Knowledge exhibits that the Bitcoin transaction charge share of signups has fallen to simply 26% not too long ago, an indication that the hype round them could also be fading.

Bitcoin Itemizing Charge Share Stays Excessive, However A lot Decrease From Peak

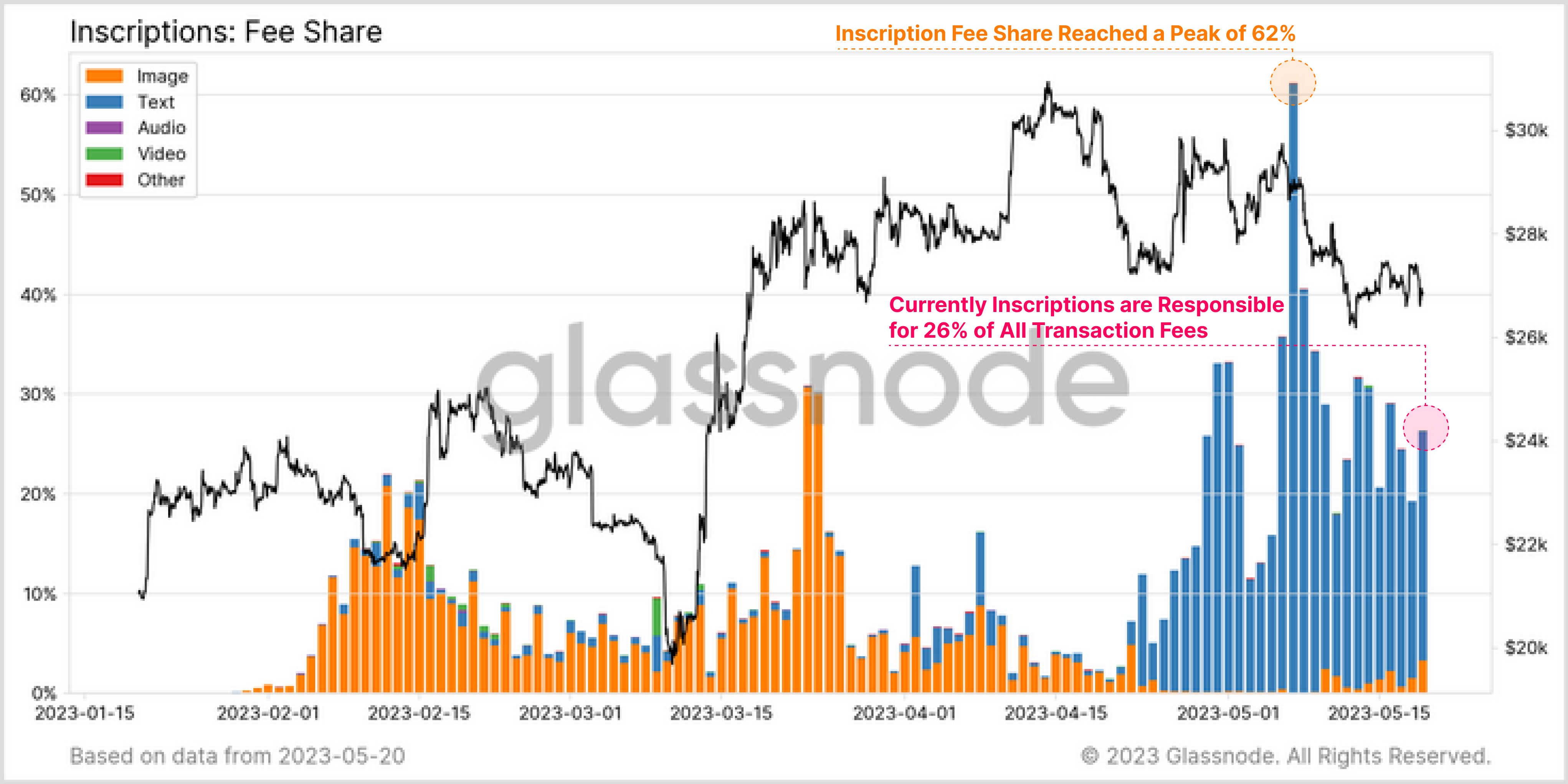

In keeping with information from the on-chain analytics firm glass knot, enrollment charge dominance was 62% at its peak. A “registration” right here refers to any type of information straight registered within the Bitcoin blockchain.

Listings solely turned attainable when the ordinal protocol appeared earlier within the yr, and since then it has seen various purposes and gained fast recognition.

As registration transactions are like every other switch on the community, they naturally affect the transaction-related blockchain financial system. A easy method to gauge the influence of listings is to make use of Bitcoin transaction charges.

Usually, transaction charges differ relying on the quantity of the request on the community. In occasions of low blockchain site visitors, traders needn’t pay massive charges to have their transfers accomplished rapidly, so charges keep low.

Nevertheless, when there’s heavy congestion on the community, holders could must impose a excessive quantity of charges as a result of there’s nice competitors for the restricted transaction capability that miners have.

Now, here’s a chart that exhibits the proportion share of transaction charges Bitcoin listings have taken since inception:

Appears to be like like the worth of the metric has come down a bit not too long ago | Supply: Glassnode on Twitter

Because the chart above exhibits, the share of Bitcoin listings charges had exploded quickly after the emergence of the expertise. Many of the contribution got here from image-based registrations (coloured orange within the graph), which acted as non-fungible tokens (NFTs) on the community.

By April, nonetheless, the fad for picture registrations had died down and the share of transaction charges for one of these switch had fallen to low values.

Shortly after the drop in curiosity in listings, a brand new software for the expertise had emerged: BRC-20 tokens.

BRC-20 tokens are fungible tokens much like ERC-20 tokens on the Ethereum blockchain and are created in the identical type as textual content registrations.

From the graph, it’s seen that the transaction charge share of registrations has reached a brand new all-time excessive (ATH) after the emergence of BRC-20 tokens, with most transfers unsurprisingly coming from the text-based kind (highlighted in blue).

At ATH, the worth of the metric had reached round 62%, which means that Bitcoin miners obtained 62% of the full transaction charges from registration-based transfers.

In current days, nonetheless, curiosity round sign-ups seems to have waned once more, with the charge share of such transfers dropping to 26%.

That is clearly nonetheless fairly a excessive stage, however nonetheless represents a really vital drop from the height.

BTC worth

As of this writing, Bitcoin is buying and selling round $26,800, down 2% prior to now week.

BTC has gone stale prior to now few days | Supply: BTCUSD on TradingView

Featured picture by Dmitry Demidko on Unsplash.com, charts by TradingView.com, Glassnode.com