On-chain knowledge from Glassnode reveals that current volatility has not been sufficient to maneuver Bitcoin’s “diamond palms”.

Lengthy-term Bitcoin holders proceed to extend their holdings

Based on knowledge from the on-chain analytics firm glass knot, HODLing remained the primary dynamic amongst long-term incumbents. The “Lengthy-Time period Holder” (LTH) group is a Bitcoin cohort that features all traders who’ve held their cash for a minimum of 155 days.

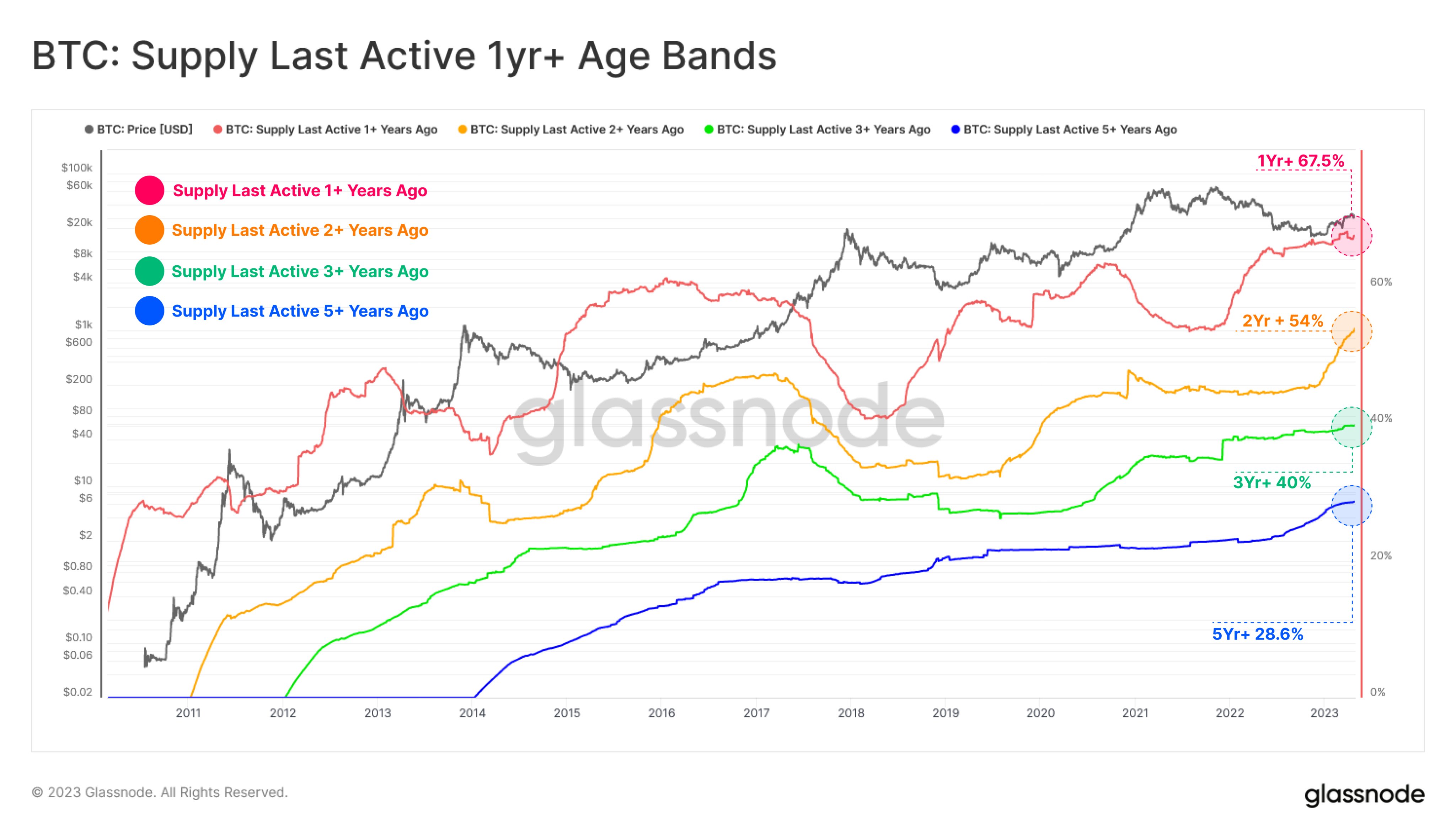

An indicator referred to as “Provide Final Lively Age Bands” can break down the overall quantity of provide every “age band” available in the market at the moment holds. Cash are divided into these age brackets primarily based on the overall time they’ve been idle on the blockchain.

Utilizing this metric, one can’t solely comply with the availability of LTHs typically, but in addition examine the habits of the totally different segments of this group.

Within the context of the present dialogue, related components of LTHs are these which were carrying components for a minimum of one yr. To be extra exact, the age teams thought of listed below are the teams 1+ years outdated, 2+ years outdated, 3+ years outdated, 4+ years outdated and 5+ years outdated.

Here’s a chart that reveals the availability pattern of those LTHs over the complete historical past of cryptocurrency:

The values of those metrics have solely gone up in current days | Supply: Glassnode on Twitter

Be aware that the age ranges right here haven’t any higher limits. Which means that youthful age teams additionally embrace intakes from age teams older than them. For instance, the 1+ age bracket contains the mixed knowledge of all of those different brackets as a result of it’s the youngest.

Now, it may be seen from the chart above that every one of those bitcoin age bands have risen in current months, implying that traders available in the market are holding cash lengthy sufficient for them to mature in these bands.

BTC has seen fairly excessive volatility lately, however these traders nonetheless have not proven any important adjustments of their provide. “This means that HODLing stays the primary dynamic amongst longer-term traders, implying that better volatility in value motion is required to entice old-timers to spend,” says Glassnode.

At present, the availability of the 1+ years cohort represents 67.5% of the complete provide of BTC in circulation, a really massive determine. The odds naturally lower with every subsequent group, as their provide can’t be larger than that of the group above them, as defined earlier.

Typically, the longer an investor holds their cash, the much less doubtless they’re to promote at any given time. That is partly as a result of the older the cash, the extra doubtless they’re to have been completely misplaced (as a result of the keys to their wallets are now not accessible).

From the graph, it’s seen that the older age teams typically noticed lesser fluctuations in comparison with the teams youthful than them. This attention-grabbing pattern reveals the aforementioned statistical truth in motion.

BTC value

As of this writing, Bitcoin is buying and selling round $28,000, up 2% previously week.

Seems to be like the worth of the asset has plunged within the final two days | Supply: BTCUSD on TradingView

Featured picture by André François McKenzie on Unsplash.com, charts by TradingView.com, Glassnode.com