- Glassnode tweeted that Bitcoin switch quantity despatched by long-term revenue holders has jumped virtually 2000% for the reason that begin of the 12 months.

- The present worthwhile switch quantity for BTC is $1.24 billion, which is 71.4% beneath the height of the 2021 bull market.

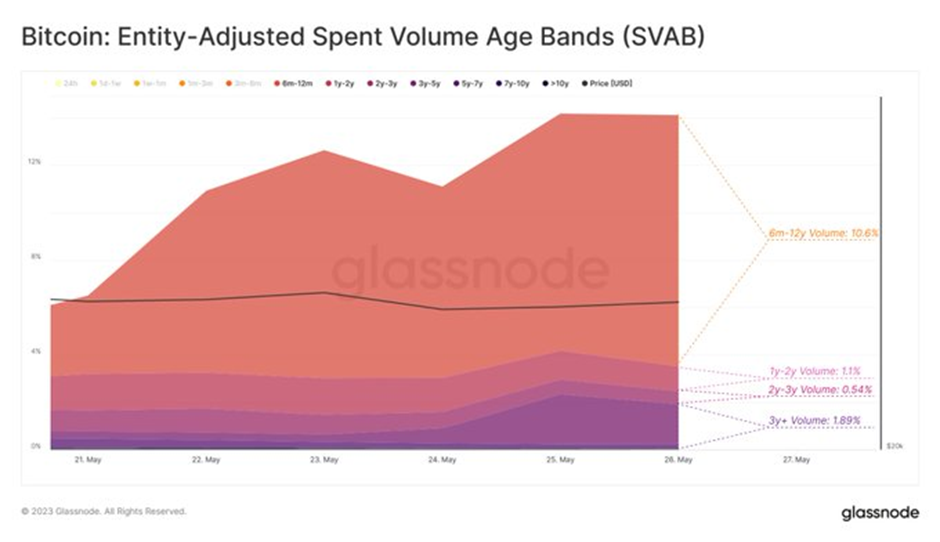

- The 6-12 month cohort of long-term incumbents is the most important spender.

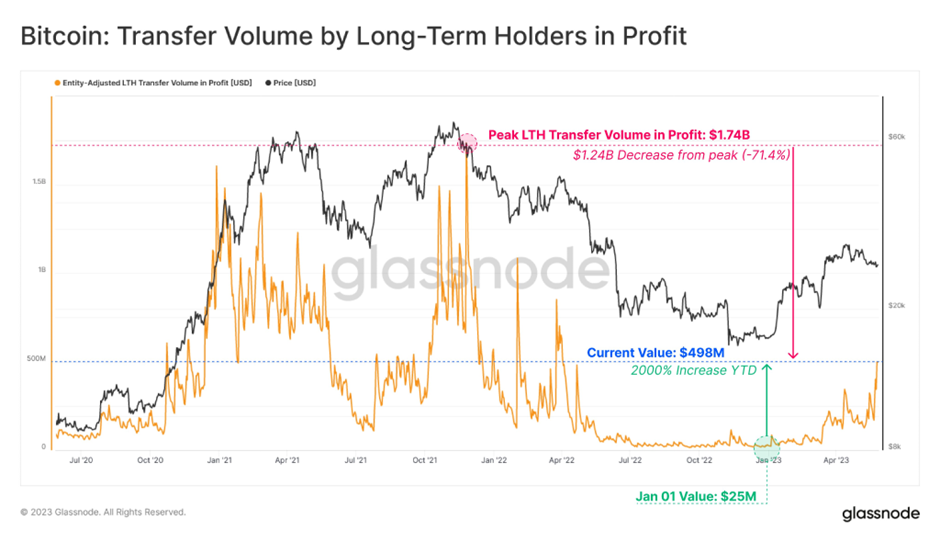

Knowledge analytics platform Glassnode reported that Bitcoin switch quantity despatched by long-term revenue holders noticed a notable year-to-date (YTD) enhance from $25 million. to $489 million, marking a rise of virtually 2000%.

Nonetheless, the present worthwhile switch quantity for BTC stands at $1.24 billion, which is 71.4% decrease than the height of $1.74 billion recorded in the course of the 2021 bull market.

In the meantime, after wanting on the spending breakdown of long-term Bitcoin (LTH) holders by age bracket, Glassnode stated it grew to become clear that the 6-month to 12-month cohort stands out as the most important. spenders. They recorded thrice the switch quantity of all different LTH cohorts – 1 12 months or extra.

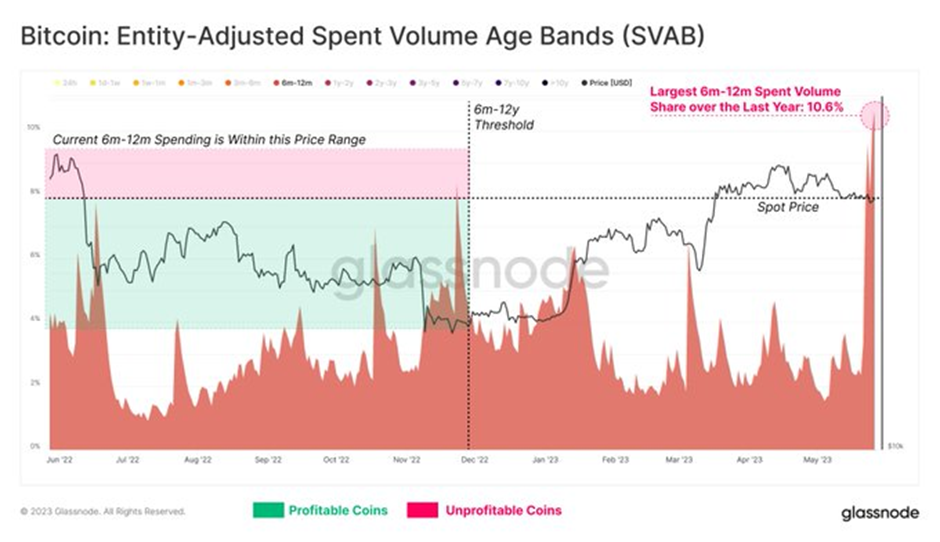

Moreover, when analyzing the spend vary for cash aged 6 months to 12 months, Glassnode says it is vital to notice that out of a complete of 183 potential acquisition days, 167 of them (92%) are at present in a worthwhile place relative to the present spot worth. This data helps to contextualize each the excessive quantity of spending throughout the 6-12 month age bracket and the current enhance within the quantity of worthwhile transfers.

Furthermore, in a earlier TweeterGlassnode famous that the Bitcoin market continues to function in an unrealized revenue state, with the present provide in revenue virtually twice as massive as the availability in loss, at a ratio of 1.9 to 1.

Nevertheless, the platform factors out that it is very important notice that this ratio remains to be significantly decrease than the height reached in the course of the bull market exuberance of 2021. Presently, the availability to revenue and loss ratio has climbed to a staggering worth of 554.5, indicating a a lot greater diploma of profitability available in the market.

Disclaimer: Views and opinions, in addition to all data shared on this worth evaluation, are printed in good religion. Readers ought to do their very own analysis and due diligence. Any motion taken by the reader is strictly at their very own danger. Coin Version and its associates won’t be held accountable for any direct or oblique injury or loss.