knowledge supplied by Martinez reveals that international liquidity jumped by $1.426 trillion final week.

World liquidity jumped by $1.426 billion this week, reaching $131.6 trillion. #Bitcoin and different dangerous property are rising, though this improve in liquidity may final till October. pic.twitter.com/PtFDjkR7wU

– Ali (@ali_charts) September 27, 2024

Bitcoin and different dangerous property have been the primary beneficiaries of the rise in international liquidity, as their worth has elevated as a result of elevated influx of capital. Martinez additionally famous that this liquidity increase may lengthen into October.

The value of BTC breaks above $66,000 on the every day timeframe | Supply: BTCUSDT chart from TradingView

Featured picture from iStock, chart from TradingView