On-chain information exhibits that lively Bitcoin addresses have risen above ranges seen in November 2021, suggesting demand for BTC is rising.

Lively Bitcoin addresses have just lately seen regular development

As one analyst identified in an article on CryptoQuant, there have been fears in February that the metric didn’t present any vital development. “Lively addresses” is an indicator that measures the every day whole variety of Bitcoin addresses collaborating in sure transaction exercise on the blockchain.

Naturally, this metric considers each senders and receivers on this measurement. It additionally solely contains distinctive addresses, which implies that all addresses with repeated transactions are counted solely as soon as. For that reason, the metric may give an thought of the variety of customers utilizing the blockchain each day.

When the worth of this indicator is excessive, it implies that many addresses are presently transferring on the community. Such a development means that blockchain is presently seeing heavy utilization.

Then again, low values suggest that the community exercise is low. This development might point out that common curiosity in cryptocurrency is low amongst traders.

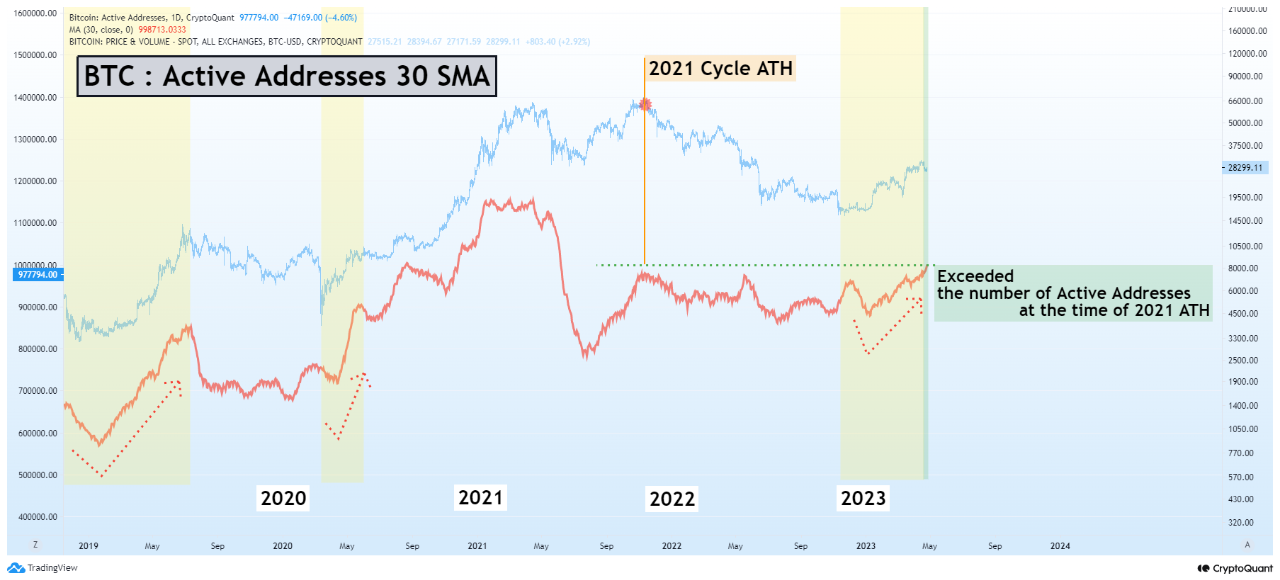

Now, here’s a chart that exhibits the development of the 30-day easy transferring common (SMA) of lively Bitcoin addresses over the previous few years:

Appears to be like just like the 30-day SMA worth of the metric has been observing an uptrend in current months | Supply: CryptoQuant

Because the chart above exhibits, the Bitcoin 30-day SMA lively addresses metric had largely moved sideways through the 2022 bear market. infinite often related to such boring occasions, so just a few contributors on the blockchain.

Nonetheless, extremely risky occasions like crashes see many customers grow to be lively. They rush to promote their cash to chop their losses or attempt to catch the underside. An instance of this occasion might be seen within the chart through the November 2022 FTX collapse.

The same impact is usually seen with rallies, however the value spike that started this 12 months initially noticed weak development in lively addresses. This raised considerations concerning the sustainability of the rally, as all extended value actions have traditionally required giant quantities of every day site visitors to proceed.

Not too long ago, nonetheless, it has grow to be clear that the indicator has seen regular and gradual development, suggesting that buying and selling curiosity within the asset is slowly however certainly rising.

Not too long ago, the Bitcoin 30-day SMA lively tackle metric has surpassed the degrees seen through the peak value of November 2021, exhibiting that there’s now vital demand for the cryptocurrency available in the market.

BTC value

As of this writing, Bitcoin is buying and selling round $29,700, up 1% up to now week.

BTC has sharply surged | Supply: BTCUSD on TradingView

Featured Picture by Aleksi Räisä on Unsplash.com, Charts by TradingView.com, CryptoQuant.com